The recent downturn in the stock market has many investors concerned about a prolonged bear market. The Dow Jones recently plunged to its lowest levels since the “Black Monday” stock market crash of 1987. How did the bull run of the 2010’s come to end in 2020? And what does this current bear market mean for investors?

What is a bear market?

Before the bear market of today, the original bear market reportedly got its name from fur salesmen in colonial times. Investopedia noted that the bearskin sellers were similar to stock traders of today.

“Historically, the middlemen in the sale of bearskins would sell skins they had yet to receive. As such, they would speculate on the future purchase price of these skins from the trappers, hoping they would drop. The trappers would profit from a spread — the difference between the cost price and the selling price. These middlemen became known as ‘bears’, short for bearskin jobbers, and the term stuck for describing a downturn in the market,” noted Investopedia.

Today, a bear market definition is much different. A bear market is a time when major stock indexes drop from a high point by 20% for an extended period.

When was the longest bear market?

The worst bear markets occurred during the Great Depression in the 1930’s. During that time, the Dow Jones cratered by almost 34% after a decline in stocks. Many investors bought the stocks on margin, borrowing funds from brokers. When stocks fell and investors couldn’t pay back their loans, there was a run on banks. The resulting bank runs and uncertainty about the economy led to the great stock market crash of 1929. That subsequently led to the Great Depression that lasted for about a decade until the U.S. entered World War II in 1941.

When did other bear markets in history occur?

During the 1987 crash, the markets dropped 31%. That decline was likely caused by a decline in the U.S. dollar after a widening trade deficit with Asian countries. In addition to the decline of the dollar, the new technology of program trading orders led to the crash. The then-new technology of computer trading had an automatic system that liquidated stocks after price decline targets were met. However, the sell-off led to more panicked selling and stop-loss orders.

As a result, Black Monday on October 19, 1987 led to a 22.7% loss in the S &P. After Black Monday, circuit breakers were put in place on Wall Street. Once losses reach 7%, traders have time to stop trading to prevent the Dow Jones from falling further.

The latest bear market in 2008 saw the markets decline by almost 25%. The last bear market was during the 2008 Great Recession. The Great Recession started after banks started failing after a previous boom in the early 2000’s.

Banks started failing after many low-income homeowners couldn’t pay their subprime mortgage loans after adjustable interest rates rose. Ironically, banks pushed these high-risk loans to consumers that ultimately led to their decline. Homeowners defaulted on their loans and the housing bubble burst. Once the housing market and banking industries tumbled, the Dow Jones fell by double digits. The Great Recession lasted from 2008-2009.

How has coronavirus caused the latest bear market?

