Why Write An Article on Buying Power?

Before we start clawing through the various types of margin accounts let me touch upon why I am writing this article.

The amount of debt in the market from investors and mostly retail investors is hitting all-time highs. This tells me that something perilous is on the horizon.

Whenever people begin to feel safe in the market, it is often the quiet before the storm.

I was reviewing the margin debt numbers provided by Financial Industry Regulatory Authority (FINRA) and things are starting to look scary.

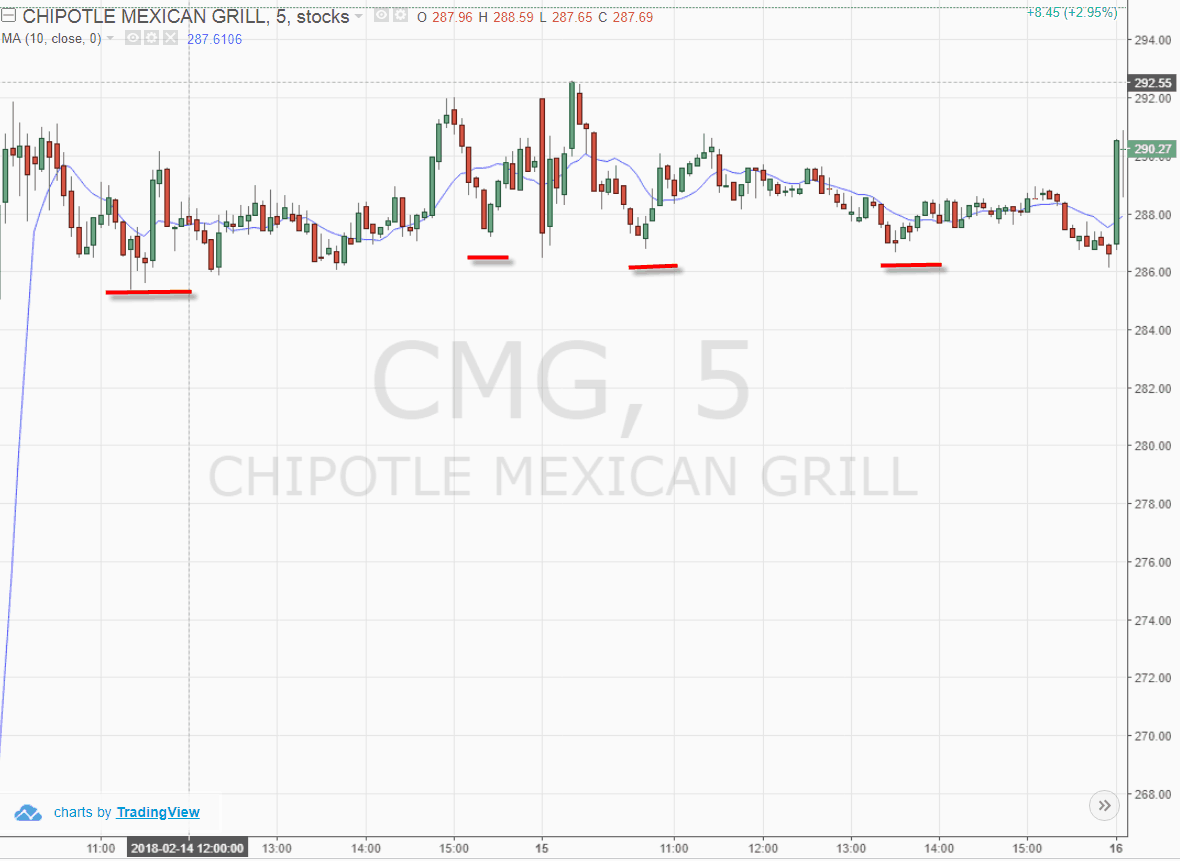

At what point will the market course correct enough to trigger margin calls? You can see margin debt peaked in January, then we had that quick selloff in 2018.

From here the margin debt subsided a bit but has since inched higher and is within striking distance of the January high.

