Absolute Breadth Index Overview

The Absolute Breadth Index or ABI measures market volatility.

Unlike other technical tools, the ABI does not forecast market direction. Hence the indicator is also known as the going nowhere indicator.

The creator of the indicator, Norman G. Fosback, first introduced the indicator in the book “Stock market logic”. If you want to go deeper into the book, check it out on Amazon.

How to Calculate the ABI

The ABI is a simple calculation and is as follows:

(Number of Advancing Issue – Number of Declining Issue)/(Number of Advancing Issue + Number of Declining Issue)

This value is expressed as a number.

Absolute Breadth Index Readings

While the ABI does not make any market predictions, extremely high readings often lead to a pause in market direction.

In the below chart we have Visa Inc. (V) on the left and QQQ Powershares ETF on the right.

Notice how the high ABI readings lead to pauses in trend during market selloffs.

This makes perfect sense as a market can rise with low volatility, but these selloffs can product high volatility bottoms as weak longs start panic selling.

Absolute Breadth Index versus Advance/Decline Index

The Absolute Breadth Index looks similar to the advance/decline index. However, the main difference is the ABI uses absolute values.

Therefore, the advance/decline index can rise and fall around the zero-line.

Trading with the Absolute Breadth index

Exchanges and Sectors

It is important to note that the ABI is ideally for the NYSE.

Traders can also build their own absolute breadth index for example such as looking at the number of advancing and declining stocks within a portfolio or within a sector.

Weekly ABI Readings

Fosback theorizes in his book there was a higher level of confluence when you divide the weekly ABI by the total issues traded.

Historically, higher values on the weekly ABI suggest prices are likely to rise over the next three to twelve months.

Best Timeframe for the Indicator

The absolute breadth index is best for long-term trading. This is due to the fact the indicator is tied to the overall market and extreme readings need time to develop.

Hence the indicator is better for swing traders and long-term traders.

Trading Example with ABI

Below is a daily chart of Microsoft (MSFT) and the Absolute Breadth index with the 50 and 200-day simple moving averages.

After the first bullish crossover of the SMA, the question is where to get long?

Extreme ABI Readings

When looking back at the chart, a value of 3,800 on the ABI would trigger a move higher in MSFT.

For each extreme ABI reading, we circle the breach of 3,800 value in red.

Notice how these extreme readings lead to some sort of rally in the stock. Before you run out there and start buying every extreme reading, you need to remember you have to combine the extreme reading with other trade signals.

For example, you can see how MSFT was hitting price support with some of the readings. You can also see there is a golden cross in the chart as well, where the 50-period SMA crosses above the 200.

These examples of confluence on the chart in combination with extreme ABI readings will increase the likelihood of a successful trade.

ABI with Bollinger Bands

Bollinger bands are a volatility indicator and therefore is a great match for the ABI.

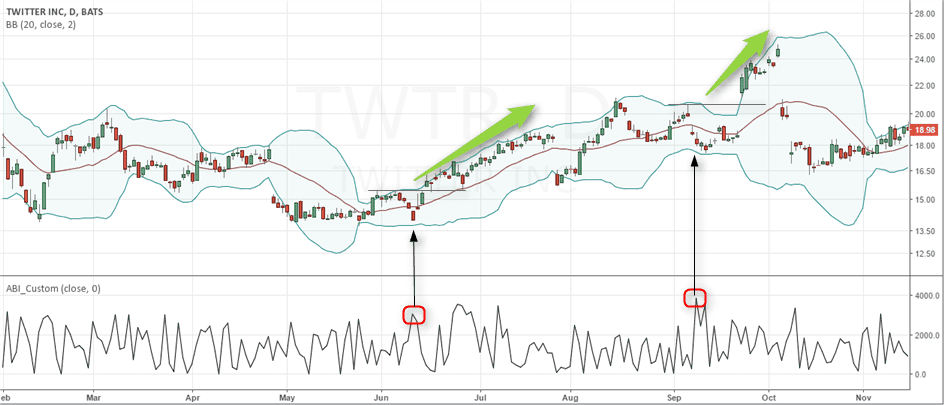

Below is the daily chart of Twitter with both Bollinger Bands and the ABI.

In the above example, there are two instances of a long position. In each scenario, it wasn’t like the candlesticks were closing outside of the bands.

The signals really are about the price hitting support, high ABI readings and the candlestick getting close to the lower bands.

After this level of confluence, there were short-term price increases which are great for swing traders.

In Summary

The absolute breadth index is great when you combine signals with blue-chip stocks. This is because large-cap stocks are most likely to be impacted by movement in the broad market.

Using the ABI to identify trade opportunities for low float stocks is likely a nonstarter. Not because the ABI is wrong, it’s more about the volatility of penny stocks cares little with broad market activity.