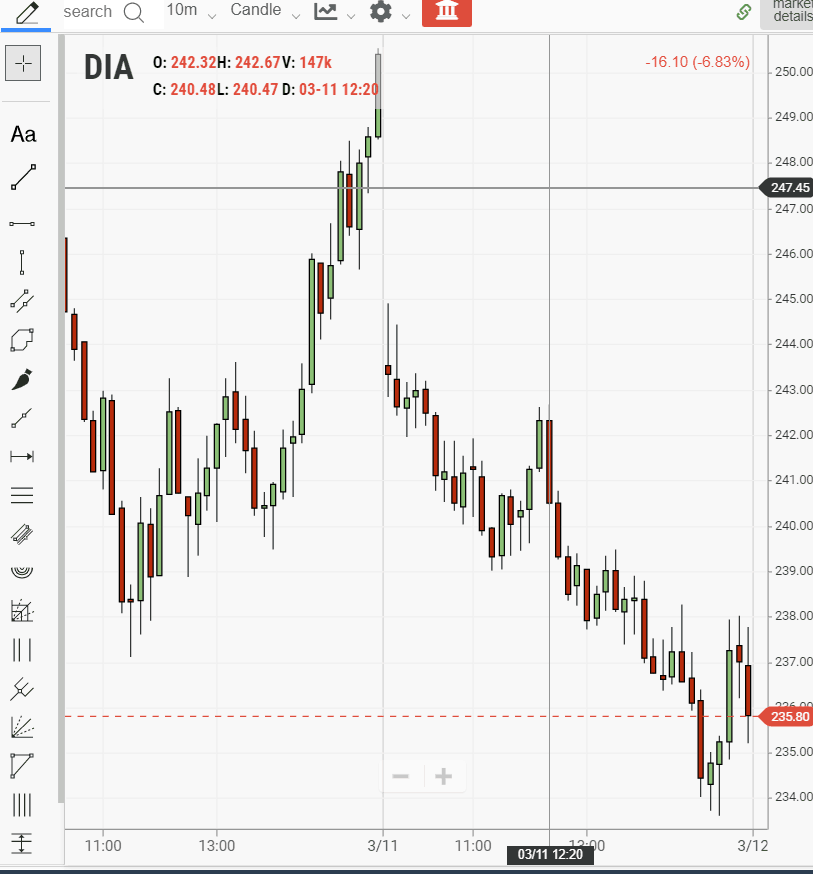

Less than a month after hitting a record high of 29, 551. 42 on February 12, the Dow Jones sank 28%. The Dow Jones plummeted to 21,200. 62 on March 12. Fears about the spread of the coronavirus ( COVID-19) pandemic have caused a massive sell-off. The pandemic caused panic since February by spreading from China. The country is inextricably connected to the U. S. because of how many American goods are produced in China. The illness has spread to Europe and to America, with the world’s largest economy. Many other nations around the world have been impacted by the coronavirus.

Over 118,000 people have been diagnosed with coronavirus worldwide. The virus has claimed about 4,800 lives so far. The illness is apparently spread through large crowds. In the reaction to coronavirus has led to a global shutdown of nations affected, especially China and Italy. Coronavirus has caused the cancellation or slowdown of sporting events, travel, and other activities. These social activities that are driven by consumer spending throughout the globe are being disrupted.

The worries about the virus have caused a drastic downturn in trading. There was a halt in trading at the New York Stock Exchange for 15 minutes on several days the week of March 9 because stocks fell so low. The S & P 500 fell 10% on March 12 and triggered a “circuit breaker” that was supposed to halt trading and prevent a further decline. However, the Dow Jones continued to tumble and dropped 2,353 points on that one day alone.

Oil price war adds to Wall Street volatility

In addition to the coronavirus crisis, there have been wild swings in the stock market. The Dow Jones is rattled because of an impasse between Russia and Saudi Arabia, two of the world’s biggest oil producers. Russia refused to honor an agreement from the oil-producing countries of OPEC ( Organization of Petroleum Exporting Countries.) OPEC initially agreed to cut oil production by 1.5 million barrels a day to drive up prices. Russia refused to go along with the Saudi-led deal. As a result, Saudi Arabia increased its oil production and flooded the market.

Crude oil prices dropped 24% in response to the ramp-up of oil production. That decline was the worst since the start of the Persian Gulf War in 1991. The drop in oil prices led to more volatility on Wall Street. Foreign Policy columnist Jason Bordoff noted that Saudi Arabia could have an advantage over Russia in the oil price war.

“The problem for the kingdom is that Russia is more resilient to lower prices than it is, having added considerably to its foreign exchange reserves while Saudi Arabia’s fiscal cushion has dwindled since the 2014 oil price collapse,” wrote Jason Bordoff.

U.S. responds to global oil war

In response to the oil price war, President Donald Trump has ordered the U.S. Department of Energy to buy crude oil for the Strategic Petroleum Reserve. Trump made the decision after oil company stocks like Exxon and Chevron have plummeted by double digits. He also made the decision after crude oil prices dropped worldwide.

“Based on the price of oil, I’ve also instructed the Secretary of Energy to purchase at a very good price large quantities of crude oil for storage in the U.S. strategic reserve,” Trump said.

“We’re going to fill it right up to the top, saving the American taxpayer billions and billions of dollars, helping our oil industry [and furthering] that wonderful goal — which we’ve achieved,” added Trump.

The twin troubles of coronavirus and the decline in oil prices have led to volatility on Wall Street that ends the longest bull market in history.

Why did the bull market start?

