During this bear market, investors may have to rebalance their portfolio to maximize their profits. This TradingSim article will help readers to show them how to rebalance their portfolios- and how much it can cost. This article will also help readers find the top five growth stocks to add to their portfolios- and five to drop to rebalance portfolios.

What does it mean to rebalance a portfolio?

After COVID-19 devastated the global economy, investors are scrambling to recover. One way they can gain control of their financial destinies is to rebalance their portfolios. Adjusting investments can help an investor keep track of their goals and minimize risk.

Rebalancing portfolios is buying or selling assets to balance out asset classes. For example, an investor can have a portfolio that’s composed of 50% stocks and 50% in Treasury bonds.

At the end of a quarter, the Treasury bonds could be outperforming stocks. If the Treasury bond of the portfolio is outweighing the stock portfolio, the portfolio could be 70/30. with more Treasury bonds than stocks. Some financial advisors call for rebalancing portfolios if an asset has increased or decreased by 5% from its original allocation.

With that imbalance, an investor may want to rebalance to change the target allocation back to 50/50. The investor may also want to add another asset to a portfolio, like emerging market ETF’s. They may also want to have asset classes that balance out their trading strategy.

When should investors rebalance portfolios?

While there is no set time to rebalance a portfolio, some financial advisors noted that rebalancing a portfolio at any time can be key. It can lead advisors to have more discipline when they rebalance portfolios.

Christy Gatien is a certified financial planner and first vice president and portfolio manager at D.A. Davidson & Co. She noted that rebalancing a portfolio can cause investors to be wiser with their investments.

“The beauty of an asset-allocation approach is that it forces us to be disciplined investors as long as we stick with it. As we rebalance, we’re trimming the areas that are doing well — selling high — and adding to the areas that are struggling — buying low,” said Gatien.

Gatien advises against rebalancing a portfolio during extremes in a bull market.

“When markets are going up, we tend to overestimate our tolerance for volatility,” said Gatien.

If investors are rebalancing portfolios during a crash, there could be a downside for nervous investors.

“When markets are going down, we tend to be overly fearful,” said Gatien.

Should investors have a specific time to rebalance their portfolios?

Some investors may want to recalibrate their portfolios every quarter or annually. Larry Miles, principal at AdvicePeriod advises against traders having a set schedule to rebalance their portfolios.

“Rebalancing based on a particular month of the year makes no sense — it’s purely arbitrary,” said Miles.

“It’s like saying, ‘I’m going to drive in a straight line for 11 miles and then, in the 12th mile, I’ll turn right,” added Miles.

Miles wants investors to rebalance their portfolios when the stock market makes dramatic turns.

“You need to rebalance as often as the market dictates, to stay on the road,” said Miles.

Should investors use a rebalance portfolio calculator?

Investors can figure out how to recalibrate their portfolios with rebalance portfolio calculators.

Jason Lowy is a certified financial planner and first vice president of wealth management at UBS Financial Services. He advocates investors using rebalance portfolio calculators to help their asset allocation.

“These calculators are great at creating a general road map for where you could allocate investments. They may not, however, take into consideration individual goals and needs based on the investor’s specific situation,” said Lowy.

Rebalancing calculators can be useful to investors if they want to know exactly how much to allocate to their portfolios.

How does an investor rebalance a portfolio?

There are three main ways an investor can rebalance their portfolios.

- Review the current portfolio before they rebalance portfolios. If an investor’s portfolio is through their 401k plan at work, they can review their portfolio through a quarterly report. They can obtain information from the brokerage companies handling their portfolios. Traders can also link their investing accounts to online apps to monitor their accounts more closely. If an investor is more DIY and old-school, they can make a spreadsheet of their investments to determine their asset allocation.

- Plan out your ideal portfolio before rebalancing portfolios. After investors look at the portfolios they have, they can plot out the portfolios they want. If an investor’s portfolio is composed mostly of stocks and they want to focus more on bonds, there are changes traders can make to rebalance their portfolios. Investors can research the bonds they want to purchase and plan out the exact rebalance of portfolios they want in a spreadsheet. With an explicit plan, an investor can plan out the asset allocation they want to rebalance their portfolios.

- Buy and sell shares to improve rebalance of portfolios. Investors can rebalance their portfolios by buying and selling shares of stocks, bonds, or other assets. Buying and selling the shares can help an investor balance out their portfolios.

