In this article, I will cover two basic trading strategies you can utilize during the market open. But first, let’s discuss what drives the madness shortly after the opening bell.

Like many other newbie traders, I thought, “the money is in the morning!!”. Well, yes and no. If you have a few thousand day trades under your belt, then yes you can make great money in the morning. However, if you are just starting out in the day trading game, you will want to paper trade the morning for an “extended” period of time.

Earnings

Overnight and in the morning there are a number of factors which cause the volatility during the morning session. Most Nasdaq stocks release their earnings after the closing bell, and many professional traders will actively trade these issues during the post-market session. But, the majority of the public does not feel comfortable or even know how to trade stocks outside of the regular session. So, you will see a flood of public orders reacting to the news in the morning. While the Nasdaq stocks report after the bell, stocks listed on the New York Stock Exchange (NYSE) and American Stock Exchange (AMEX) report before the opening bell. These earnings reports are mostly released between 8 am and 9:15 am. So, again you have traders falling over themselves to react to the earnings report; however, unlike the Nasdaq, which you can trade actively during the pre and post markets, with the NYSE and AMEX, unless you are Goldman Sachs, you will have to wait your turn after the bell rings at 9:30 am.

News

Thank the folks over at CNBC, Wall Street Journal, and stock analysts for this one. Now, I’m not one of those traders bashing the news syndicates and investment firms, they are simply doing their job. It’s how traders respond to this information which generates the moves. This is why I always stay informed of what’s in the news, but I do not trade based on the news. Step back and think about it for a second. Does Cramer have any idea of your investment objectives? Has Cramer done a detailed risk analysis of your portfolio? Well, if you are unsure of the answers to these questions, it is NO!!! It really gets under my skin when people say Cramer said the stock would go up, I bought it, and it tanked. Well, this is the stock market, unexpected things happen, the bigger question is, why did you take Cramer’s advice on blind faith without doing your own research? How can you buy a stock without knowing the price swings or how the stock trades? Cramer covers anywhere from 25-50 stocks every day. Even if Cramer is a great trader, at least 30% of these calls will be wrong. While these are great odds, you nor Cramer, have any idea which “pick” is more likely to work out. But, the public loves to react to these “public tips” from television and stock analysts, which is a major contributor to the sharp moves as everyone is reacting to the news.

Economic Reports

Every day there is some news release related to the economy. The unemployment rate, housing market, CPI numbers, etc. These numbers affect the bond market and treasury yields, which in turn affects equities. If you are day trading, it is a must that you know the economic schedule, so you are not blindsided by a 10 am existing home sales report. Visit yahoo finance to see the list of upcoming economic events.

Federal Open Market Committee (FOMC) Meeting

The FOMC meeting is technically part of the economic calendar, but it is such a huge event that it needs to have its own section in this article. The FOMC is responsible for the following monetary policies: open market operations, the discount rate, and reserve requirements. The FOMC holds eight scheduled meetings per year. The FOMC meeting minutes are released three weeks after each scheduled meeting at 2:15 pm. The days leading up to and the morning of the FOMC announcement, you basically have flat markets. So, you will want to cut back on the number of trades you put on prior to the 2:15 pm release, as you will get caught in the chop.

Why Novice Traders should stay away from the Opening Bell

The opening bell will provide great trading opportunities, but it also carries a great deal of risk. Let me provide you with a real-life example. Let’s say you noticed the gap on MXIM on 8/17 in the morning. The stock was up over three percent and it appeared that it cleared a significant downtrend. Then the stock backed off of this resistance line, but not by much. So, it looks and feels as though MXIM is going to make a break for it. On the next 15-minute candle, MXIM had an inside bar. But this doesn’t concern you as no highs or lows were penetrated. MXIM then produces three more down candles on the 15-minute chart, prior to rolling overfilling the gap and dropping a point. This quick reaction to the morning gap would have represented a five percent loss in a matter of three hours. Often times new traders are unable to adjust to quick changes in trends and do not have the experience to know when to get on and off the horse. Remember, the opening bell is not going anywhere. The volatility will always be present, it is part of the game. So, take your time getting used to the setups, it is well worth the wait.