The bull market ended after an impressive run before falling into a bear market. While the bear market comes when the market falls 20% below a peak, it’s the polar opposite of a bull market. The term bull market probably comes from the belief that bulls always charge upward with their horns. Therefore, when the stock market is doing well for an extended period of time, that is a bull market. A bull market means that the Dow Jones rises 20% above its current peak for an extended period of time. The latest bull market ran from 2009-2020.

Before the recent volatility, the Dow Jones was enjoying a record run of prosperity. The stock market rocketed 20% above its last peak in March 2009 and has soared ever since. The recent bear market ends the longest bull market that started in the spring of 2009.

How did the Fed help drive the bull market?

As the U.S. was surviving the Great Recession, the federal government’s $700 billion bank bailout helped revive the economy. In addition to the bank bailouts, the Federal Reserve helped lay the groundwork for the 2010’s bull market. The Federal Reserve spent $1 trillion on mortgage and government bonds to enable quantitative easing. The move pushed interest rates lower and enabled consumers to take out more bank loans and investors to buy more stocks.

The Fed also kept its federal funds target rate at a rock-bottom rate of 0%-0.25%. The federal funds target rate is the rate depository institutions charge for overnight lending to banks. That low rate empowered banks to borrow money at low rates and increase their profits.

In addition to the Fed’s dovish policy that led to helping businesses, the 2017 Tax Cuts and Jobs Act also boosted stocks. The business-friendly tax cuts helped lower the tax rate of corporations. Corporations participated in stock buybacks, which boosted companies’ stock prices.

As a result of all of those factors and a robust economy, Wall Street enjoyed 10 years of a skyrocketing economy amid rising stocks. As a result of the longest bull market, the S&P rose 330% over the last 11 years.

Why did the bull market end?

While the bull market had a long run, even before the coronavirus crisis, there were low points to the bull market wave. The recent Brexit controversy in the United Kingdom in 2019 temporarily caused a dip in the markets. Uncertainty about the United Kingdom leaving the European Union led a short-term dip in the global markets. The U.S.-China trade war started by President Trump also led to market volatility in 2019 as well. The U.S. and China engaged in a stand-off over tariffs led investors to worry about how international trade would be impacted.

With the latest volatility in the stock market, the bull market has officially ended. Coronavirus accelerated the Dow Jones’ decline. Just a month after reaching a record high, the Dow Jones has lost $6.7 trillion in value in the latest bear market. A mixture of a global economic slowdown and investor worries have led to a massive stock sell-off. The official end to the bull market was during the week of March 9.

What is the Fed’s response to the bear market?

Now that the Dow Jones in a bear market, many investors are watching to see what actions will be taken. In response to the Wall Street crash, government agencies are taking action again. The Federal Reserve lowered interest rates in an attempt to revive Wall Street. The U.S. central bank pumped up stocks by lowering its fund target rate to 0% in 2009.

Now the Fed is taking action a similar again a decade later. The Federal Reserve will cut interest rates down to the range of 0%-0.25%. That comes after concerns about the markets tanking the week of March 9. The Fed will also launch a $ 700 billion quantitative easing program. The Fed’s quantitative easing will be comprised of $500 billion of Treasury purchases. The Fed will also distribute $200 billion in mortgage-backed securities.

The Fed released a statement before lowering interest rates.

“The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” noted the Federal Reserve.

The Federal Reserve added that it is making it easier for banks to issue loans to consumers. The U.S. central bank wants to help banks loan more to Americans. The Fed noted that it “is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.”

New York Fed takes action in bear market

Local Federal Reserve banks will also inject cash to try to revive the market. The New York Federal Reserve also recently announced that it will purchase $37 billion in 30-year bond treasuries.

“These purchases are intended to address highly unusual disruptions in the market for Treasury securities associated with the coronavirus outbreak,” said the New York Fed in a statement.

The New York Fed will offer banks $1 trillion in loans in exchange for Treasury bonds.

Willie Delwiche, an investment strategist at Baird, hopes that the return in qualitative easing will help ease investors’ worries.

