When you hear timing, you are likely thinking of the larger cycles in the broad market. These cycles could be related to the presidential election or quarterly earnings reports.

These cycles help investors understand when it makes sense to invest their funds with the greatest odds of getting it right. Remember, in trading and life, it’s not just about being right. It’s equally if not more important to be right at the right time.

Well, this same principle applies to day trading which I will explore in this post. The only difference is the timing aspect is on an intraday basis.

Market Timing Versus Buy and Hold

Every major study will show you that a buy and hold strategy kills any market timing approach. There have been a number of case studies that have shown just buying and holding the S&P 500 index and you will outperform money managers.

So why should you care about market timing for day trading?

Let me be the first to tell you that day trading is all about market timing. As you go on a shorter timeframe, the loss of time requires you to get things right.

So, if you plan on day trading, focusing on your timing is one of the most critical things to your success.

Market Timing for Momo Traders

As a momentum trader, you are buying and selling the most volatile stocks of the day. The day will start as early as 4 am depending on how far you want to push it.

At a minimum you will need to be in front of your computer by 7:45 am. The reason is that the low float, penny stocks will make significant moves in the pre-market.

Should You Trade the Pre-Market?

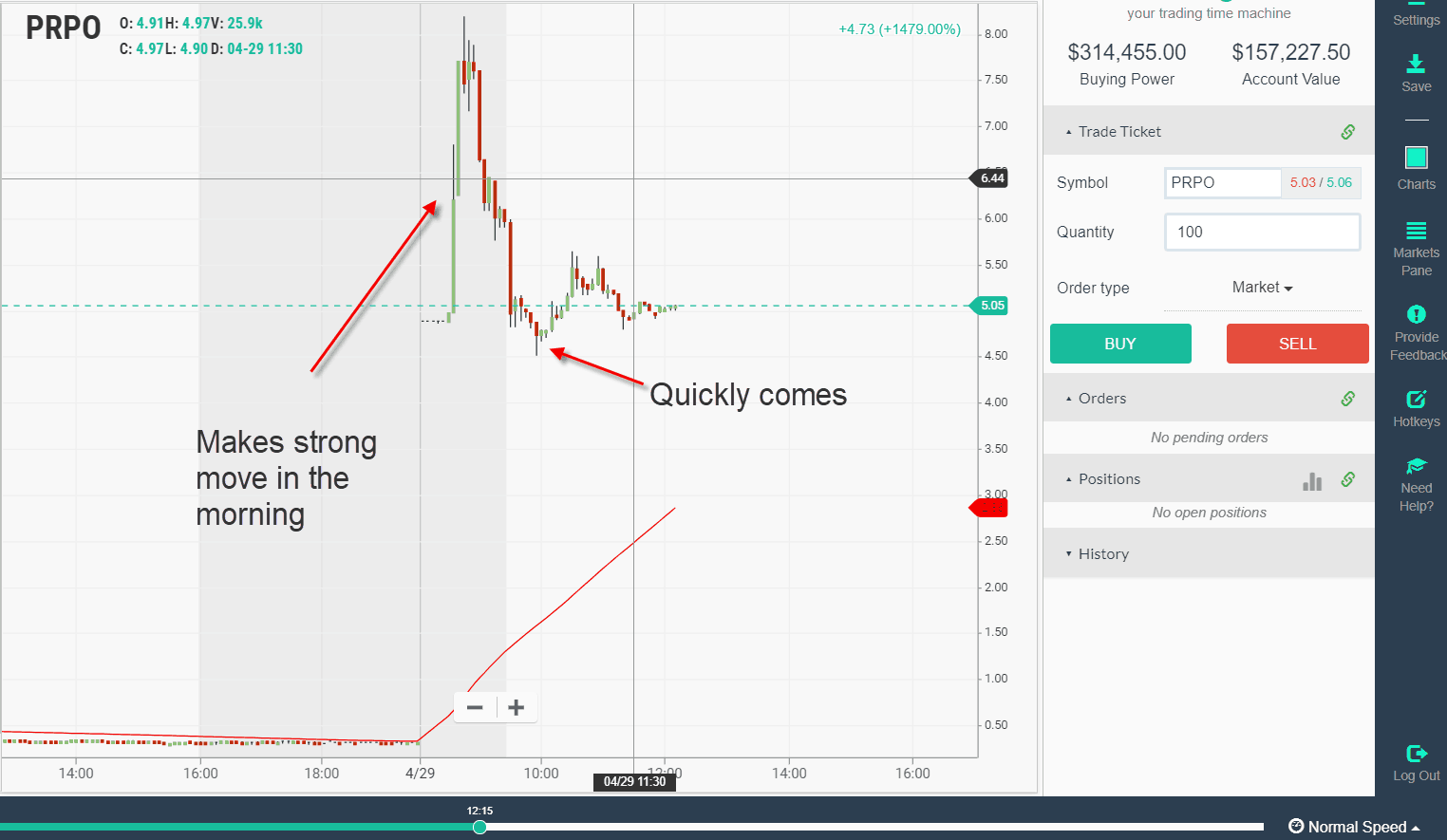

This is something you will need to test. I can’t tell you how many times I have watched stocks scream higher in the pre-market, only to quickly selloff within the first 5 to 15 minutes after the open.

After the open, within the first hour, the bulk of the move is over.

During the first hour, an extremely volatile stock does one of two things.

It either pushes higher, extending the morning gains or it reverses and comes back to earth.

My experience has shown me that for really cheap stocks, they often will implode at some point during or shortly after the first hour.

So, if you buy into these impulsive moves higher, do not get too attached, because traders are looking to book profits.

Momo Timing Example

How Do You Improve Your Odds of Timing a Momo?

The big thing that helps and I wish someone would have told me earlier on, is you have to go to a lower timeframe.

I was trying to trade momentum stocks on a 5-minute chart. You will want to go to a one-minute chart and if the volatility is really out there, you will need to go sub one-minute.

This will help you see the action unfold on a more granular level, which will help you exit the trade quicker, versus waiting for an entire 5 minutes to elapse.

Remember, 5-minutes is literally a lifetime in the momo trading world.

Market Timing for Non-Momos

Two Setups

