S&P 500 ETF Overview

Global markets all have exchange-traded funds (ETFs). These are products which include a basket of stocks or other securities.

Some of the most popular ETFs are those that mirror the S&P 500. Why are these ETFs so popular?

The U.S. market is the most valuable and liquid market in the world. According to an article in the business insider, the NYSE is at the top of the heap with 18.83 trillion.

Guess what exchange is next?

That’s right, another US exchange – Nasdaq with 7.51 trillion.

Which ETF represents the majority of these valuable stocks from these exchanges? You guessed it, S&P 500 related ETFs.

Well in this article, we will cover 6 things you should know about S&P related ETFs before you invest.

#1 – What is the Average Return of the S&P 500 ETFs?

The S&P has been on of the most consistent investments over the last 50 years. People may complain about the market and lackluster returns, but these are likely comments from investors looking to time the market. If you invested money in the market over the long-term things just work out.

The S&P 500 was created in 1957, so let’s dig into the types of returns you could have expected over the years. To do this, we leveraged an S&P 500 calculator from DQYDJ.

For each return period, I have listed the total return percentage and the average annualized return.

1969 to 2019 Return (50 Years)

Total Return: 2654.685%

Average Annualized Return: 6.857%

1995 to 2019 Return (25 Years)

Total Return: 450.085%

Average Annualized Return: 7.362%

2009 to 2019 Return (10 Years)

Total Return: 219.301%

Average Annualized Return: 12.310%

2014 to 2019 Return (5 Years)

Total Return: 52.474%

Average Annualized Return: 8.803%

Is the S&P 500 a Good Investment?

Above we have laid out the average returns for 50, 25, 10 and 5-year windows. Do you see what they all have in common?

That’s right, a positive return on your investment. This is the funny thing about the market. If you just fire and forget you are likely better off than trying to time the market – unless you are committed to mastering the craft of trading.

#2 – How Do You Invest in an S&P 500 ETF?

Investing in an S&P 500 ETF is really simple. If you were going to try and buy every stock on the S&P 500 it would cost you a small fortune. You would need to place 500 trades at an average cost of $7.99 depending on what low-cost broker you decide to use.

You would then need to constantly track each security and rebalance the portfolio based on the performance of the stocks.

Do you see how an ETF can keep your costs down and take all the work off your shoulders?

So, how do you invest?

401k, IRAs and Other Retirement Funds

If you are employed or self-employed make sure you take advantage of any ETFs offered by your employer. You will need to determine the amount of funds to allocate based on your retirement horizon, but the point is to make sure you take advantage of the opportunity.

Low-Cost Broker

If you do not have an account, create one with one of the many low-cost brokers. You can then search for and invest in the S&P 500 fund that best meets your needs.

You can then set up an automated monthly investment schedule so you can build up your account over time. Remember, from our list of returns above, it’s about letting time work in your favor.

Contemporary Investment Services

You can even use services like Acorns to invest change after purchases in the ETF of your choice.

The point is, you have multiple options for how to invest in an S&P 500 ETF.

#3 – List of S&P 500 ETFs

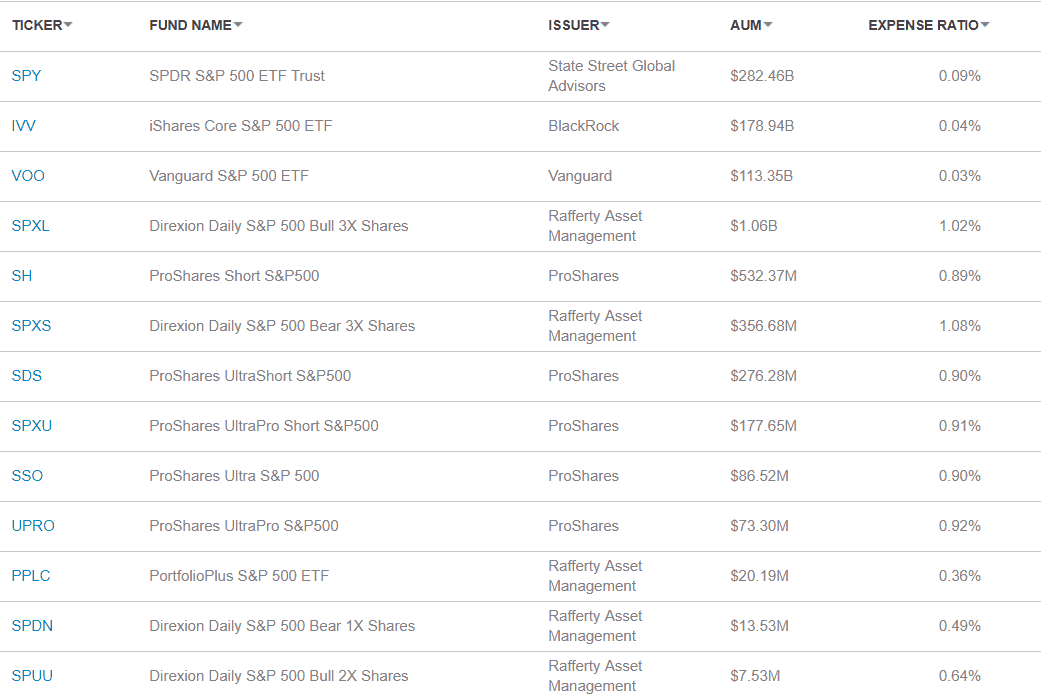

Since we have covered the returns of the S&P and how to invest in one, we now need to sort through which ETF to purchase. If you do a quick Google search, you are likely going to see a list of ETFs like the one below.

