Dividend based investment is one of the popular investment strategies that aims to take advantage of the steady payments made by stocks that pay dividends. Dividend investing is a type of Income Investing which encompasses a broader theme and includes bonds and fixed-income securities. The basic premise behind dividend investing is that the investments made in certain assets will yield regular and a stable income for the investor.

Not only does dividend investing provide a passive income flow, the dividends can also be used to reinvest in purchasing additional shares. This can be a powerful way to invest especially when compounding is brought into the equation.

Most of the dividends paying stocks represent companies that are financially stable and having a steady stock price that increases over time. Dividend paying companies often generate consistent cash flows and are usually known to be more stable companies.

Among the different ways to build a portfolio it is often suggested that some part of the portfolio should be allocated towards dividend paying stocks as in most cases, these are considered to be safe stocks. Dividends are the foundation of a company and are in fact the end result from a shareholder’s perspective. Dividend investing is often popular among younger investors as it creates passive income in the longer run. At the same time, dividend investing is popular among older investors nearing retirement as the dividends provide a stable retirement income.

One of the most essential aspects of dividend investing is of course compounding which is a result of reinvesting the earnings from dividends and is one of the most powerful concepts in the world of investing. It is no wonder the Albert Einstein called compounding the eighth wonder of the world.

Why does a company pay dividends?

One of the most commonly asked question when it comes to dividend investing is why a company would pay dividends when it could use the cash for other things such as acquisition, reducing debt or share repurchases.

The companies that typically pay dividends are usually well established firms that have reached a certain size and/or unable to sustain higher level of growth. Such dividend paying companies are no longer interested in expanding industries and pay out the retained earnings to investors as a way to provide additional shareholder value.

Stocks that pay dividends are usually found in the financial and utilities sector which account for 4.96% and 2.97% in dividend yield on average.

One doesn’t have to look too far when it comes to dividend paying stocks. Some of the big dividend payers are in fact household names. Coca Cola Company (KO) is one of the components of the Dow 30 since 1987 and has been paying dividends since 1920’s and increasing the dividends frequently. As of 2015, Coca Cola has a dividend yield of 3.4%. Other big names include telecom giant Verizon, Johnson&Johnson, P&G and so on.

Dividend Yields

Dividend yields are one of the commonly used terms in dividend investing and it always pays to take a refresher on this term. Dividend yields are is a financial ratio that measures how much a company pays in dividends every year relative to the share price. Dividend yield is calculated as a percentage after dividing the dollar value of dividends paid in a year by the one share of stock in dollar value.

Dividend yield is based on the following equation.

When choosing dividend stocks, dividend yields are one of the most commonly used metrics. Obviously, stocks with higher dividend yields are preferred, all else being equal. However, as with everything, high dividend paying stocks have their own downside such as growth potential. Although dividends might be the end result for a shareholder, the more dividends a company pays, the much less it is reinvesting in the business which could erode the shareholder value.

Thus, when looking at investing in dividend stocks, investors need to find a balance in a company that has growth potential and also pays out reasonable dividends. Here are three simple dividend investing strategies that you can use.

1. The Dogs of the Dow Strategy

Dogs of the Dow is the most simplest of all dividend investment strategies and is ideal for beginner investors. As the name suggests, this investment strategy deals with stocks listed on the Dow Jones Industrial Average. Having to focus on just 30 stocks for dividend investing is a lot easier for beginners that to track a larger set of stocks.

The Dogs of the Dow strategy was popularized by Michael O’Higgins in 1991 when he released his book “Beating the Dow.” According to Higgins, he classified 10 high dividend yielding stocks as the “investment dogs” of the Dow as the rising yields were a function of falling prices. The back testing results mentioned in his book, dating back to 1920’s supported O’Higgins theory which eventually became one of the simplest dividend investing strategies used by both beginners and seasoned professionals.

The Dogs of the Dow strategy is very simple yet attractive. The Dogs of the Dow are a set of 10 stocks out of the 30 constituents of the Dow 30 which have the highest yield. Using the Dogs of the Dow investment strategy, the investor will merely shuffle the portfolio so as to allocate the holdings equally across the 10 stocks.