“If the market feels the Fed is responding appropriately and is helping investors and consumers, and feel like somebody is in charge, maybe that can help settle things down,” said Delwiche.

While the action was meant to help the stock market, the bank assistance from the Federal Reserve has had a mixed effect. As of the week of March 16, the Dow Jones still shed another 1,000 points. However, by March 17, the market jumped 1,000 points. By March 18, the Dow dropped again, losing over 2,000 points.

What will be the government’s response to the bear market?

The Trump administration is taking action to help boost the stock market. The government will offer paid leave to workers who have to stay home under quarantine. Congress is also in negotiations with Trump to offer a stimulus to help boost the Dow Jones. There will possibly a $1 trillion stimulus package that will give $1,000 to each American worker that has to work from home.

Some financial experts want the government to act more urgently to stop the bleeding on Wall Street. Joe Kalish, chief global strategist at Ned Davis Research wants the government to immediately pass a stimulus package to help the Dow Jones rebound.

“We need to see meaningful support for economic activity and credit backstops especially for small businesses, not a targeted approach executed only by the executive branch,” noted Joe Kalish.“We will likely need congressional involvement. This is a potential solvency problem.”

Should investing in a bear market include “buying the dip”?

Regardless of whether there is government intervention or not, investing in a bear market can either be financially savvy or a financial disaster. Many investors are encouraged to “buy the dip” and buy stocks during this huge sell-off. Buying the dip is buying stocks during a bull market when stock prices are lower.

Some financial experts like David Mazza say investors should buy the dip. The trading expert says investors should invest in stocks when they drop in a bear market. However, Mazza advises that investors should invest in a bear market under certain conditions. Mazza says investors should buy the dip only if they’re optimistic that the stock market will bounce back later.

“From a longer-term perspective, valuations across the market just got a lot more attractive. For investors that do not believe this will lead to a true 2008 type of global downturn, dipping your toes into the water does make some sense”, said Mazza.

Some financial advisors are against investing in a bull market

While some financial experts advocate being a bear investor, others are more hesitant. Mohamed El-Erian, chief economic advisor at Allianz, cautions against investors buying stocks in a bull market. El-Erian believes that investors are in for the long-haul should exercise caution before buying the dip because of the volatilty of the stock market.

“If you are a long-term investor, I would wait. I think fundamentals are going to deteriorate even faster. I think the policies and fundamentals are going to go in favor of bad fundamentals, unfortunately, initially,” said El-Erian.

Which stocks should investors buy in a bear market?

If investors want to make decisions on what stocks to invest in, there are stocks that are performing well in a bear market. Some stocks have been performing well as a result of the coronavirus outbreak. Costco ( NYSE:COST) stock has risen as shoppers have bombarded the store. They are panic shopping for items and emptying shelves to try to combat the coronavirus. The warehouse retailer’s stock surged 8% on March 13 and subscription numbers are up after shoppers rushed Costco stores.

Costco’s chief financial officer, Richard Galanti, noted that Costco members have bought many items during the coronavirus pandemic that have driven up sales.

“Members are turning to us for a variety of items associated with preparing for and dealing with the virus such as shelf-stable dry grocery items, cleaning supplies, Clorox and bleach,” said Galanti. He also noted that “water, paper goods, hand sanitizers, sanitizing wipes, disinfectants, health and beauty aids, and even items like water filtration and food storage items” are bestselling items in the stores.

Costco is selling out of Clorox ( NYSE: CLX), another stock that is performing well in a bear market. Clorox’s stock price rose by about 15% throughout 2020 as of March 13. The company that makes cleansing wipes and other disinfectant materials have been flying off store shelves in the wake of coronavirus. UBS analyst Steven Strycula believes that coronavirus (COVID-19) fears will continue to drive Clorox stock up.

“Based on conversations with retail buyers, we estimate COVID-19 related demand could boost baseline disinfectant category trends by 3-5x in the next few months as retailers work to rebuild inventory and stay in stock,” reasons UBS analyst Steven Strycula.

