You can check across the web and pretty much any source related to day trading will tell you that having a good pre-market trading strategy is a critical aspect of successful trading.

But, how do you know what to look for when it comes to price action? Should you actually place trades during the pre-market? Is the pre-market a good indicator? Should you give the same amount of credence to pre-market trading strategy equally across every stock?

In this post, I will cover what I do in terms of pre-market trading strategy and how I use the early morning activity to help determine my trading plan for the day.

Identifying The Setups

1 – Avoid Low Float Stocks

I know this is the direction you will hear from many trading experts on the web. From my experience trading, low float stocks are virtually impossible to trade using pure judgment. The moves are so sharp that it takes a unique risk profile to consistently make the right decisions and walk away from the markets with profits on a daily basis.

If you are unable to find float information, a simple way is to avoid penny stocks. If we are to speak in general terms, penny stocks often times have low float due to the lack of investment dollars

2 – Only Stocks 10 Bucks and Higher

So, when scanning for plays you need to first filter out all of the stocks below to dollars. You will notice right away that the universe of possible plays is much smaller, but that’s ok. We are looking for quality over quantity.

3 – Stock is up/down 4% to 15%

This is the sweet spot for high float stocks that are priced accordingly. Too low of a move and you will likely waste time sitting in a position that has a low probability of turning into a big winner.

Trade something over 15% and odds are the bulk of the move has already occurred and the only thing left is either sideways action or a pullback from the peak points.

4 – Volume of a Few Hundred Thousand

There will be times that you see a stock up huge, but only on 15,000 shares. This will give the illusion that there is far more upside, but with such low volume, it only takes a reasonably backed trader to place a sell order to squash your morning paper profits.

So, you need to look at how much the stock normally trades on a daily basis. But at a minimum, you should look for 100k shares. This, of course, is not enough for a stock like Apple but for a stock that trades on average 500k shares daily, a 100k shares is good pre-market movement.

5 – Universe of Possible Plays

After you filter the early movers based on these criteria, you will have a list that looks similar to something like the below graphic.

6 – Trade Clean Charts

Next up, you want to find a stock with a clean chart. What is the definition of a clean chart? You want to see setups that have a nice basing pattern and not running up into a parabolic peak.

Clean Chart Example

Now the opposite of a clean chart is one that spikes right before the open or starts to trend against the primary trend in a slow and methodical fashion.

Ugly Pre-Market Trading Action

7 – Identify Highs and Lows of the Pre-Market Trading Session

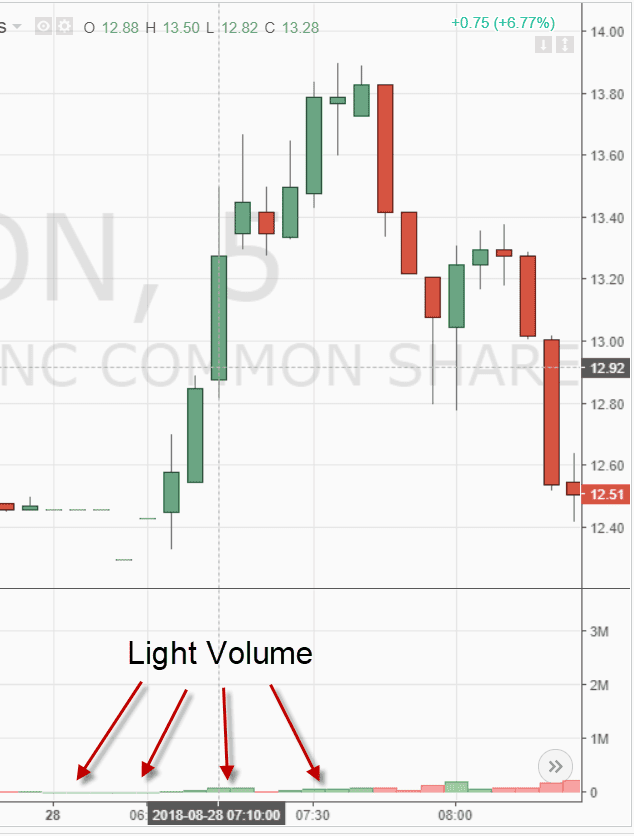

The most important things to capture during pre-market trading is the high and lows from the session. While pre-market trading is on light volume, these key price points will act as magnets during the regular session.

