How do Stop Loss Orders Work?

If I had to define a stop loss order, it’s just that, a protective order which stops you from losing more money than you would like. In a nutshell these are orders that are placed a certain distance from your entry price and if reached your position is closed. This does not mean 50% of your position is closed, but an entire liquidation.

When you think of a stop loss order, you should get a visual of a defeated soldier waving a white flag on the battle field. It is a complete concession that your original plan was wrong.

As we probe deeper into the topic you will receive a compelling argument on both sides. One point of view that stop loss orders are a good idea, the other that if used incorrectly, this capital preservation technique could have the exact opposite effect on your equity curve.

Stop Loss vs Stop Limit Orders

There are a number of stop loss order types, so without confusing you or myself, let’s slowly ease into this one. Stop loss orders can be placed on both sides of the market: long or short. In addition, the orders can be placed as limit or market orders.

Buy Stop Market Order

A buy stop loss market order is an order to buy a specific number of shares at the market or ask price. The buy stop market order is used to close short positions and is placed above your entry price. For example, if you are short Google at $1,000 and place a buy market order at $1,250, then your short position will be liquidated as a market order to buy back all of the shares on a price breach of $1,250.

Buy Stop Limit Order

A buy stop loss limit order is an order to buy a specific number of shares at a limit price. The buy stop limit order is used to close short positions above your entry price. As an example, if you are short Apple at $500 and place a buy stop limit order at $525, then your position will be liquidated at the set price of $525. This may seem in theory that you have more control over where you exit the position versus a market order; however, if your sell price of $525 is jumped by the bulls, you could be stuck holding your position.

Sell Stop Market Order

Do you really want me to explain? It’s the exact opposite of the buy stop loss market order, but used to prevent further losses from a long position.

Sell Stop Limit Order

Again, not trying to put you to sleep, it’s the exact opposite as the buy stop limit order, but is used to prevent further losses from a long position.

If you want more in terms of definitions of various stop loss orders, please visit the following link to an article on Tradersedgeindia.com. They’ve done a pretty good job of explaining the basics.

How to place a stop loss order

You place your stop loss orders like any other order through your trading application. For short positions, you will want to place a buy stop loss order and for long positions you will want to place a sell stop loss order.

It’s a bit confusing because when I first started trading I expected to see an order type called ‘stop loss’. In actuality, stop loss is just the term used to signify you are attempting to close a losing position.

You will want to place your stop loss order some distance from your entry price, which signifies to you that the position has gone against you and it’s time to take the loss.

That sounds easy enough right? Wrong! Knowing where to place your stop loss order is more magic than science. As you read further along in this article you will see why.

How to use stop-loss orders

Most traders will look at key levels of support or resistance as obvious points to place their stop loss orders. This can come in the form of a recent swing in an up or down trend, or the breach of a key top or bottom in a horizontal pattern like a head and shoulders bottom.

This sounds so simple enough, but it’s far too complicated to see on first glance.

It makes logical sense right, close your position when a key level is breached. Clearly, something is wrong and you must protect your capital.

Yes and no. The more you trade, the more you will realize the market is filled with more head fakes than the best bobble head at your local dollar store.

Why stop loss orders can cause you to lose more money than you would otherwise

The first reason stop loss orders can lose you money is you don’t know what you are doing. That sounds harsh, I know. But if you have been trading for a few months you are probably having enough time trying to figure out what’s going on, let alone have any idea of when you are wrong.

Your lack of understanding of the inner workings of the market will cause you to place stop loss orders at what will later be the turning point for the stock. The level of frustration you will face as your position is closed right before the stock takes off will feel like your 8th grade girlfriend dumping you right before the dance.

I go into detail of how was recently burned below…..

Stop loss orders and how marker makers will gun for you

While the activity of market makers is completely legal, we have all cursed them at one point or another in our trading careers. The market makers will often see a number of orders clustered around a specific price and these orders act as a magnet for how these makers will bid the price of the stock. This is why you will notice that your order when triggered, will often lead to a bounce in the opposite direction.