So, which ETF should you choose? Well, we pulled data from a number of sources to filter the list down (etf.com, etfdb.com).

Assets Under Management

I don’t know about you, but this list is too long. The first filter you can apply is assets under management. Just by applying the too big to fail logic, the top three in this list are as follows:

- SPY

- IVV

- VOO

Expense Ratio

Next, you can filter the list down based on the expense ratios. The SPY has an expense ratio that is over 100% greater than the IVV and VOO.

Dividends

You may not know, but some ETFs provide dividends just as other blue-chip stocks.

Based on the above table, VOO provides the best dividend return.

Do you see how quickly we have been able to filter down the list? Now again, this was an exercise to show you how this can be done, but you can apply your own filters to shorten the list.

#4 – Is the S&P 500 ETF a Good Investment for Global Investors?

If you are an international investor, a SPY ETF is a great investment opportunity for gaining exposure to the US markets.

Think about it, if you live in South Korea for example, investing in the VOO for example, gives you the ability to invest in the US without having to know everything about the US market. For example, you don’t need to specialize in a particular sector where you need to track the performance of individual stocks.

You also don’t need to concern yourself with interest rates and how politics will impact the market.

So, if you live in Korea, you can focus on spending time with your family during the evening hours and not concerning yourself with what is going on in the US.

#5 – Should You Invest in a 3X S&P 500 ETF?

The above list of leveraged ETFs from ETF Stock Encyclopedia shows you all of the options you have in the ETF space. You can do 1x, 2x, and even 3x.

You can also invest in short ETFs which allows you to go against the market.

Now, just to quickly summarize. I do not trade leverage ETFs on either a short-term basis or as a long-term investment.

The reason for me is that it goes back to the first table in the article which describes the average annual return. If you know you are headed towards double-digit returns, why do you need to take on more risk with these leveraged ETFs.

Sharp Market Moves

The other piece with leveraged ETFs is that if the market moves to drastically one way or another, it can result in the fund shutting down, at which point you do not have time on your side to recoup your investment.

This has been famously documented with the collapse of the Credit Suisse velocity fund which tracked the VIX.

Once the VIX shot up, the inverse fund lost 85% of its value overnight and closed down 93% the next day. In this example, I know it’s an inverse ETF, so you have unlimited exposure, but just see how quickly things can get out of hand when you purchase an inverse ETF with leverage.

Now, this sort of move is not going to happen with the S&P 500, because the ETF will mirror the index. But, I’m just illustrating that you cannot apply the same buy and hold strategy and assume you will make 30% per year instead of the standard 8% to 10%.

Still not clear, let’s talk about the topic of daily resets with these leveraged ETFs.

Daily Resets

The concepts or daily resets is rather complicated, so I’m not going to go into any great detail within this article. For working examples, please see the article by etf.com.

The short of it is that because the ETF is leveraged the fund has to rebalance daily to account for price moves of stocks. This is slightly different than a one-to-one rebalance because the fund has to reset its leverage and not just its position.

This process of rebalancing over time erodes the returns from the fund. Therefore, it’s not like you are getting double the returns if you are right.

The longer you hold the ETF the greater the loss of returns over time.

#6 – Day Traders Love Leveraged ETFs

Let me again reiterate I do not trade leveraged ETFs. I only trade low volatility stocks because it’s the only way I can avoid making blow up trades.

However, if your system calls for volatility and the SPY is just too slow for you, a leverage S&P 500 ETF will do the trick.

You have a plethora of choices and you can trade inverse ETFs without the need to go short.

Leveraged ETFs Trade High Volume

The other great benefit is the level of volume which allows you to get in and out of positions with ease. Below is a chart of the SSO which is a 2x EFT of the S&P 500.

Huge Price Swings

So, we know that buying an holding a leverage ETF does not equal triple the returns due to daily resets.

But if you are a day trader, you can use the volatility of a leveraged S&P 500 ETF to capture the intraday move.

Taking a look at the below chart of the UPRO (ProShares Ultra Pro S&P 500 ETF)

Now I get heart palpitations when I look at 7% move intraday. Reason being, I never want to trade a stock that can go that far against me.

However, if you are a day trader and you are not interested in trading penny stocks, look at the price swing of this move!

Where else can you trade a security with this much volume and price swing?

How Can Tradingsim Help?

Tradingsim is the best market replay platform in the fintech space. Learn whether one of the many SP&500 ETFs works with your trading style and risk tolerance levels.

Practice trading both short-term and long-term investing strategies to see which one works best for you.