Direxion – Overview

Exchange traded funds have become as popular as the assets they track. The main benefit of trading or investing in an ETF is investors can handpick sectors and stocks they want exposure to.

With many ETF providers coming into the market, the competition has also led to cost cutting. These costs cuts make most ETFs quite affordable for retail investors.

Direxion is one of the world’s leading ETF providers. Founded in 1997, the company boasts over $13.4 billion in assets under management (AUM) as of December 2017.

Direxion offers exchange traded funds, Direxion leveraged ETFs, Direxion inverse ETF and Direxion mutual funds. That’s quite a bit of products uh? Well remember, Direxion has been at this since 1997.

The wide choice of ETFs to choose from makes Direxion’s ETFs widely favored among investors with a greater appetite for risks.

Typically, short-term investors prefer to make use of the 3x leveraged ETFs and the inverse ETFs which allows investors to speculate on both the long and short side of the underlying asset.

Before we go into detail about how to trade Direxion ETFs, let’s first ground ourselves on these financial products.

#1 – What is a Leveraged ETF?

A leveraged ETF is an exchange traded fund that makes use of both financial derivatives and debt in order to amplify the returns of the underlying index or assets tracked.

This is quite different compared to traditional ETFs which simply track or mirror the performance of the underlying indexes or assets.

The aim for leveraged ETF is to simply offer a constant amount of leverage at all times. Typically, this leverage is around 2x or 3x. In other words, it is the ratio of 1:2 or 1:3.

For example, a 3x (three times) leveraged ETF aims to offer investors and speculators additional exposure to the underlying asset or index without any additional costs.

For example, Direxion’s Gold Miners Bull 3x (NUGT) leveraged index offers 300% daily investment result before fees and other expenses. It is the same with the inverse ETF DUST.

The most important thing to understand about leveraged ETFs is the fact that they offer daily returns.

Therefore, the typical buy and hold strategy finds no place when it comes to leveraged ETFs, which understandably, makes for a strong topic of disagreement in the investing community.

The keyword here is “daily” as leveraged ETFs offer 300% of the return on the underlying index or assets over the day. However, the returns do not hold ground if one starts to look over the longer-term period.

#2 – What is an Inverse ETF?

Some traders will refer to an inverse ETF as a short ETF or a bear ETF.

Such ETFs are widely used during bear markets and offer investors the advantage of “staying long” while shorting the assets or the index.

An inverse ETF is built by using derivatives that include futures contracts among other derivatives.

Inverse ETFs are in fact a suitable alternative for investors who want to stay on the short side of the market. This brings immense benefits for investors who would otherwise need to hold a margin account in order to short sell the asset.

When combining leverage to an inverse ETF, investors can potentially look at making strong profits. However, despite the promise of huge returns, inverse ETFs are no doubt risky to trade.

#3 – What are Direxion Inverse ETFs?

Direxion’s inverse ETFs are perhaps one of the most widely used exchange traded funds especially in a bear market.

The inverse ETF is also known as the Direxion bear ETF or Direxion bear 3x ETF.

The above chart is of the DUST ETF. This is a bear ETF which tracks 30 firms in the precious metals mining industry – primarily in the gold market.

As you can see, the 1-month and year-to-date returns on the NYSE Arca Gold Miners ETF are – 2.24% on the month and 5.98% year-to-date.

If the investor would have instead purchased the DUST ETF and thus shorting precious metals, the inverse ETF holder would have gained 5.03% on the month and 7.54% on a year-to-date basis.

Do you see how not only does an inverse ETF protect your money in bear markets, but it also presents the opportunity to get you ahead.

#4 – Direxion ETF List (Inverse and Leveraged)

The below table shows some of the most popular and widely traded exchange traded funds from Direxion. This list includes the top 10 Direxion ETF assets and their year to date returns.

| Symbol | ETF Name | Total Assets* | YTD* |

| FAS | Direxion Daily Financial Bull 3X Shares | $ 1,886,805.00 | -7.53% |

| NUGT | Direxion Daily Gold Miners Bull 3X Shares | $ 1,233,701.00 | -26.68% |

| SPXL | Direxion Daily S&P 500 Bull 3X Shares | $ 972,693.00 | 0.05% |

| JNUG | Direxion Daily Junior Gold Miners Index Bull 3x Shares | $ 833,798.00 | -26.41% |

| TNA | Direxion Daily Small Cap Bull 3X Shares | $ 730,443.00 | 17.38% |

| TECL | Direxion Daily Technology Bull 3X Shares | $ 688,489.00 | 19.49% |

| SOXL | Direxion Daily Semiconductor Bull 3x Shares | $ 668,843.00 | 2.36% |

| ERX | Direxion Daily Energy Bull 3X Shares | $ 445,404.00 | 7.89% |

| TMV | Direxion Daily 20-Year Treasury Bear 3X | $ 368,043.00 | 7.11% |

| LABU | Direxion Daily S&P Biotech Bull 3x Shares | $ 358,972.00 | 17.98% |

*as of 06/28/2018

One key point to call out is that the top 10 list is made up of the 3X product and not the 2X. This tells me investors are chasing potential profits, but I would love to see how many of these investors are profitable.