Because dividend yields can change, the investor using the Dogs of the Dow strategy will need to rebalance their portfolio, by replacing some of the existing stocks in the portfolio for new ones few times a year. As you can see, it is this simplicity that has made the Dogs of the Dow a strategy that has consistently yielded good returns.

Despite the simplicity, investors need to apply caution however. According to some professional investment advisors, investing in high yielding stocks doesn’t mean that the stock is undervalued. It could also signal financial distress and could mean that future dividends could be cut or even eliminated altogether.

Supporting this view is the classic example of Eastman Kodak which was one a giant in the photographic film sector which eventually had to declare bankruptcy in the wake of digital photography. However, prior to Eastman Kodak going bust, the company was a well known constituent in the Dogs of the Dow.

Another theory that urges investors to apply caution is not to over allocate one’s portfolio to a particular sector such as financials or utilities which pay higher yields.

2. The Dividend Reinvestment Plan (DRIP)

The dividend reinvestment plan is not technically an investment strategy but rather a tool designed for long term investing. Dividend Reinvestment Plan or DRIP allows investors to purchase additional shares of the stock by reinvesting the dividends when enough money is accrued. To make use of DRIP, investors need to enroll in the stock’s DRIP plan. Once enrolled, the investor no longer receives dividend payouts in the form of cash but instead the money is used to purchase additional shares.

Not all dividend paying stocks offer DRIP, however there are quite a few big names such as Procter & Gamble (PG), Wal-Mart Stores (WMT), Abbvie Inc. (ABBV) and so on which offer the DRIP option. Investors need to enroll in the stock’s DRIP before the record date to be eligible for the next dividend payout to be applied to the reinvestment program. Reinvesting in the stock via the DRIP is also said to be less expensive that compared to buying stocks directly. Another advantage of reinvesting via the DRIP is that the price paid for the shares is determined by the average cost of the share price over a period of time unlike having to pay the highest or the lowest price of the share when purchasing the shares directly.

Investors can also choose to be either fully or partially enrolled in the DRIP plan. In the second scenario, investors can allocate a certain number of shares to the reinvestment plan. For example if you had 50 shares of GE, then you could allocate 25 shares to the DRIP, meaning that the 50% of the dividends are reinvested via the DRIP plan to purchase additional shares while the remaining is paid out as cash.

Investors are also able to use the DRIP program even for stocks that do not offer this option. In this case, the stock broker offers a DRIP alternative. Some of the brokers that offer DRIP program includes Ameritrade, E*trade, Charles Schwab.

The benefit of using DRIP is of course the power of compounding, where you can start with a relatively small amount of shares and increase your holdings over a long period of time. The DRIP method is perfectly suited for young investors.

Investors should note that utilizing DRIP does not make them immune to tax. Thus, DRIPs are not free. The dividend that comes from a stock which is held in a taxable account is fully justifiable as tax and there are no exceptions because you are reinvesting the dividends.

3. Investing in a dividend ETF

For investors who have small capital to start with, investing in a dividend ETF offers a good starting point which allows diversification without having to put up too much capital. Historically, the debate on whether investing in dividend stocks individually or in a dividend ETF continues to rage on, but each of these have their own pros and cons.

For one, investors with small capital can look to dividend ETF’s which allows them to invest in dividend paying stocks. Within the ETF universe, there are different types ranging from growth ETF’s that focus on companies whose dividends are rising to high yield ETF’s which primarily track high yield dividend paying stocks.