This is for a number of reasons. First traders that placed, for example, short trades, while often place their stops right above the pre-market high. Secondly, breakout traders will at times ignore the days’ high and focus on the pre-market high as the place to enter the trade.

8 – Pulling the Trigger

At this point, you are ready to pull the trigger. You have filtered the stocks down to a manageable list and have identified the high and low points from early trading.

So, what do you do next?

Proper Risk to Reward Ratio

Find the stocks with the best risk to reward ratios. On the web, you will see 3 to 1 as the common ratio but remember the market will not always make itself available to this degree.

Therefore, if you can find setups with 2 to 1 or even 1.5 to 1, feel free to pull the trigger. The key point is that you are placing odds in your favor. So, once you are able to trade with a higher degree of accuracy, by also having a greater reward on each trade than what you are risking, you are sure to come out on top.

Place Your Order Slightly Beyond the Pre-market Highs and Lows

You should place your stops slightly beyond the pre-market highs and lows. At times, you will see nasty head fakes where a stock will tip over the high only to retreat lower.

I see this mostly with low float stocks that trap people in subpar stocks, thus completing the dump action and creating tons of bag holders.

This can still happen in high float stocks, but the repercussions of being wrong are not as steep. Again, a way to manage this risk is to place your orders slightly beyond the pre-market levels.

Order Type

For me, I only place stop limit orders. This allows me to enter the trade beyond the pre-market high but place boundaries on how high I am willing to enter the trade.

This allows me to define my limits in order to adhere to my risk to reward requirements on the trade.

Example of Putting it All Together

So, far we have covered how to filter stocks down in the pre-market, but let’s now go through a play-by=play of how you would do this on a real trading day.

Filter Down the List

First, we start off by looking at the top gainers for the day. You can accomplish this by looking at the market movers widget in TradingSim.

Next, we filter down these stocks based on volume, float, spreads, percentage gain and price. This then takes a large list like the one above and now makes it manageable.

Identify Clean Chart

Next, we want to find the stock with the cleanest chart.

First up is ZUMZ.

ZUMZ simply does not have enough pre-market volume trades to identify a pattern.

Next up is CRON.

CRON had great volume and price structure. However, the stock was running in an up channel and any breakout would just run the stock up to resistance from the morning.

This actually happened which you can see below.

For those of you that wonder why a stock reverses right after gapping up on the open, you only need to look at the support and resistance lines formed in the pre-market to get your answer.

With only one stock left, MESA, let’s see if things get better.

MESA had no volume and no clear chart pattern.

Therefore, on this particular day, there were no clear pre-market setups to trade on the open.

Now, this does not mean there were no good setups for the trading day. It just means there were no strong patterns which developed prior to 9:30 am.

This is a critical point for you to remember. There are days where there are no setups early in the morning. You have to become comfortable with this fact and demonstrate patience before placing trades.

Why I Do Not Place Pre-Market Trades

I do not place trades during the pre-market for a host of reasons. Let me go a little deeper since that response was way to the point.

Huge Spreads

First, the spreads during pre-market trading are too great. A stock with a normal spread of less than .25% could now have spreads of .75% and up. This makes it challenging to get my desired price.

Thin Volume

If a stock trades a few hundred thousand shares during the pre-market this is considered to be great. The only problem with this is that a stock can move against you without many participants.

For these two reasons, I do not place trades in the early morning.

Only Reason You Should Trade in the Pre-Market

The one caveat to trading in the pre-market is if for some reason you are holding a day trade overnight. In the morning, you can at times get spike moves, again on low volume which you can use to exit your position.

Two wrongs in life normally don’t make a right, but if you start to break your rules and hold trades overnight, closing the trade out is of critical importance.

In Summary

Finding good setups comes down to executing the same filters on a daily basis. Remember, just because you do not find a trade in the pre-market does not mean you won’t find good setups during the day.

To learn more about TradingSim and how you can scan the market for pre-market trades and implement pre-market trading strategies, please visit our homepage to learn about our latest offerings.

Where can I find stock trading program that has Bolingbrook bands?