This post will look at the top seven equities markets and the top seven stock exchanges based on market capitalization. You’ll also learn why equities markets should be on your watch list, and what factors to consider when day trading equities.

The Top 7 Equities Markets for Day Traders

There are several ways to decide on the best equities markets for day trading. The top seven equity futures below are based on volume (taken from the CME Group’s futures trading exchange).

As you can see, the E-mini S&P 500 futures market trumps all the others. Boasting the highest daily trading volume on average, it is clearly the largest equity index futures market to trade.

The list is not set in stone, as this can change from one market to another. For instance, you can expect to see a completely different list when looking at ETFs. This is because volume differs based on the ETFs.

Sometimes, you can also find two or more ETFs that track the same underlying asset or the markets. For example, in the ETF world, two of the top seven ETFs are known to track the S&P 500 index market returns.

The results can thus vary from one type of market to another. Plus, there are other factors such as the expense ratio, which helps to decide on the preferred ETFs.

The Benefits of Having a Watch List

Most professional traders have many assets on their watch list that they observe. Financial instruments that make it on the list are the ones where the trader has already studied the basics, and is merely waiting for a technical trigger.

Likewise, for day traders, having a set of equities markets on their watch list can save time on studying the markets. Note that most of the equities markets tend to behave similarly.

Let’s take the example of the Brexit event in June. News of the leave camp’s win sent the markets into chaos, and this saw investors across the world react to the markets.

For example, the Nikkei 225 index fell on the news even though Japan had nothing to do with Brexit. (The UK did not rank high on Japan’s list of trade partners either.)

The chart below shows how some of the major global equities—the S&P 500, Dow Jones, Nikkei 225 and London FTSE 100 index futures—reacted to the news.

The chart shows that equities markets tend to behave similarly. This is simply because of investors’ appetite for risk and the search for markets with high returns.

So, in most cases, when investors are bullish on the markets, they’re willing to take on more risk. This translates to higher returns from the stock markets.

Yet, during times of uncertainty (whether economic or political), investors tone down their bullish expectations. This translates to a slump in the stock markets.

As you can see, day traders who trade equities markets—be it via futures or ETFs—have a specific advantage over their peers. You should note, though, that not all equities markets are ideal to trade.

Factors to Consider When Day Trading Equities Markets

If we assume that you have your own list of equities for day trading, there are some things to keep in mind:

- Trading volume reflects the amount of shares or contracts that are traded on the asset for the given period of time. A high trading volume indicates a high interest in an asset.

- Liquidity tells you how easy it is to buy or sell an asset without changing its price. The markets in question should be liquid yet volatile. This will allow you to make some worthwhile trades that will increase your trading capital.

- Trading commissions and fees can vary between markets. While there are variations of the same underlying asset, the fees can greatly differ.

- Although the spreads on the select list of equities are expected to be small by default, you should still pay attention to them. Ideally, you should focus more on the instruments with lower spreads.

- The technical aspects of the trading instruments are also something to look at. Some equities are known to be more technically oriented than others. For example, E-mini S&P 500 is a well-known futures equity index that can be traded with technical indicators.

- When trading global equity indexes, focus on market timings as well. For example, day trading a foreign equity index during the offline market hours in that region could influence both liquidity and trading volumes. Remember this, especially when looking at the foreign equity indexes.

At the end of the day, it’s all about how familiar you can be with your trading instruments—and in this context, with the equity indexes. Don’t let peer pressure or other factors affect your analysis and judgment. Focus instead on building familiarity with the instrument in question.

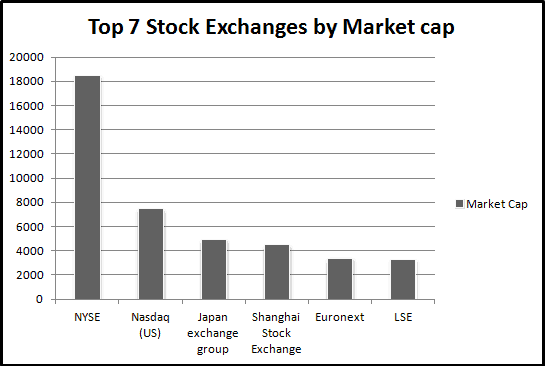

The Top 7 Stock Exchanges by Market Capitalization

There are more than 60 stock exchanges across the world, with a combined valuation of over $70 trillion. But, from this list, only 16 are in the trillion dollar club: an exclusive group of stock exchanges that boasts a total market capitalization of more than $1 trillion. These 16 make up nearly 87% of the total global market capitalization.

Not all trading instruments are charged similarly. Plus, trading fees and commissions can eat into a significant part of the trading capital. However, the average day trader can choose financial markets ranging from the ETFs to the derivatives versions of trading.

Succeeding in day trading is all about building familiarity with the assets. You should thus focus on having a select list of financial instruments that you can rely on. (Especially when it comes to building consistency in your trading activities.)

Do you have your own insight to share about trading equities? Let us know in the comments …