This is because the market maker can use yours and other stop loss orders from newbie traders to provide the sell orders large enough for a big buy for the smart money.

Think I’m making this up? Notice how stocks will have these quick moves through support only to rally so hard that you don’t have the courage to jump on the trade.

How to use Trailing Stop Loss Orders

One method of stop loss orders we have not covered to this point is trailing stops. This is where you have booked profit in a trade and you trail or move up your stop loss order as the stock continues to move in your favor. The great thing about trailing stop loss orders is that you will lock in profit at as the stock rises, thus lowering your risk profile and increasing your paper profits. It’s a great method for new traders who are learning the art of letting their winners run.

Stop loss orders and volatility don’t mix

If you are trading a volatile stock, using stop loss orders is a difficult proposition. Think about it, the really volatile stocks can swing between high and low points wildly. It’s tough enough to time the swings, let alone know exactly where to place your stop loss order.

Trading tightly with a volatile stock is contradictory at best. Take a look at stocks like CHTP, NIHD, and VNDA. Pick any timeframe or day of the week; where do you place your stop? Notice how levels are breached with no regard, only to rally as if there is no resistance at all.

For these highly volatile stocks, you have to truly accept the risk. If you are long, you are long. If you are short, you are short. You need to wait until your profit target is reached and be prepared to lose money if it doesn’t. If you are not prepared for that reality, don’t get involved with the high flyers.

Let me tell you a secret, I don’t use stop loss orders

Before I go any further, I am not advocating you do the same. Only you can decide what trading strategy works best for you.

Over the years for me I’ve noticed that stop loss orders cause me more pain the help. In the past, I had so much fear of the market. While it’s always good to have a healthy level of respect for how the market can take your money, you should never be afraid.

My fear was causing me to place my stops at ridiculously tight levels from my entry price. This would work if my strategy called for tight stops and I used the same approach every single time. This however was not the case for me.

In my mind placing the trade and then establishing a stop loss order was proof to me that I was accepting the risk of the trade. This couldn’t have been the furthest thing from the truth.

I was just going through the motions of what I thought it meant to trade with a set of rules. Does this sound familiar?

In the end, when I decided to no longer use stop loss orders, I knew I needed another method for protecting myself against runaway losses.

So, if I am long, I will place an alert at a key support level. If that level is breached, I will be alerted of the price action. Instead of just panic selling, I will see the volume and price action at the key support level.

At this point I will make a call of either closing out the position, or moving my mental stop lower. Over time I have noticed that these breaches are just classic head fakes that the experts use to squeeze out the little guy before the big move.

If you look back over your trades and you notice that the ensuing move starts right after you are closed out, placing a mental stop and then evaluating the price action may be what you need to turn a sharp corner in your trading journey.

A real-life example of using Stop Loss Orders

While thus far we have discussed stop loss orders in theory, there is nothing like the real world smacking you in the face. In the next few paragraphs I will cover an actual trade where I was squeezed out right before the big move.

The trade was in a stock that we all know and love named Tesla. Now Tesla had made a quite miraculous move up to a high of $194.50. After which the stock began a nasty correction back down to the $120 – $117 range.

I managed to avoid this blood bath, which looking back on it was a pretty good call. I entered the trade at $123 which was a little early, but I got in on 11/18/2013, where the stock had a $15 dollar range.