If you are looking to purchase a Direxion product, I would say it makes the most sense to start with this list. You can then dig deeper to see if there are other products which may offer a better expense ratios and less volatility.

#5 – Direxion Biotech Bull (Bear) ETF Example

Most investors know that the Biotech sector always makes for an interesting play.

However, when one commonly talks about Biotech ETFs, some of the names that come to mind are IBB (iShares NASDAQ Biotechnology ETF) or XBI (SPDR S&P Biotech ETF). These are the traditional ETFs that offer investors exposure to the sector.

Direxion Biotech Bull and Bear ETFs such as LABD (3x leveraged ETF) or LABU (3x inverse leveraged ETF) are not as popular. These ETFs offer investors the ability to stay long the sector with tremendous upside.

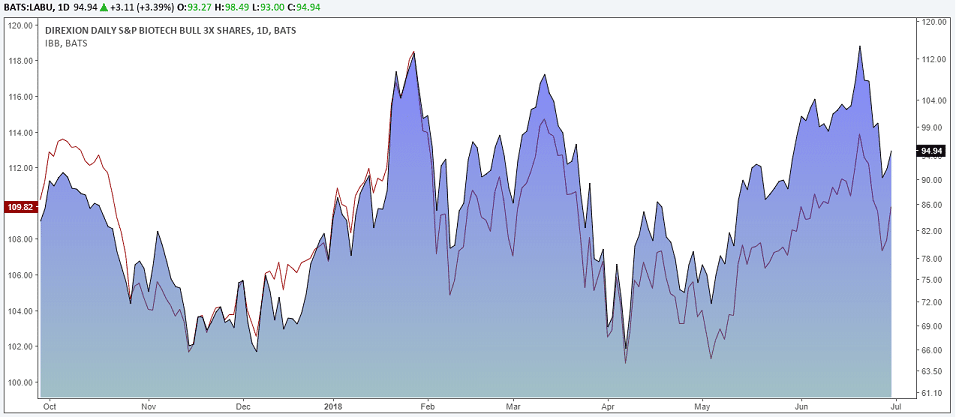

The LABU/LABD tracks the S&P’s Biotechnology Select Industry Index (SPSIBITR). and the LABU ETF.

The chart above might look similar with both the ETFs tracking more or less the same sector and nearly the same set of companies from the Biotech sector.

But, when one looks at the daily return that is where the similarity ends. While the IBB shows a 0.09% increase, Direxion Bull leveraged ETF has an over 3% range on a daily basis.

Now before you dive into the Biotech ETF, you need to ask yourself why?

Meaning biotechs by themselves are extremely volatile and if played properly will net you big gains.

So again, do you really need the additional risk exposure of a 3X ETF?

#6 – Why Direxion leveraged and inverse ETFs are not for everyone

It is obvious that higher leverage cuts either ways. Investors can expect strong returns while at the same time their risk also increases significantly.

For the short-term investor or speculator, Direxion ETFs offer a great way to quickly realize higher profits especially when they are right. Used wisely, the inverse leveraged ETFs can offer investors the ability to short the market and not only protect their portfolio’s but grow them during downturns.

There is no doubt however inverse and leveraged ETFs carry somewhat higher expense ratios compared to traditional ETFs.

If you are trading Direxion’s leveraged or inverse ETFs for the first time, then exercise caution. This is due to the volatility and the returns that are specific to these ETFs. Investors need to have a strong background and familiarity when trading Direxion ETFs as they can be risky.

The volatility and the daily ranges can lead to significant losses quickly. For example, if you are in a short 3X ETF, every point move is magnified by 3.

Imagine if the ETF has a 20% move, this means you are literally down 60% of your money.

Does this make sense to you? Again, only you can answer that financial question for yourself, but the risk is just insane of you have trouble balancing your portfolio.

However, for seasoned investors, Direxion’s ETFs are the perfect instruments for hedging against potential market volatility. But to think of Direxion as purely a way to make more money is likely a recipe for disaster.

#7 – Leveraged and Inverse ETFs Are for Day and Swing Traders

Leveraged and inverse ETFs are often the cause of polarizing opinions among both investors and speculators alike.

The reason I believe stems from the fact traders begin to look at these ETFs as a means to make three times the return of the market over the same period of time.

The reality is that the swings down will shake the trunk of the most confident trader.

To this point, Direxion themselves have publicly stated these 2X and 3X products are for position/day trades and are not intended for long-term investing.

This means if you have the chops to put on one of these trades, then you need to be a person actively monitoring and trading the markets.

These are not get rich quick products that you can fire and forget.

In the United States alone, there are over 1,800 exchange traded funds listed. Of these, one out of seven ETFs are a leverage or inverse ETF product.

So, with so many choices and needing to know the setups you are trading, if your window is longer and you have no desire to actively manage your account on a daily basis – then purchase a standard ETF.

Leave the volatility to those traders that have the time and capacity to manage these opportunities.