One of the biggest advantages of futures trading is the fact that the futures markets are open nearly 23 hours a day. This continuous market allows traders at all levels, and even from different geographical regions to take advantage of trading the futures markets, regardless of whether the U.S. equity markets are open or not. Thanks to the large liquidity, especially in the stock index futures and financial futures, there are significant price changes even outside of the U.S. trading hours.

Whether you are a futures trader or an equity investor, you might have heard about the pre-market futures prices. Largely quoted in the financial media, the pre-markets futures prices offer a broader insight into the general sentiment and points to how the U.S. equity markets will open on the day.

What is the ‘Pre-market’ trading in futures?

The pre-market is the period of trading that occurs outside of the regular U.S. trading hours or market sessions. It lasts for two and a half hours. While the futures markets are open for much longer than the typical 8-hour trading schedule for the equity markets, hours that fall outside these main trading hours. The equity markets close at 3PM central time and open at 8:30 AM central time. Therefore all trading activity that occurs after the 3PM CT is often referred to as the after-hours trading and all the trading activity that occurs before the 8:30 AM trading hours is known as the pre-market trading.

The stock index futures pricing is based on the underlying asset which is the cash markets for the indexes. Therefore, no matter how far prices deviate from the official index close, the pre-markets trading usually see’s activity which by the market open and by mid-day any strong deviations send the futures or the stock index prices to trade at the same levels.

There are different pre-market hours for the different underlying assets and the different trading hours. For the most part, the spot markets that trade 24 hours don’t quite have a pre-market value; examples include Gold, Crude oil, etc. For the equities and even single stock futures, the pre-market hours are clearly defined as the U.S. markets trade at specific times.

Understanding fair value

When talking about the futures prices and the main underlying cash index, another factor that traders need to bear in mind is the concept of fair value. Futures prices are broadly based on the trader’s perception and the prices constantly fluctuate based on the current supply and demand of the front month futures contract. After the official closing hours of the U.S stock markets, the futures markets continue to trade and therefore price deviations from the official close is not uncommon. The futures prices continue to trade as the markets receive new information and adjust to the news accordingly.

Fair value is a concept that comes from a complex calculation comprising of various factors such as the last closing value of the index, the prevailing interest rates and the remaining time for the front month’s contract expiration. The fair value gives an approximation on the correct size of the spread and doesn’t change until the next day’s closing price is available.

air value is a premium and it calculates the difference between the futures value and the spot index value and shows whether the markets are in equilibrium. In technical terms, Fair Value or FV is equal to the interest that could be earned on the index or the cost of carry minus the relevant stock dividends that occur during the current futures contract month duration.

The calculation for fair value is:

FV= Index Value ×[(1+Interest rate)^(((Number of days)/365) )-1]- ((Sum of dividends)/Divisor)

As an example, if the S&P500 index closed at 2100 yesterday while the S&P500 futures closed at 2105, the spread or the difference between the cash index and the futures price is +5. If today’s fair value reading is calculated at +10, meaning that current futures contract settlement price is 2110 or 10 points above yesterday’s closing price of the spot index.

So in the pre-market hours, if the S&P500 futures rise to 2110, it infers that the markets are priced at fair value. When the futures markets are at value it does not indicate any directional bias. However, if the futures markets pre-market trading prices are 2 points above the fair value it indicates a stronger opening on the stock index and when the futures prices are a few points below the fair value, it indicates a weaker stock market open.

How are pre-market quotes useful?

Pre-market and after-hours prices are in fact just normal trades, one would make during the regular trading hours. The only difference being that there is limited information and liquidity. Pre-market trading is largely conducted via various market participants who are usually less than the number of market participants one would get to see during the official trading hours.

The lack of liquidity during after-hours and pre-market trading sessions can see price being impacted by large contracts which can often move the market by a few points as there are not enough participants to absorb the large orders.

Pre-market quotes are generally used by traders and investors as a leading indicator for the regular trading hours. The pre-market pricing can offer glimpse into how the main stock index will open on the day. The data from the pre-market shows the last sale and price of the index futures during the pre-market hours, which ends at 08:30 CT.

The pre-market quotes do not influence the stock index prices much except for showing how the stock index will open. In many cases, the pre-market and after-hours trading can also see high volatility which can be absent from the main stock index’s trading session.

The above chart shows the official S&P500 index data on the left and the E-mini S&P500 futures data on the right. You can see that the range between the official index and the futures index are quite different, especially on the 9th of November, a day after the U.S. presidential elections.

