Market capitalization is defined as a value of a publicly traded company derived by multiplying the total number of shares outstanding by the current share price. For example, if a company had total shares outstanding of one million and the share price was $5, then the company is said to have a market capitalization of $5 million.

Market Capitalization is calculated as follows:

Market capitalization answers the question of how much money would it take if you want to buy all the shares that are currently outstanding at the current stock price.

Market capitalization comes in two forms.

A full market capitalization method includes account for all shares that are provided by the company. This includes unexercised stocks, stock options given to employees and executives, preferred stock and so on.

The free-float market capitalization methodology accounts for only the shares outstanding or shares that are readily available and obviously excludes the locked-in shares.

It should be obvious by now that the free-float method of market capitalization is lower than the full-market capitalization and the free-float market cap is often referred to and widely adopted.

Market cap is an important metric for stock investors in understanding the relationships between the potential for reward and risk as well as comparing companies within a sector. Market cap helps investors in building a balanced portfolio, understanding the risks involved based on the category the stock falls into and it can also help to build a portfolio that is targeting high growth, stable income or a mix of both.

The importance of market capitalization can be seen in the way the stock indexes are comprised of. A capitalization based stock index is where the constituents are weighted in accordance to the total market value of the outstanding shares. Some of the world’s leading stock market indexes are based all capitalization based or weighted indexes. The NASDAQ100 for example is made up of 107 non-financial companies on a capitalized weighted index basis. Other examples of some international stock indexes that follow the market cap method include the Germany’s DAX30, London’s FTSE100, the CAC40 and so on.

When it comes to market capitalization for stocks, the stocks can be categorized into three broad categories.

Large-cap companies: The companies that fall into this category are the big guns having a market value of $10 billion or more. Large cap firms are said to be the most stable and have a solid reputation behind them with steady growth being one of the hallmarks. These large cap companies are also the most dominant within their sectors as they are more popular and quite likely a household name. However, despite being the leaders, investing in large cap companies is said to be a conservative type of investing due to the apparent safety net that such type of companies provide. You will also find most of the dividend paying companies categorized as large cap due to the fact that after achieving years of growth, the large companies are stable, have a decent cash flow and can even afford to pay dividends to its investors.

Examples of large cap companies include, Agilent Technologies Inc. (A), Adobe Systems (ADBE), and American International Group (AIG).

Mid-cap companies: These companies are businesses that have a market value of a minimum of $2 billion but less than $10 billion. Mid-cap companies are ones that are experiencing growth and are in the process of increasing their market share. The mid-cap companies are often found to be competitive and from an investing stand point, mid-cap companies offer larger growth potential and smaller risks when compared to small capitalized firms. The mid-cap companies sit in the middle and offer a balance of risk and growth. They are not too risky but at the same time there is considerably growth potential. Most of the big names of tomorrow, can be often found in the mid-cap category.

Examples of mid-cap companies include Alcoa (AA), Bats Global Markets (BATS), LendingClub Corp. (LC).

Small-cap companies: The small cap companies are the ones that have a market valuation between $300 million and up to $2 billion. Small cap companies are high potential companies but come with significant risks such as the downturn in the economy and susceptible to the immediate industry risks as well. Besides this, small cap companies are thinly traded compared to their mid or large cap counterparts. This poses a significant risk as the lack of liquidity can mean that investors need to bear the risk of getting bad fills on their trades. Small cap companies also have less capital and are not adequately financed and as a result make them more prone to risks.

To the upside, because the small-cap companies are still in the early stages of growth, the returns come as a result of investing in such companies can be huge. Simply put, it is a lot easier for a company to double yearly sales of $50,000 compared to a company that is already logging $5 million in sales.

Examples of midcap companies include Ambarella, Inc. (AMBA), Abercrombie & Fitch Co. (ANF), Barnes & Noble Education Inc. (BNED)

Besides the above three market cap types, companies with valuations of over $100 billion are termed as Mega Cap companies. The mega cap companies are at the top of the chain and have some strong brand names such as Apple Inc. Microsoft, Nestle and so on.

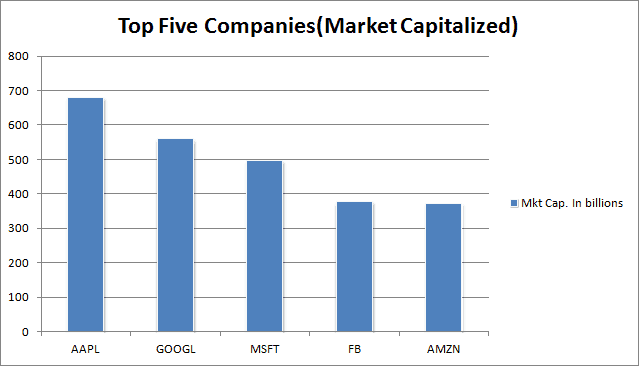

What are the top five biggest companies by market cap?