Working from home creates boom in Zoom stock

Another stock that has seen improvement in the wake of the coronavirus crisis is Zoom ( OTC: Zoom) . The videoconferencing software company has seen shares rise as more people are working from home. The stock surged by 24% over the last month. Zoom is continuing to show its strength a year after its IPO went public.

What stocks should investors avoid in a bear market?

Airline stocks are performing poorly in the wake of coronavirus. Shares in those industries have tumbled as a result of the virus scare. Many people are traveling less in America and there is a travel ban from Europe. All of these factors are making airline stocks a risky investment. American Airlines (NYSE: AAL) stock is down 50% over the past month. The airlines are hoping that a $50 billion bailout from Congress will help the industry rebound from its current losses.

In addition to airline stocks, cruise line stocks are a poor option for investors. Similarly to airlines, restrictions on cruises and cancellations have hurt share prices. Cruise lines that have been breeding grounds for coronavirus have been deeply impacted. Shares of Norwegian Cruise Line ( NYSE:NCLH) have cratered by 72% since the global pandemic spread.

Restaurant stocks suffer from social isolation rules

Another industry that is struggling amid the economic downturn is in the restaurant industry. Darden Restaurants ( NYSE: DRI) stock is down by double digits. The stock of the parent company of Olive Garden has tumbled by at least 16% since coronavirus spread in the U.S. Social distancing caused many Americans to eat at home instead of eating out at chain restaurants. Many restaurants are closing around the country through state mandates, but chains like Olive Garden will remain open. Olive Garden noted in a statement that it is adding hand sanitizing locations and separating tables. Darden also said it will give paid sick leave to employees that are not well.

“We are proud of our 190,000 team members for the support they are providing to our communities. One of the most important things we can do is to care for those who care for you. Recently, we rolled out a paid sick leave policy to every one of our hourly team members, so they can stay at home until they feel better while still being compensated”, said Darden.

Despite the precautions and proactive steps to help employees, restaurant stocks like Darden are taking a hit during the coronavirus pandemic. Restaurant stocks may further decline if the stock market continues to experience volatility.

Should investors choose inverse ETF’s in a bear market?

In addition to individual stocks, ETF’s (exchange-traded funds) have been hit in the bear market. However, inverse ETF’s have become attractive in the current bear market. As ETF provider Direxion noted, the ETF’s can offer a quick return during a bear market.

“These tools may be used when seeking to hedge the market. As their name reveals, inverse ETFs go up when the market goes down, and they go down when the market goes up. Inverse ETFs allow you to seek the opposite return of specific sectors and asset classes; for instance, the S&P 500, and Financials, Energy and Technology sectors,” said Direxion.

“Again, the thing to remember about these funds is that they’ll lose value as long as the market keeps going up. But the potential rewards can be attractive if the market suffers a setback. At the very least, inverse ETFs may serve as a hedge. It’s important to note that an –1x ETF which seeks 100% of the inverse performance of an index, is subject to daily compounding. However, basic math dictates that the compounding would be less than the compounding in a -2x or -3x leveraged ETF,” added Direxion.

Which inverse ETF’s would be best for bear investors?

Some inverse ETF’s that investors may decide to invest include these top ETF’s. ProShares Short QQQ had a 26% return during the 2018 correction and has an annual dividend yield of 1.76%. Direxion Daily S&P 500 Bear 1x and ProShares Short S&P 500 also had double-digit returns during the 2018 turbulence of the U.S.-China trade war. Those ETF’s could perform well during a bear market.

What ETF’s should investors choose in a bear market?

ETF analysts believe that the ETF industry can withstand the volatility in the stock market. WallachBeth Capital’s Andrew McOrmand advocates choosing options for ETF investors. He also wants investors to research the ETF’s before choosing these funds.

“We do know very active traders that don’t use options. I think options are a great thing,” he said. “I would focus on listed options, listed index options and ETF options, but understand that vol[atility] is high and understand the pricing, meaning that you are going to pay up to put your idea on and, certainly, there’s risk in selling those ideas,” said McOrmand.

“For ETFs themselves as listed tickers, you could look at liquid alts[liquid alternative investments] like QAI and MNA, which are less correlated to the overall market and can dampen volatility,” said McOrmand.