Market Open Trading Strategies

Now that we have covered some of the general topics related to the opening bell, let’s dig further into actual opening bell trading strategies for navigating the chaos.

Let me first reiterate that the volatility is where you can make money in the market, but it’s also a way to lose money. Therefore, if you feel you need to crawl before you walk, take your time.

Strategy #1 – Fading the Opening Gap

In prior articles, I have covered more volatile gap strategies, but in this post, I will try to address our more risk-averse friends with a trading strategy they can use in the morning.

The basis of this strategy is that if there is a gap between 0.5% and 1.5%, there is a solid chance for the price to completely retrace the gap. Reason being, there wasn’t a lot of force in the move, therefore traders will likely fade the gap.

When the markets open, you first need to spot these lackluster gaps, which believe it or not are quite prevalent in the market. Like you, I am focused on the big winners and losers, while this low hanging fruit is all around us.

For long trades, buy the stock after the gap down. Short trades should be entered after the minor gap up.

Another thing you will want to look for is a light volume on the gaps, as these again reiterate the weakness of the move.

A stop loss should be used when trading this strategy. I will suggest you use a stop loss equal to half the amount of the gap. So, if the gap is 1.3% of the stock price, you should place a stop at 0.65%. This way the stop will give us approximately 1:2 risk-to-return ratio.

The target for each opening gap trade is the close of the previous day.

Let’s now walk through a real-life chart example:

This is the 2-minute chart of Twitter from the market opening on Oct 16, 2015. In this example, we opened a short trade based on the counter gap trading strategy.

Twitter opened with a bullish gap of 1.17%, which is within our parameter of 0.5% – 1.5%.

We open a short trade on TWTR at $30.08. We then place our stop loss order at a distance equal to half the amount of the gap, which is 0.59% above our entry. This stop loss again ensures we have a risk to reward ratio of approximately 1:2.

As you see, the price starts declining with the first candle after the gap, before another failed attempt at a rally, which does not trip our stop.

12 minutes later, the price decreases to our profit target and we exit the trade. We were able to walk away from this trade with a 1.11% profit.

You could be thinking to yourself, well what is so fancy about this approach. You are absolutely correct with that line of thought. The key to this strategy is our attention to maintaining a healthy risk to reward ratio on every position and also not looking for much in terms of profits.

If you are able to swing for singles and make sure you keep your winners bigger than your losers, things tend to work out for the best.

Strategy #2 – Using Price Action to Ride the Gap

Knowing which side of a trade to take with a gap is the key. You will need to closely monitor the price action as it develops to anticipate which way the market will inevitably break.

Trading in the direction of the primary trend logically should be easier, but trust me when I say there is no free lunch in the market.

The secret or edge to identifying which way the trend will break comes down to sitting tight for the first 30 minutes and doing nothing. That’s right, let the action play out right before your eyes without taking any trades.

Let’s now dig into a real-world example:

This is the 5-minute chart of Ford Motor Co, from Jan 13 – 14, 2016. We have a short trade, which was signaled during the Opening Bell, 30 minutes after the price gap.

Ford starts the new trading day with a bearish gap of $0.27 (27 cents). We set the high and the low of the gap as shown on the image above. 30 minutes later, we see that the price is still below the low of the gap. We short Ford and immediately place our stop loss right above the gap.

After we enter the market, the price starts a sideways move. For this reason, we place the purple resistance area above the tops of the price.

If Ford breaks this level, we need to close our position; however, the price begins another decrease. After this decrease, another resistance area develops (blue line). Notice that the price then falls off a cliff.

We exit the market when the price closes a candle above the blue resistance. We generated a profit equal to $0.32 (32 cents), which is 2.55% of the share value. With our stop loss, we also risked $0.32 (32 cents). This means that we created a short trade with 1:1 risk-to-return ratio. Notice that in most of the cases if you are right with your position, you will generate more than a 1:1 risk-to-return.