Due to changing factors, the companies in the top five of the biggest companies by market capitalization are in a constant battle and retaining a top spot for long is hard by any company. If earlier, the biggest companies by market capitalization were dominated by energy and financial sector companies, there has been a change in the trend as over the years, technology companies have usurped other big names from the past.

The biggest company by market capitalization is no doubt Apple Inc. (AAPL) with an estimated $582 billion as of 2016 (and is now at over 679 billion as of early February 2017), followed by Alphabet Inc (GOOGL), Microsoft (MS), Facebook (FB) and Amazon (AMZN).

In other words, the above companies are the most valued by investors in the absolute terms. Investors should know that the above list is not set in stone and can change over a period of time. The picture below shows how the companies have been fluctuating in the top 5.

Stock price and market capitalization

For most investors, stock price is one of the starting points in evaluating a company and this is because the stock price is one that is widely quoted in the media. The price is also how one perceives the company to be. For some investors, cheaper stock prices are attractive while for some, higher the stock price the more value they seem to have. But this is far from the truth as market capitalization is one of the metrics that needs to be considered rather than looking at stocks.

Market capitalization can help investors to make better investing decisions such as understanding which of the two companies is worth more when they have the same or nearly the same stock price. A stock price alone won’t tell you much in terms of whether the stock is a good investment or not. On the other hand, market capitalization can tell you which of the companies that you are evaluation has better prospects.

For example, if you were looking at a sector and you notice that company A had a stock price of $14.59 with total shares outstanding of 202.55 million. Then you have company B with a stock price of $14.34 and total shares outstanding of 142.13 million. If you ignore the minor difference in the stock price, both these stocks look to be priced nearly the same. When you multiply the stock price by its shares outstanding, you can see that company A has a market cap of 2.96 billion while company B has a market cap of 2.04 billion, giving more worth to company A than company B.

Besides the share price, the company’s outstanding shares play an important variable in determining the market cap of a company. The shares outstanding are the number of shares that are readily available and it can vary from one company to another. Companies can also influence the shares outstanding by initiating a buy-back program or issue stock splits and reverse stock splits. This is done partly because of investor psychology as well. Most investors tend to prefer buying stocks in a lot of 100 shares or so, thus a stock price of around $50 to $100 is usually maintained by companies.

For example, in 2014, Apple Inc. split its stocks on a 7-1 basis. This practically allows for Apple’s shares to be more affordable as the stock was trading at $94 under the stock split, compared to the closing price of $645.57 prior to initiating the stock split. This allows many investors to quickly purchase the shares in Apple at a lower price.

Pros and cons of stock market capitalization

As with most metrics in fundamental analysis, stock market capitalization has its own pros and cons. At the outset, the market capitalization can enable investors to differentiate the relative size between the companies being evaluated but it ignores the specifics about the capital structure which causes the share price of one company to be higher or lower than the other.

Therefore, a company with a share price in triple digits but having lower shares outstanding will have a lower market capitalization compared to a company that is trading around $10 or $20 but having higher shares outstanding. The share price as you can see is merely a result of the total shares outstanding that exists.

One of the biggest factors however is that market capitalization does not tell you a couple of important metrics such as debt or the liabilities of the company, dividends, stock splits, all of which matter.

Market capitalization should also not be confused as a metric for estimating a company’s actual net worth. In this scenario, the shareholder equity is said to be a more accurate representation of the net worth of the company. Unlike market capitalization, shareholder equity or just equity is nothing but a company’s assets minus liabilities.

Using market capitalization for building a portfolio

Besides sector allocation, professional investors also focus on building their portfolio based on the market cap size comprising of a balanced mix of mega, large, mid and small cap companies. As an active trader market capitalization can help in understanding how a stock is likely to behave and it also gives a general overview of what to expect from the stocks. Thus, if your portfolio had a larger exposure to small cap stocks, you know that while you expect high returns, the risks are also equally big.

As an example, if you took a 1 year return, the S&P500 benchmark index returned 17.4% for January 2017. When compared for the same period, the iShares Core S&P Mid-Cap ETF (IJH) had a total return of 30.07%, while the iShares Core S&P Small-Cap ETF (IJR) had a total return of 34.13% for the same period. Of course the risks of the small cap and mid cap ETF’s are also proportionately higher.

Market capitalization can help active traders in broadly categorizing one’s portfolio as to whether they seek a fixed income type of portfolio, which offers stable returns, thus mostly targeting large or mega cap companies or seeking high growth companies that can generate returns that can beat the benchmark stock index. Bear in mind that when it comes to evaluating a company, market capitalization can only do so much and it is up to the investor to look at other metrics to get a full picture of the company.