The futures prices on the right had a day’s range of 138.25 points, while the S&P500 index’s range was only 44.8 points. So what happened here?

The futures markets, which are open for much longer than the S&P500 stock index was merely reacting to the news of the U.S. presidential elections. Thus, prices hit a day’s low of 2028 in the futures trading but by the time the U.S. markets opened, prices were trading quite differently.

Do pre-market futures trading define the day’s range?

There is no theoretical evidence that the trading range (High-Low) that is formed during the pre-market trading session has a direct impact or defines the day’s trading range in the main stock index. The markets are dynamic and constantly adjust to the new information that is released. For example, there are times when the pre-market trading can have just a 3 or 4-point range, but after the markets official open, the actual trading range can be different, higher or lower depending on the market information at that point in time. For example if the pre-market trading was largely quiet, and the official trading session is marked by important economic releases, you can expect to see higher volatility and this larger trading range being defined.

On the other hand, there are many intraday futures trading strategies that can be used from the trading range established during the pre-market trading hours.

As traders, the biggest challenge is in attempting to figure out whether the markets will be volatile enough to trade intraday and when to avoid trading the markets on low volatility days. Trading range breakouts is the most obvious method to trade on potentially volatile trading days.

Traders can also use the previous day’s official market trading range and apply this information in the pre-market trading. The most common being going long or short on the futures contract when price breaks out from the previous day’s official trading range that was formed.

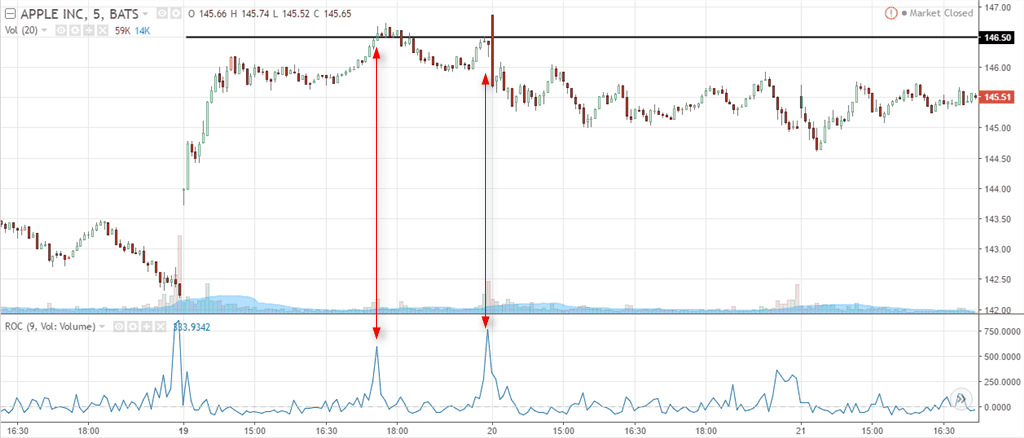

The chart above gives an example where the trading range is established from the previous day’s high and low from the official stock index. Applying these prices to the futures markets on the next day, we can see that in the pre-market hours, price tested the previous day’s official low and breaks out from the after-hours and pre-market trading range high. The futures markets then continue on to post new highs later in the day.

Similar moves can be expected to downside breakout as well.

As this article describes, the pre-market trading hours can provide crucial information to traders and other market participants on how the day’s official open will be like. Higher futures pre-market close than the fair value points to a bullish opening, while a pre-markets price below the fair value indicates a weaker open. The range and volatility that is formed during the pre-market hours is largely defined by how much of information is available. Events that influence investor sentiment during the pre-market or even the after-hours markets can often see either a flat trading session or volatility marked trading.

However, once the official index opens and trading is conducted during regular market hours, the trading range can greatly differ especially during key market information releases such as economic releases from the U.S.

The pre-market trading can also be volatile during the quarterly earnings releases. Since most companies tend to release the earnings report during the pre-market and after-hours market trading sessions, this can significantly impact the stock index prices during these times.

Therefore, in conclusion, the pre-market trading range is not an accurate indicator that will define the day’s range but rather it shows whether the market will be opening stronger or weaker based on the fair value. Other variables affecting the ranges include information released during the pre and after-hour markets as well as the information that comes out during the regular trading hours.

For futures traders, the pre-market trading range can be used in combination with the previous day’s official range to trade the volatile break outs that can occur.