Sometimes this will be 1:2, 1:3, or even 1:4. Also, if you want to lessen the volatility of your trades after the price develops during the first 30 minutes, you can extend the waiting time. Some traders wait up to one hour before they enter based on signals from the opening gap.

Combining the Two Opening Bell Trading Strategies

The fade the gap and price action strategy can be combined to really take advantage of the opening gap plays.

Have a look at the image below:

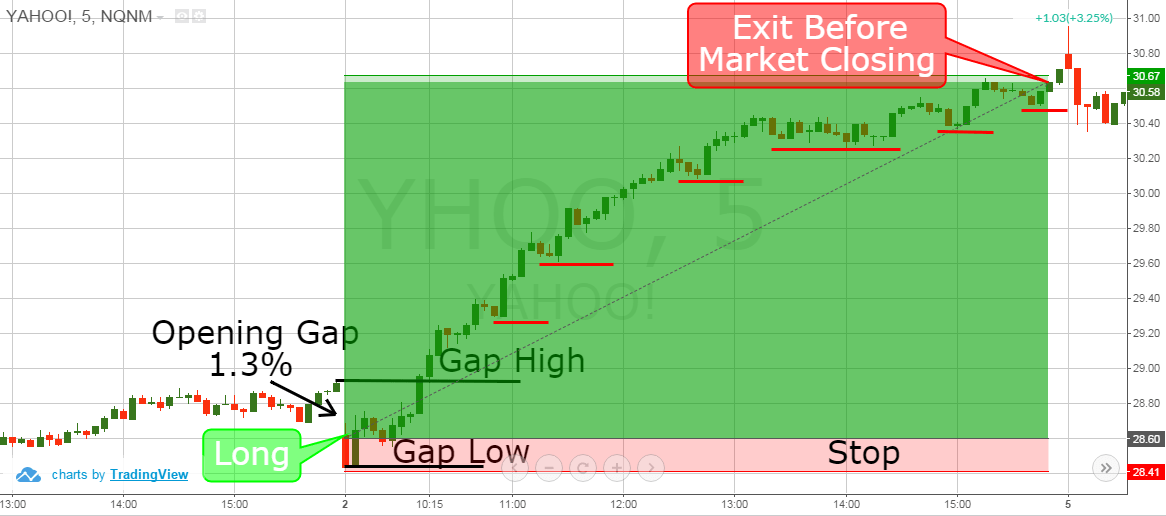

This is the 5-minute chart of Yahoo from Oct 2, 2015.

First, Yahoo opens the day with a 1.3% bearish gap. The gap falls in our 0.5% – 1.5% zone, so we immediately go long, as stated in our fade the gap strategy. We set a stop loss of 0.65% below the entry price.

The gap is eventually closed and our profit target is hit. As you can see, the price then overcomes the previous day’s high after the first thirty minutes of trading, which triggers our second strategy. Good for us, all we have to do is hold the position.

The red lines represent support areas, which could be used to close our trade. Fortunately, none of these support zones are breached and we managed to stay in the market until the end of the trading day. We exit the trade one period before the market closing.

In this trade, we risked 0.65% of the size of our trade. However, with risking 0.65%, we managed to catch a price increase equal to 7.24%, which is more than impressive. This way we created 1:11 risk-to-return ratio.

This trade reveals the full power of the opening bell trading strategies.

Conclusion

- The Opening Bell is a very volatile trading period.

- Some of the events which affect the price action in the opening bell are:

- Earnings Reports

- Economic Reports

- Federal Opening Market Committee (FOMC) Meetings

- Only experienced traders should trade during the opening bell.

- Two trading strategies you should explore after the market opens are:

- Fading the opening gap

- Letting price develop after the gap and then take the trade

- These two strategies can be combined at times to cover the entire trading day.