What are the costs of rebalancing a portfolio?

Rebalancing portfolios can be beneficial, but also costly. When investors buy and sell shares on their own, there can be high fees. Selling a lot of assets, especially in a short period of time, may result in high trading fees, as Lowy noted.

“Rebalancing too often could result in a lot of transactions” and transaction fees, said Lowy. Investors can reduce the fees by investing with commission-free brokers. They can also choose online brokers that rebalance portfolios automatically for clients free of charge.

Investors should also learn about the capital gains taxes that can be levied on sold assets. Capital gains taxes come from profits from asset sales.

Short-term capital gains can be taxed as income. Long-term capital gains can be in the brackets of 0%, 15%, and 20%. Investors should consult with their tax professionals to determine the total costs of rebalancing portfolios.

Investors should thoroughly research stocks before they buy or sell shares of stocks. However, these following five stocks have seen the most growth so far this year. Investors can add these five stocks to their portfolios to rebalance their portfolios. For investors rebalancing portfolios during a crash, these stocks can be beneficial additions.

Top 5 stocks to add to rebalance portfolios

1.Beyond Meat

Beyond Meat (NASDAQ:BYND) is a company that is booming right now. For investors looking to add a growth stock to rebalance portfolios, this stock is a strong option. The meat alternative producer’s year-to-date performance is already an impressive 72.9% growth. With the COVID-19 crisis affecting meat warehouse workers, there are meat shortages in many grocery stores.

Beyond Meat’s rising stock can help investors rebalance portfolios

Because of the shortage, Beyond Meat has benefitted from the meat shortage. Many grocery stores have requested more orders from meat substitute producers like Beyond Meat to stock their shelves. The corporation’s stock surged a whopping 134% since the coronavirus crisis started.

Peter Saleh is an analyst at BTIG and watches corporations like Beyond Meat. He believes that customer loyalty is key to Beyond Meat’s success in grocery stores.

“What we really like about this story is you’re seeing the repeat rates of about 46% at least in the grocery store, which tells us that there’s really strong demand for this product, and I think you’re going to see more of it coming to menus at restaurants near you,” said Saleh.

Saleh also predicts more opportunities for Beyond Meat products to be offered in restaurants once they re-open.

“They’re at about 34,000 locations in the U.S. in terms of restaurants. Now, that’s only about 5% of the U.S. restaurant doors that they can get into, so I think there’s a lot more opportunity not only on the sausage or beef side but also on the poultry side. I think they’re working aggressively to expand that as well,” said Saleh.

Beyond Meat has excellent Q1 2020 earnings to help rebalance portfolios

In addition to its current success, Beyond Meat had a winning Q1 2020 earnings report. The company’s revenue skyrocketed 141% to $40.2 million from Q1 2019. Ethan Brown, Beyond Meat’s CEO, spoke about the results in a statement.

“I am proud of our first- quarter financial results which exceeded our expectations despite an increasingly challenging operating environment due to the COVID-19 health crisis,” said Brown.

Brown also stressed the importance of keeping the company’s workers safe during this current pandemic.

“The health and safety of our employees and their families is our top priority and we have implemented a series of measures to minimize risks while supporting business continuity,” said Brown.

With more consuming less meat or going vegan altogether, Beyond Meat is a growth stock to add to rebalance portfolios.

2. Netflix

In addition to Beyond Meat, Netflix stock (NASDAQ:NFLX) is also a growth stock performing well during this time of quarantine. Investors looking to add an entertainment company stock can rebalance portfolios with Netflix shares.

Netflix thrives during shutdown

With many people stuck at home, Netflix became a go-to source of entertainment. The streaming service added 15 million subscribers that watched hit shows like Tiger King and Love is Blind. Netflix also met Wall Street expectations with a reported Q1 2020 revenue of $5.77 billion.

Netflix touted its rising viewership in a statement.

“During the first two months of Q1, our membership growth was similar to the prior two years, including in UCAN[United States and Canada]. Then, with lockdown orders in many countries starting in March, many more households joined Netflix to enjoy entertainment,” said Netflix.

Analysts bullish on Netflix stock to rebalance portfolio

Because of Netflix’s increased viewership, Jefferies analyst Alex Giaimo rated Netflix stock as a buy in a note to clients. While the stock has been volatile over the last month, Giamo says Netflix is a long-term buy for investors who want to rebalance their portfolios. He notes that since more viewers are abandoning cable for streaming services, Netflix’s stock should rise in the long run.

