Municipal bonds are a great way for investors to diversify their portfolio within the debt markets. One of the unique advantages being that when you buy bonds locally, you also benefit from tax exemptions.

Many investors often focus on the Treasury bonds, which are of course risk-free. But so are municipal bonds, depending on the ratings. There are multiple ways one can invest in municipal bonds such as municipal bond ETFs. These are more convenient if you live elsewhere or want to use the municipal bond ETF to hedge your debt portfolio.

From an ethical standpoint, it also helps the investor in knowing what they are lending money to their local municipality. While it is easy to invest in a municipal bond, municipal bond ETF is also another option. Through these bond ETF you can diversify between the treasury bonds and the local bonds.

Wouldn’t it make you happy knowing that you are lending money to support the local municipality’s financing? The icing on the cake further comes from the fact that you also get to earn a modestly higher yield.

Municipal bond ETF have grown in popularity thanks to the explosion in the exchange-traded funds. These days you can pretty much find an ETF in a host of categories and asset classes.

The bedrock of municipal bonds is that they are tax-free. Furthermore, the lack of futures contracts of these keeps it away from large international investors. For example, China, Japan’s government pension investment fund and the likes are some of the biggest investors in the bonds from the U.S. Treasury.

An investor can, of course, purchase municipal bonds, but that doesn’t exempt them from the tax benefits a local investor can get.

Municipal bond yields are typically higher than what you would get if you invest the same money in a treasury bond. With quite a few benefits already, let’s take a look at what a municipal bond is.

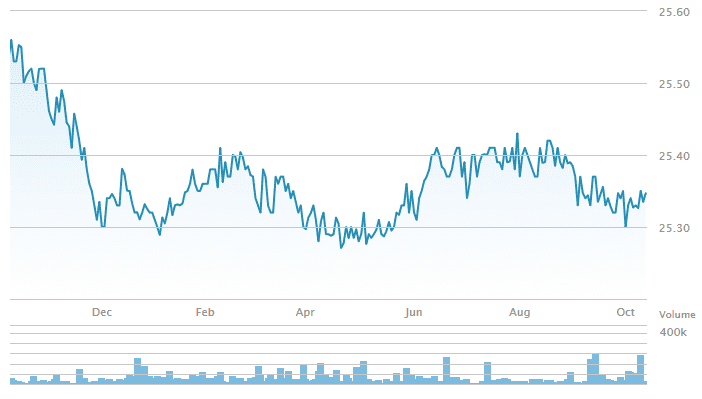

The chart below shows the bond yield spreads between the munis and the treasury market curve slope.

As the article indicates, the 10-year AAA-rated municipal bond yields 85 basis points higher compared to the Treasury which is just 25 basis points.

But beware that municipal bonds are also subject to default risk. This article from the NY Times covers the famous Jefferson county debt crisis and its default.

While the above is just a fleeting example, there are many other benefits. In this article, you will learn about municipal bond ETF and the benefits of investing in one. So, let’s start with the basics.

What are municipal bonds?

Municipal bonds are debt securities which are also known as Munis. These bonds are raised by local authorities that are not at the federal level. Think of municipal bonds like those that are issued by counties and cities.

Local authorities make use of the bond market in order to finance their projects. Some municipalities use bonds to fund day to day obligations such as paying salaries or for maintenance of equipment.

For example, if a local county wants to expand a community park and they are short of cash, then they can issue municipal bonds. The county then uses the money that it gets from issuing the bonds towards the maintenance of the park.

When you buy a municipal bond, you are basically lending money to the bond issuer. The bond issuer here is the municipality in question. By lending money, the issuer promises to pay regular interest on the loan. The tenure of these interest payments can be quarterly or semi-annual payments.

After the fixed period of the loan, your original principal is paid back to you. As you can see municipal bonds are not very different from the treasury bonds.

Municipal bonds also follow the format of short-term bonds which mature in three or five years. Long-term bonds mature in the time frame of a decade or more.

In the United States, interest from the municipal bonds is exempt from the federal income tax. In some cases, the interest may also be exempt from the local state taxes as well.

This is applicable if you buy the municipal bond from the place where you reside. As you can see, there are some benefits of investing in municipal bonds.

Types of municipal bonds

Municipal bonds come in two forms.

Revenue bonds raise cash to pay for projects such as community parks, toll roads and bridges and so on. In other words, the money from revenue bonds cover projects that generate revenue for the local authority.

Obligation bonds are not backed by any assets. A general obligation bond is merely backed by the “full fair and credit” of the issuer. The issuer, which is the local authority, of course, has the power to tax the residents in order to pay the bondholder if need be.

There is a major difference between revenue bonds and obligation bonds.

Revenue bonds are given on the basis of the revenue that is generated by financing a project. This can be somewhat of a less concern for an investor if they believe that the project will indeed finance itself.

On the other hand, obligation bonds could potentially require the local authority to tax their residents in order to meet the bond obligations.

Bear in mind that some revenue bonds can be non-recourse. If the revenue stream dries up or the project fails to generate the revenue in a few years, the bondholders do not have a claim to the revenue source.

There are other variations in the municipal bonds. For example, a non-profit hospital or a community college can raise cash via the municipality. Such bonds are conduit bonds. The ultimate beneficiary of the capital from the bond issue agrees to pay the issuer.