Tom Lydon, CEO of ETF Trends, believes that the ETF’s are a safe option in the wake of the current bear market. He also agrees with McOrmand that staying calm in the face of Wall Street volatility is key.

“We’re cheering on the ETF business for sure. It’s doing what it’s supposed to do at this point. Going forward, I think [McOrmond’s] words of wisdom about being calm, sticking to your long-term model, is important. If you’re trading, make sure you’re efficient in your trading.

What should investors do in a bear market?

With the volatility in the stock market, these actions could be effective for investors. Investing in a bear market could be profitable with these strategies. Dollar-cost averaging is for risk-averse investors that want to remain steady in a bear market. Dollar-cost averaging means investing stocks at regular intervals at the same amount. This strategy can work effectively during a bear market. Investors put a certain amount into buying stocks. With a steady amount, there can be a pay-off during a bear market. If stock prices fall, your average cost can fall and investors can buy more shares of stocks.

Diversified portfolios would also be pivotal to investing in a bear market. Having a diverse mixture of stocks, bonds, and futures can help investors in a bear market. Futures can especially be an effective way to invest. Futures like the E-mini S & P 500 are one of the most trades indexes. Buying Treasury bills can be effective as well. The yields on 10-year Treasuries have skyrocketed 27.2 basis points in the past few days. Investors are likely investing in a perceived safety in Treasury bonds with the uncertainty of the stock market.

Another investment strategy is to invest in stocks with high dividends. Some stocks with high dividend payouts include Big Pharma company Pfizer(NYSE:PFE) and storage company Public Storage (NYSE: PSA). These stocks often give investors high dividends of at least 3%.

Another bear market investing strategy that is effective is simple patience. Because of the volatility in the market, it’s impossible to time when the Dow Jones will enter a bear market. Riding out the wild swings of the stock market is key to investing in a bear market. By just waiting out the bear market investors can profit. Even for passive day trading, thinking carefully before investing will lead to better investment decisions.

Some financial experts see buying opportunities in bear market

While many financial advisors are pessimistic about the current stock market, investor Bill Miller says the bull market is a great time to invest. The chief investment officer of Miller Value Partners said that the bear market can be advantageous for savvy investors.

“I think this is an exceptional buying opportunity. I don’t mean to put all the money in at once but I do think layering it in right now is the way to go,” said Miller.

Financial experts believe bear market will last if no pharma breakthrough

Many other financial experts believe that the bear market will last longer than expected. Paul O’Connor, head of multi-assets at Janus Henderson Investors believes there is a medical component to the Dow Jones recovery. He says that unless coronavirus infection rates slow, Wall Street will continue to be nervous.

“The missing fundamental ingredient for a sustainable recovery in risk appetite is some evidence that the growth of global Covid-19 infection rates is peaking. Clearly, we are not there yet,” said O’Connor.

Tom Essaye, founder of the Sevens Report, also thinks that innovations in medicine is key to helping the skittish stock market.

“Volatility is not over yet,” said Essaye.“We also need to see more progress on the pharma side of things and above all else we need the growth rate of the virus to peak in the coming weeks.”

John Hill, interest-rate strategist at BMO Capital Markets, said that the government’s response is key. He believes the policies implemented will affect the stock market.

“Unless the White House and Congress significantly disappoint with their policy response, there is room for the bearishness to extend,” said Hill.

When will the bear market end?

For investors who want to be more aggressive during this bear market, there are many options. However, it remains unclear how long this downturn will last. The stock market has gone through wild up-and-down swings over the last few weeks. The S &P credit rating agency believes that the U.S. is headed toward a recession.

“The increasing restrictions on person-to-person contact in Europe and the United States have sent markets reeling as risk-aversion rises and views on economic activity, earnings, and credit quality deteriorate sharply,” S&P said in the note.

No matter what happens in the bear market, investors will be closely watching Wall Street. They will monitor what stocks they should buy or sell. The massive sell-off is part of a cycle of bull markets and bear markets. As long as investors are patient and wait out this current crisis, they can find the best stocks, ETF’s, and futures to add to increase their portfolios.