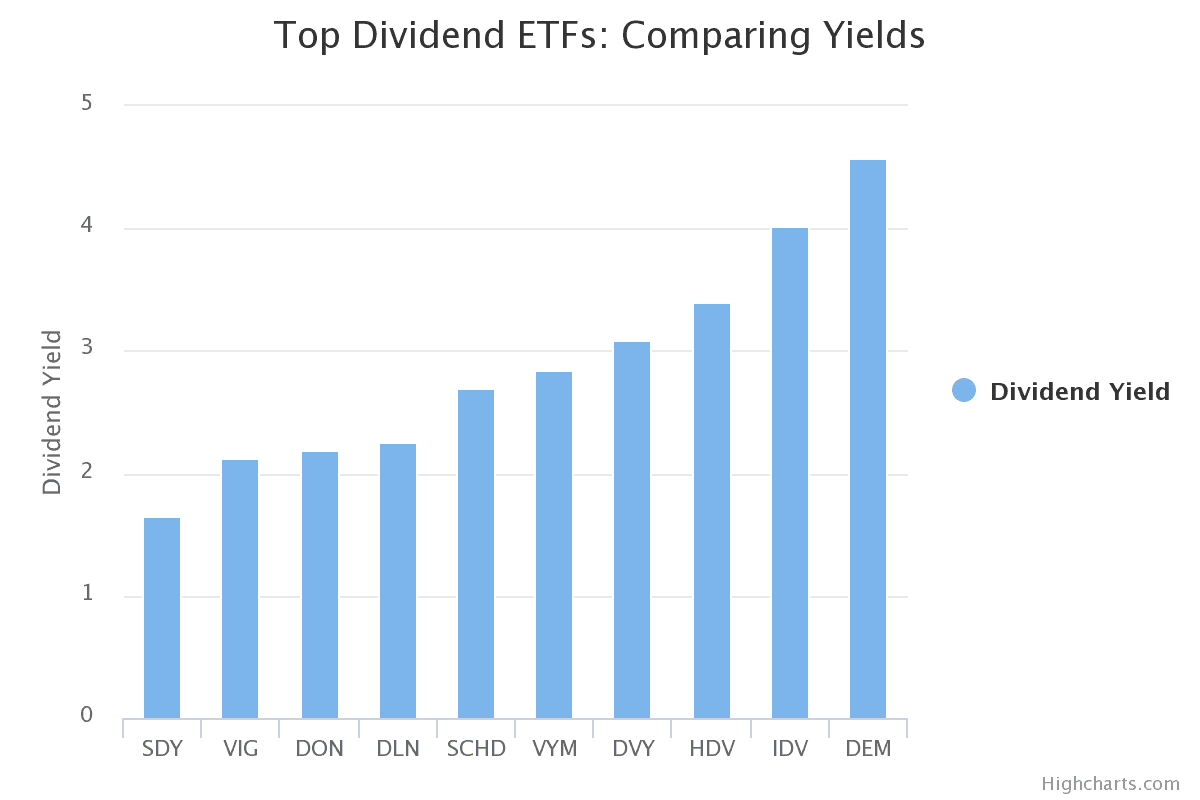

Some of the ETF’s in the dividends category include:

- SPDR S&P Dividend ETF (SDY) which has $12.7 billion in assets under management and an expense ratio of 0.35% and a dividend yield of 2.5%.

- The Vanguard Dividend Appreciation ETF (VIG) is a dividend growth ETF which boasts of $22.9 billion in AUM with a 0.10% expense ratio and 2.4% dividend yield.

The benefits of investing in an ETF compared to investing in individual dividend paying stocks is that investors can lower the commissions paid for purchasing multiple shares from different dividend paying companies. With a dividend ETF, it is straightforward. Furthermore, investing in a dividend ETF is as simple as buy and forget, as compared to researching the stocks in the portfolio frequently.

Dividend ETF’s interestingly have a lower annual expense ratio compared to other ETF, but on the same note dividend ETFs are expensive compared to stocks which as 0% expense ratio. With dividend ETF’s investors won’t have a say in the stocks that the ETF holds.

Despite the short comings, dividend ETF investing caters to a certain niche of investors with particular capital requirements.

The above three methods outlined are some of the most widely used investing strategies to invest in dividend paying stocks, depending on the investor’s capital and the duration of investment. Dividend investments and other income investing strategies gained popularity in recent years with central banks across the world keeping interest rates near zero which pushed investors to seek for yield making dividend investing an attractive choice for many at different stages of their investing lifecycle.

While dividend investing can offer the promise of earning additional income, investors should remain cautious to the yield trap. In a search for high yield, it is not uncommon to find the investor to flock to high dividend stocks that look attractive, but that can be a trap. Some good examples of yield traps include Frontier Communications (NASDAQ: FTR) which took a beating in 2016 which offered an 11% dividend yield, other examples include Pearson’s (NYSE: PSO) which had a 9.8% dividend yield. While this is not always the case, investors should be cautious when researching into a high dividend yield stock, which can be as a result of the stock price moving lower which will eventually result in the company cutting the dividends leaving he investor with a stock that has depreciated in value including the dividends that it used to pay.