What I have noticed in the morning, there are two types of setups. Now there are a number of patterns that fit within these setups, but at the end of the day, there are two setups.

There are stocks breaking out and stocks pulling back before breaking out.

These setups will develop between 9:30 and 11:00.

Below are two real-life trading examples I placed for big wins.

Pullback Setup

Breakout Setup

Now, these setups are for more low volatile stocks. Remember, the momo setups are pretty much done by 11 am.

Give The Pattern Time to Setup

We have talked about this extensively in another article, but the key in the morning is letting the trade setup. If you run out there at 9:33 am on a stock you will likely get into a situation.

You need to give the stock time, so you can identify the pattern and then strike.

For example, take a look at the below chart. Are you able to make an informed decision based on one bar?

Sometimes, one candle is enough if the stock is breaking a key level that has been developing over days. However, more times than not, you need to let the bulls fight it out a little before pulling the trigger.

Here is how Google played out after the first bar.

11:30 to 1:00 and Sometimes 2:00

This is the time window where trade success diminishes. I wasted countless thousands trying to master lunchtime trading.

Now, if you are holding a position from the morning that is trending hard great.

But if you are opening a new position, make sure you are selective about which stocks to trade. You do not want to end up in the spot of trying to time a move during the lunch window when volume and volatility are at a low.

Things Pickup Again After Lunch

After the 1 to 2 pm time slot, things start to pick up again. If you are timing the market, you will want to look to enter new positions at this point. You then ride the wave into the close.

I have noticed stocks will start to run into the 3 pm time window. This is part of my game currently where I am working through what to do at this point.

At times 3 pm represents the end of the party but at times the stock will run to 4 pm.

Timing Outside of the Morning, Lunch and End of Day

There are times when you are day trading that the time zones for the day have no relevance. This is when the volume on a stock spikes outside of the morning timeframe at some random time.

For example, if a stock has a significant spike at 12:34 pm, traders will take notice.

In order to find these types of setups, you will need a real-time scanner that can zoom in on this kind of action at the point of impact.

How Can Tradingsim Help?

As you can see market timing has many layers. There are those of you that will be in a weekly or daily basis tracking larger trends. While others will focus on day trading and the minor time cycles present each and every day in the market.

Well, you can leverage Tradingsim to practice both methods to see which works best for you. You can also trade other time zones to see which one best suits your trading style.