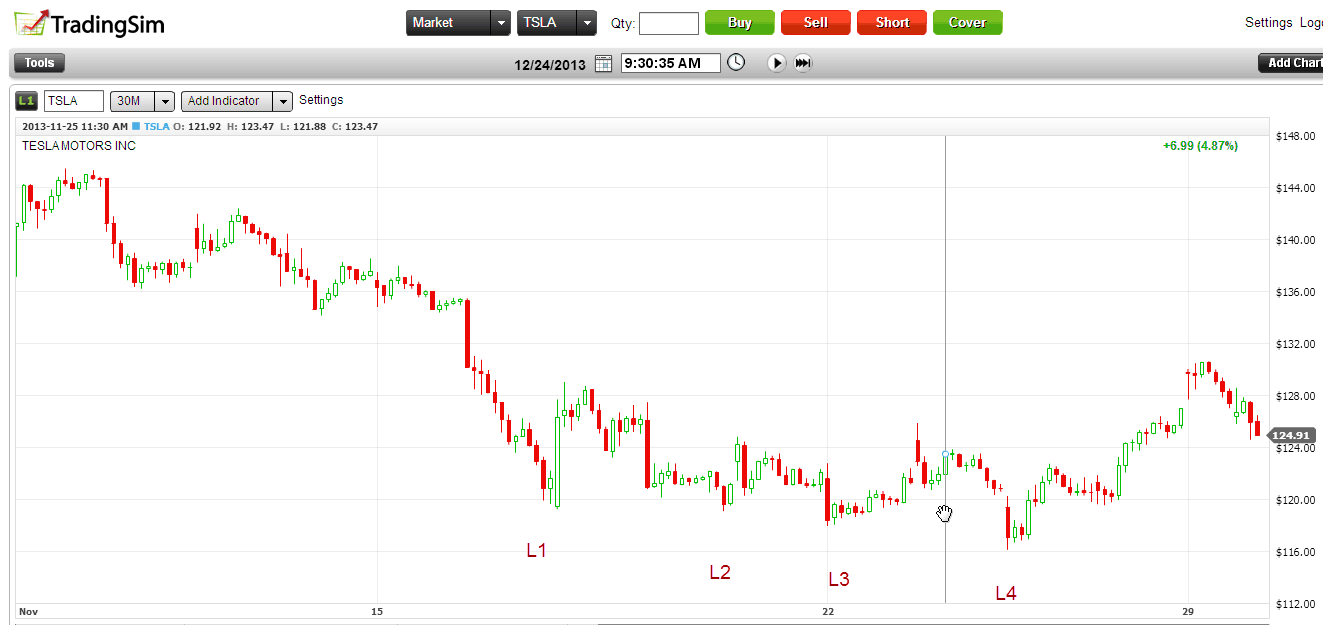

After entering the trade, Tesla began to move sideways for a number of days. There was a clean base which formed and as the stock dragged lower, there were three successive moves down which pushed the stock lower. You can see these swing points in the below 30-minute chart.

After the stock took out the previous day’s high, in my mind the move had started, so I placed my stop loss order directly below the last swing low as illustrated.

Everything about this to me even as I write this makes perfect sense. The only problem is the market of course went after that low, because odds are there were hundreds or maybe even thousands of other traders that did the same thing as I did on that day – place a tight stop.

As you can see, TSLA spiked down to hit a new intra-day low of $116.10 only to begin the sharp move up. As of the writing of this article (1/23/2014) TSLA hit a high of $182.38. Even with my awful entry price of $123, this still represents a profit of ~ 50%.

Now you could say, well the trade didn’t work out, but you were trying to protect your capital so it’s still a good trade. In my humble opinion, I say no. First off, at the peak of my paper loss I was only down 6% and on a volatile swing trade like Tesla, that’s less than a scratch.

The bottom line is that I was unwilling to take the risk. From what I remember on the trade, I was more concerned with the possibility of Tesla breaking down below $97, and that was all I could see. Makes perfect sense now why the move to $116 rattled my cage.

Has something like this happened to you in one of your past trades?

Summary

Stop loss orders can be a great mechanism for you to protect your profits and to place controls around the anarchy that is the market. This is especially helpful for when you are starting out in your trading career. As you begin to understand how you react to the market (emotions, fears, greed, etc.) you will begin to see that these hard fast rules can hurt as much as help.

If you are struggling with where to place your stops or just looking to improve your trade management, please check out the cutting edge trading simulator at Tradingsim. We are helping traders like yourself make more money without risking their shirt.

Photos

Dice Photo by Incalido

Market Maker Photo by Wikipedia

Secret Photo by Jeremy Atkinson