FINRA has only been collecting this data since 2010, so it’s hard to do a comparative analysis of prior bear markets. But I think you can see a need to exercise caution as things can only go so far.

Well what is Buying Power?

Buying power is the money extended by the brokerage firm to a trader for the purpose of buying and selling short securities. An account must be approved for margin trading in order to have buying power beyond the cash on hand in the account.

New traders starting out make the mistake of focusing on how much money they are extended to trade by their brokerage firm.

This is why some traders will start out using cash, progress to a margin account, then a day trading account, then futures and ultimately a Forex account where you can get up to 100:1 borrowing power.

To me the need for margin early in your trading career speaks to more greed and lack of patience to build your account value over time – the right way.

In this article, we will highlight the buying power for different markets and more importantly the psychology around when and when not to flex your financial prowess.

Buying Power Based on Account Type

Now that I’ve established why it’s important you are aware of the record debt, let’s dive into the type of margin accounts and see if it makes sense for you to increase your buying power.

Cash Account

You may be asking yourself, why are we discussing a cash account in an article covering buying power?

Simple answer – in a cash account, your money is your buying power.

This is not a bad thing. You are going to have less risk exposure and will also avoid all of the trappings that come with borrowing money to trade.

For me, I do not use margin when trading – I don’t need the headache.

Yes, I can make more money, but to what end? I can see myself slipping into the path of greed. So, while it may take me a little longer to hit my goal (which changes quite frequently), the thing that matters the most is not worrying about a margin call.

Standard 2 to 1 Buying Power

Overnight buying power of stocks is the amount of money a trader can have in positions which are held overnight. In the majority of cases, this amount is simply double the cash on hand.

So, if a trader has a $50,000 account, the trader will have $100,000 worth of overnight buying power. This buying leverage will change depending on the stock you are trading.

For example, as stocks become extremely volatile, brokerage firms will have a list of stocks which have special margin requirements, they may require more than a 2 to 1 ratio for overnight positions.

You will want to verify with your brokerage firm if your stock of choice has special requirements before taking a position.

If not, what can happen is you will assume you have a 2 to 1 ratio and realize that a stock may require 75% cash to hold the position. This will reduce the amount of money you can invest and without knowingly doing so, you will end up over-weighted in a high volatility stock.

This is literally the last thing you want to do. What I mean is that not only are you using borrowed money, you have most of your cash tied up in a volatile stock and you are holding the position overnight.

Sounds a bit risky right?

Day Trading Buying Power

This is where the train begins to come off the rails a little; day trading is a different animal altogether.

In the States and most world exchanges, you are allowed 4 to 1 buying power for your trading activity.

In order to qualify for day trading buying power in the United States, the trader must have a minimum account balance of $25,000.

This means if the trader has a $50,000 cash account, the trader will be able to buy or sell short $200,000 worth of stock during the trading day. The last thing you want to do as a trader in this scenario is place 200k large into one stock.

If you are right, you can compound your account like crazy; however, if you are off you can create tremendous harm to your account.

Futures Buying Power

Thus far we have discussed the buying power for the equities market. Now, the buying power for the futures market is far greater.

The CME has an awesome example of buying power for futures which we have illustrated below:

How to Use Buying Power

Hedging

Instead of looking to buying power as a means to speed up your ability to compound your account, look at buying power as a means to hedge against market volatility.

For example, if you are taking a large position in the cash market, you can open a hedge in the futures market with a small percentage of your total account value, in the event the unfortunate were to occur.

Shorting

At times in the market you may want to employ a shorting strategy as a primary trading technique or as a hedge. In order to sell a stock short, you will need a margin account to borrow the shares.

While you have a margin account, you do not have to use more than the cash you have on hand.

In Summary

Buying power should be used as way to protect your account by hedging and allowing you to short the market.

Do not look to increased borrowing power as a way to get rich quickly. Remember to use caution and a sound trading strategy before investing your money.

Lastly, if you are reading this and you are part of the 600B+ of margin in play, remember the good times will not keep rolling indefinitely.