Before we cover the top performing silver ETFs we will first discuss the basics of silver ETFs. It’s important we ground you on the commodity before diving into top lists.

Silver ETFs – Quick Facts

- Silver has often been referred to as poor man’s gold. Despite this nickname, silver ETFs have a real purpose in that they can be used as a a hedge to diversify portfolios in the precious metalsmarket.

- Silver is measured in ounces and in most cases tracks the spot price of the commodity.

- Silver ETFs have been around since the early 2000s and offer investors an attractive investment product relatively cheap.

- The iShares Silver Trust (Ticker: SLV), managed by Barclays Global Investors and launched in 2006 started the popularity among investors in silver ETFs.

Why are Silver ETFs Popular?

Silver ETFs are easier to manage for investors compared to futures or other derivatives because of accessiblity and less competition from savvy investors..

Another attractive feature of Silver ETFs is they are usually held in the physical form. For example, the iShares Silver Trust (SLV) are held in the bullion form in London as good delivery bars. SLV also holds the bullion in New York and other locations. This will prove useful for all your Walking Dead fans that feel the end is near and electronic records will vanish.

Lastly, silver is one of the preferred safe haven assets during times of economic, political or financial uncertainty. Investors also turn to silver (besides gold) and many view it as an alternative currency to central banks.

Why Invest in Silver ETFs?

Investing in silver ETFs offers a more afforadble way to gain exposure to the metal compared to owning the physical commodity outright.

Silver ETFs also offer more diverse means to gain access to the silver market. For example, some ETFs track the silver miners which are the bloodline for silver on the production side. Other silver ETFs include leveraged as well as inverse ETFs.

What are the Key Considerations of Owning Silver ETFs?

As with any ETF, there are three important factors to consider related to costs:

- Expense ratios

- Daily average volume

- Underlying assets of the ETF

Expense Ratio

Expense ratio for any exchange traded fund is the annual fee paid by the holders of the ETF. It is expressed as a percentage of the assets and is deducted during the fiscal year as part of the ETF’s fee.

For example, the iShares Silver ETF charges an annual expense ratio of 0.50%. This means that the fund will cost $5.00 in annual fees for every $1,000 invested.

Daily Average Volume

When it comes to investing in silver ETFs it is important to take into account the daily average volume. Generally, the higher the daily average volume, the lower the expense ratios and other costs.

Choosing a silver ETF with higher daily average volume can protect you from abrupt price movements. Higher volume also makes it easier to buy or sell with ease and at your desired price.

Underlying Assets

Not all silver ETFs are the same. The most conventional silver ETFs are those that directly track the spot price of silver. Besides this, traders can also invest in silver ETFs of mining companies tracking production and silver ETFs tracking derivative contracts.

Top Five Most Popular Silver ETFs

There are many silver ETFs to choose from these days. Each type of silver ETF can cater to a particular need of you the investor.

Silver ETFs can be direct or indirect ETFs. Direct silver ETFs either track the underlying spot price or invest in mining or production companies. Indirect silver ETFs track the various derivatives. Common examples of indirect ETFs are inverse or leveraged silver ETFs.

Investors seeking higher returns (with higher risk) can of course invest in leveraged and inverse silver ETFs. The leverage can be 2x or even 3x. Similarly, inverse leveraged ETFs gives the investor the ability to profit during bear markets without having to short sell.

The table below shows the top five silver ETFs based on total assets under management expense ratio and spread.

| TICKER | FUND NAME | ISSUER | EXPENSE RATIO | AUM | SPREAD % | SEGMENT |

| SLV | iShares Silver Trust | BlackRock | 0.50% | $5.17B | 0.06% | Commodities: Precious Metals Silver |

| SIL | Global X Silver Miners ETF | Global X | 0.65% | $411.10M | 0.16% | Equity: Global Silver Miners |

| USLV | VelocityShares 3X Long Silver ETN | Credit Suisse | 1.65% | $361.21M | 0.10% | Leveraged Commodities: Precious Metals Silver |

| SIVR | ETFS Physical Silver Shares | ETF Securities | 0.30% | $328.49M | 0.07% | Commodities: Precious Metals Silver |

| AGQ | ProShares Ultra Silver | ProShares | 5.28% | $208.46M | 0.11% | Leveraged Commodities: Precious Metals Silver |

When investing in silver ETFs, look at the annual expense ratios and the daily average volume. These variables will give a quick snapshot on the costs of holding the silver ETF.

Some silver ETFs are also cheaper but they come at the risk of lower liquidity and higher spreads.

If you want to trade or invest in silver ETFs it is important to understand the outlook for the market as well.

What is the outlook for the Silver Market?

Let’s review the spot silver market to gain a rough outline of where the silver commodity is heading.

After reaching a peak of $48.02 in early 2011, silver prices have dropped significantly. Silver prices, especially over the past four years have settled to in a range between a high of $21.20 and low of $13.88.

This partly comes from the fact central bankers have turned more hawkish. With tightening interest rates, improving global trade and a strong economy, the demand for silver as a safe haven has fallen.