The issuer, in this case, happens to be the local authority issuing the municipal bond. In case of a default, the issuer does not have any obligation to pay the bondholders.

Read more about the credit risks in municipal bonds.

Municipal bond ETF basics

So far, we cover what a municipal bond is. Let’s look at the basics of a municipal bond ETF. Starting with the basics, a yield in the bond is the relationship between the coupon and the market price.

The coupon price is fixed but the market price fluctuates.

When the price of a bond rises, the yield falls and vice versa. While this is simple, it becomes complicated when you look at a bond ETF.

A bond ETF is made up of several individual bonds. Given that each of the bonds has a different yield determining the value of a municipal bond ETF can be a daunting task.

When evaluating a municipal bond ETF, there are four things to bear in mind.

- Yield to maturity for municipal bond ETF is the weighted average of the yield in all the bonds that the ETF holds. The yield to maturity reflects the behavior of the underlying bonds as if they were held to maturity. The yield to maturity can be higher as it does not account for the fund expenses.

- 30-day SEC yield is the second factor. This is the annualized income of the ETF over the past 30 days. The fund expenses are subtracted, and this gives investors the real sense of how the ETF fares. The 30-day SEC yield is susceptible to volatility due to the short-term nature.

- The yield distribution is derived by annualizing the recent distribution such as income, capital gains which is divided by the net asset value of the ETF. The yield distribution is the most up to date statistic.

- Finally, the 12-month yield is the interest paid in the last twelve months divided by the recent net asset value and capital gains distribution.

Risks of investing in municipal bonds

Whether you are investing in municipal bonds or its ETF equivalent, there are risks that you should consider.

Call risk is the potential for an issuer to repay a bond before maturity. This is possible when interest rates fall. A similar example can be a homeowner refinancing their mortgage loan to take advantage of lower interest rates. When interest rates are stable or moving higher, the call risk reduces.

Credit risk is the risk that a bond issuer may fail to pay an interest or fall short of repaying the principle. This is also known as a default. While there are credit ratings available for various municipal bonds, it does not discount the fact of a credit default.

Interest rate risk impacts bonds in general. Municipal bonds have a par value just as with any other bond. When the bond is held to maturity the lender receives the face value amount along with the coupon payments. The bond market price can move up as interest rates fall and vice versa. When rates rise, investors holding a low rate fixed bond will have to sell their bond before maturity as it lowers the market value of the bond.

Inflation risk is another aspect that influences bond markets strongly. Inflation is an upward move in consumer prices and it reduces purchasing power. This is a risk for bond investors when receiving a fixed interest rate.

Liquidity risk refers to the risk that the investor won’t be able to find an active buyer of the bonds they wish to unload. Liquidity risk can be significant if one looks at municipal bonds that have lower ratings or are obscure. Generally, investors buying municipal bonds hold them to maturity which also increases the liquidity risk.

Municipal bond ETF – the most popular

The municipal bond ETF family is dominated by three big names. These are:

iShares short maturity municipal bond ETF (MEAR), Invesco VDRO tax-free weekly ETF (PVI) and the iShares iBonds Sep 2019 term muni bond ETF (IBMH).

MEAR has a target portfolio of bonds with a less than three-year maturity term. This muni ETF gives a viable solution for cash management and it is actively managed. Therefore, investors need to steadily follow the reshuffling of the portfolio.

The PVI is interesting because it is a portfolio with a weighted average index of the variable rate demand obligation. The PVI holds thirty municipal bonds with floating rates. The interest rates are set every week, but the bonds come with a 20 or 30-year maturity. The bonds can also be redeemed on a weekly basis. It is a very liquid fund but it charges 5 basis points higher than its competitors.

Finally, the IBMH is unique to the above two because it behaves like a bond than a fund. The IBMH has a bullet maturity instead of the perpetual exposure like its counterparts.

The IBMH unwinds and returns all capital to investors on the maturity date. Interestingly, coupons received from the IBMH are exempt from the federal and the alternative minimum tax. The IBMH is preferable when looking for a tax-exempt bond portfolio.

Is a municipal bond ETF better than a municipal bond?

In the previous section, we outlined the risks of investing in bonds. As we noted earlier, buying a municipal bond and holding it to maturity is more preferable. But if you were to invest in a municipal bond for short term then it obstacles start to emerge.

One of the downsides of buying municipal bonds is that they are not very transparent. Bonds trade over the counter so there is no central clearing exchange. This makes the average bondholder to transact easily.

In the secondary market, bonds come with a significant markup. Municipal bonds apparently have a higher mark up than usual. By some estimates, the mark up is about as high as 2.5%. This makes the cost of investing in municipal bonds difficult.

The lack of liquidity is another factor that makes it difficult to invest or even speculate in municipal bonds.

A municipal bond ETF, on the other hand, does not mature, unlike the individual bonds that are in the portfolio. The municipal bond ETF is constantly rebalanced with new bonds added to the portfolio. Despite the reshuffling, bond ETF maintains a constant maturity.

Because the bond ETF trades at an exchange there is a certain level of transparency as well. The municipal bond ETFs are also liquid, so you can easily buy into or sell your positions with relative ease.

If the above is not enough, municipal bond ETF pays a monthly income as well. This is because of the different number of bonds the ETF holds. Investors need to understand their investment goals before deciding on whether to investing in a municipal bond or the bond ETF.