We’ve all heard that the market has the ability to bring out the rawest in human emotions. At the end of the day trading is not a hobby but an experiment in the art of survival from dueling with your common man. How do you know when you have abandoned sound logic and have gone off the reservation? This is a very personal question and depending on the trader answers will swing wildly from one side of the pendulum to the next. For you it might be erratic mood swings or a change in how you perceive the market. How do you know when greed has you in its grasp? This article will explore some exercises of how you can realize when trading that your “dark passenger” according to Dexter is in control. If you watch Showtime you will totally get that reference.

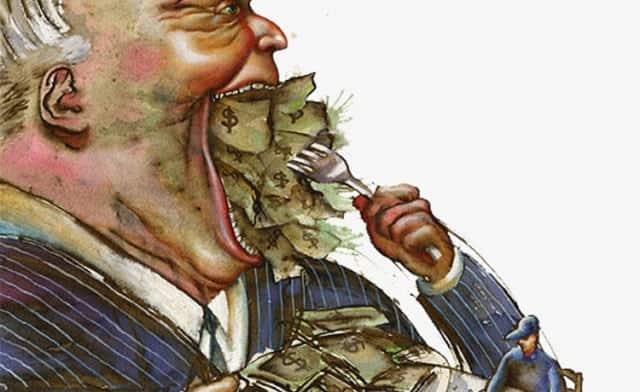

According to Wikipedia Greed is the ” inordinate desire to possess wealth, goods, or objects of abstract value with the intention to keep it for one’s self, far beyond the dictates of basic survival and comfort. It is applied to a markedly high desire for and pursuit of wealth, status, and power.” We as traders have a propensity for chasing wealth. Many of us have entered the arena of trading not only for basic needs but a since of power that we too can conquer not only our internal fears but also we can defeat and ultimately master the market. We’ve all heard Gordon Gekko’s infamous speech in the move Wall Street where he says greed is good. This sounds great as a sound byte in a Hollywood production; however, greed can wreak havoc on your trading account. The reason is greed like any other human emotion has no business in the trading business.

Leveraging your way to Profits

Leverage is the gas that fuels the greed engine. If you are just trading cash you really need the market to have a considerable move for you to reap large gains. This requires work on your part as the odds of the market always moving significantly in your favor is not a common activity. This experience with the market places you in the mind frame to have realistic expectations in terms of returns. Once we introduce margin into the equation, this theory no longer holds. For example, if you were hoping to make 20% on a trade using cash, you would need the market to move 20%. Well what happens when you factor in 100% margin. Well now you only need the trade to move 10% in your favor to hit your target. Like most newbie traders once they hear about margin on equities, the next question is how can I get more? This question if not checked will lead to an immediate interest in futures, options, or forex. Now, I am not bashing these markets, but I do think lack of experience, increased leverage and unrealistic expectations are not a way to run a trading business.

If you take a review of your trading activity in your day trading journal for the last year can you spot a time where you were greedy? It generally happens in one of two scenarios. (1) You can’t put on a losing trade and money appears to be flowing directly from God’s hands to your pockets OR (2) you have been on a lengthy losing streak or had a significant loss and are looking to make it all back. In either case your emotions are likely flying to the extreme. This feeling of needing to make more will come over you not when you are quietly reviewing your trades from the day, but rather during the trading day when every small gain now has the potential for big profits. Below I have listed 10 ways you can identify when you are in the greed zone.

10 Greedy Characteristics

1. You find yourself forgetting your rules. Which during day trading is the last thing you want to happen since your profit margins are often based on smaller movements.

2. When reviewing your pre-market plays, every stock looks like a winner.

3. Shortly after opening your position you see a price target that is much higher but you have no justification for the target.

4. Trading feels stressful all of the time. From the minute you get up in the morning, until you close your last position. Instead of approaching trading with a calm head, you have a constant feeling of fighting and living on the edge.

5. You stop reviewing your trades. If someone were to ask your win/loss percentage over the last week you would have no idea; however, you would know how much money you need to make for the week.

6. You abandon limit orders and start placing more and more trades at market. Most of the times this will occur when you are trying to get into the position, because you can’t stand the idea of not being in on the winning trade.

7. You start to over trade. If you normally put on 3 trades per day, you will now find yourself placing 6 or more trades per day. This sort of behavior will run its course as the increase in trading activity while abandoning your day trading rules always points to losing money.

8. You begin to increase the percentage of margin you are willing to use per trade. As things go against you, you will find yourself using more and more margin to cover losses.

9. You never pull any money out of the market. The more money you make, the more schemes you come up with of how to flip the money.

10. You admit to yourself that you have completely abandoned your trading rules and money management principles. Your logic is that you will only do this until you win your money back, or hit some ridiculous target. Problem is if you hit your target number you somehow end up talking yourself into one more big trade, so you can really come out way ahead.

Don’t take my word for how greed can affect your trading results. Check out this cool clinical study on day traders which covers greed.