With economic policies aimed at reducing corporate tax, the stock markets have been the best place to park your money.

Despite the optimism, the current economic cycle is either mid-way or near the end of its boom. This means, that a possible bust cycle in the global economy is around the corner.

This translates to a potential increase in demand for silver as a safe haven asset. However, no one can predict when then economy will turn for the worse.

From a technical stand point, spot silver prices are basically trading flat within the said range. A breakout from the range could potentially establish the next leg of direction in the precious metal.

To the downside, a break below $13.88 could trigger sharp selling. This could push silver prices back to $9.85.

Alternately, to the upside, silver prices will be looking at a stiff resistance level of $21.20 – $19.82. This level needs to be cleared in order to establish a strong uptrend.

Investing in silver ETF based on market outlook

At the moment, the silver market along with most other precious metal commodity markets have been trending lower. This is evident from the table below.

| TICKER | FUND NAME | 1 MONTH | 3 MONTH | 1 YEAR | 5 YEAR |

| ZSL | ProShares UltraShort Silver | 4.54% | 4.69% | -3.36% | -7.11% |

| SLV | iShares Silver Trust | -3.43% | -4.73% | -5.09% | -4.41% |

| SIL | Global X Silver Miners ETF | -6.29% | -6.78% | -15.68% | -2.89% |

| USLV | VelocityShares 3X Long Silver ETN | -11.49% | -17.10% | -27.11% | -30.77% |

| SIVR | ETFS Physical Silver Shares | -3.32% | -4.69% | -4.93% | -4.21% |

| AGQ | ProShares Ultra Silver | -7.15% | -10.56% | -15.11% | -15.40% |

The ETFs have all been yielding negative results. However, you can see that the top of the table, the UltraShort Silver ETFs from ProShares has managed to yield positive returns. This is due to the inverse nature of the ETF.

How to use Silver ETFs as a Hedge?

As a hedging tool, silver ETFs are ideal. It is known that silver alongside gold are considered an effective hedge against inflation.

Most investors also hold the physical bullion as well, despite the higher costs. Holders of silver in the physical form can use the silver ETFs as an effective hedging tool.

When compared to gold, it is important to remember that silver has a higher volatility. So, investors need to be aware of this when using silver ETFs to hedge their portfolio’s exposure.

For investors, silver (alongside gold) makes for good value especially to hedge against the loss of purchasing power in the fiat currency. This was evident in the immediate aftermath of the global financial crisis where central banks across the world started to pump trillions worth of currency into the markets in order to revive their respective economies.

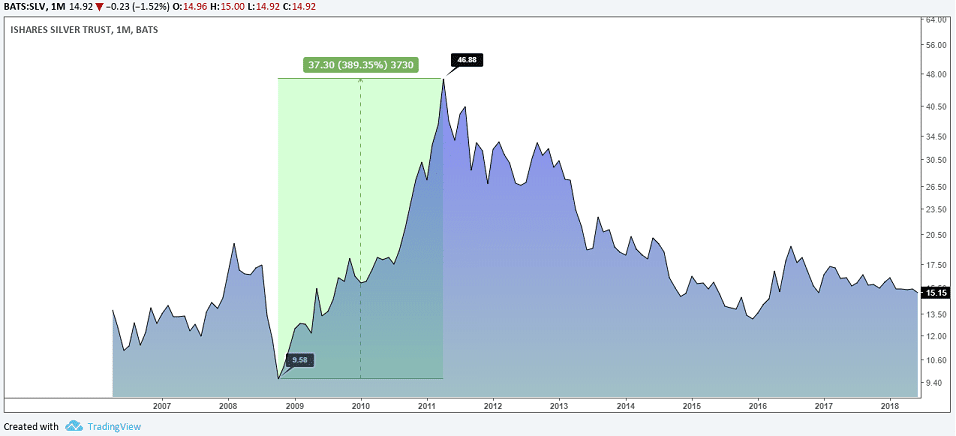

The iShares Silver Trust (SLV) chart illustrates this point very well. After initially bottoming near $9.58, SLV increased 389% in a span of two and a half years.

What to consider when investing in Silver ETFs?

One of the things to consider when investing in silver ETF funds is that the metal is not a foolproof hedge for inflation. This is due to the known fact that silver also has strong use in industrial applications as well.

Therefore, silver tends to fluctuate alongside the economic upturns and downturns of production of goods and services. This is something that is quite unique to silver.

For example, during an economic downturn, the industrial and manufacturing sectors also play a role. Weaker demand could potentially influence the price of silver and thus the silver ETF funds too.

Investing in Silver ETFs – Conclusion

In conclusion, unlike the fiat currency, silver as a commodity is unique and is free from the government’s policies.

Silver might be a poor man’s gold, but at the same time, there are some unique characteristics that also sets it apart from gold as well. Thus, when considering investing in commodity of precious metals ETFs, it is worth considering exploring silver ETFs as an investment vehicle.