“Stock sentiment leans more positive, with bulls highlighting the accelerated shift from linear to OTT (over-the-top TV) while bears push back on valuation and technicals,” wrote Giamo.

“Near-term choppiness is expected, but we advise buying dips and owning shares long term,” added Giamo.

For investors looking for a long-term investment, Netflix can be a smart choice to rebalance a portfolio.

3. Citrix

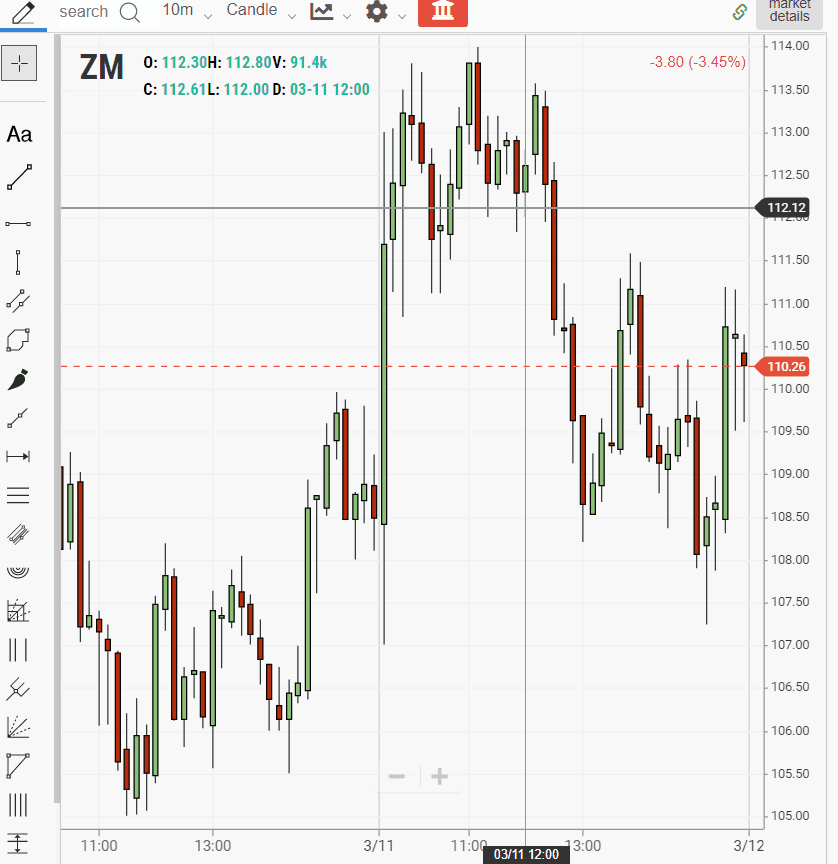

For investors looking for a well-performing tech stock, one choice may be an overlooked company-Citrix (NYSE:CTXS). Citrix isn’t as high-profile as Zoom (NASDAQ: ZM), but is a tech company that helps many people that have to work from home. The cloud company provides remote access software to workers, which is essential now during the quarantine.

Citrix stock rose 37% this year and grew exponentially during this quarantine. The company’s chief marketing officer, Tim Monaghan, recently spoke about how Citrix has helped remote workers for decades.

“Remote work is top of mind for companies around the world. And while some see it as a short-term fix to the COVID-19 problem, smart companies recognize it may be a long-term solution as they plan for what promises to be a radically different future,” said Monaghan.

Analysts say Citrix can help rebalance portfolios

Because of Citrix’s strong performance, Raymond James analyst Robert Majek upgraded the stock to a buy in a note to clients. He believes that the increase in flexible work-from-home schedules will help Citrix stock grow.

“We believe the surge in business continuity planning, including facilitation of remote work, could be a structural change that drives virtual desktop and application demand not only this quarter but in the next 1-2 years, giving us[Raymond James] increased confidence Citrix can meet or exceed 2020 and 2021 street growth estimates.”

William Blair analyst Jason Ader also believes Citrix stock will outperform Wall Street expectations. He wrote in a note to clients that he believes investors should add Citrix to rebalance portfolios.

“Our rating change is driven by the view that the wake-up-call nature of the current crisis will drive many organizations to expand their usage of (Citrix) technologies, which should result in a higher long-term growth rate for Citrix and a re-rating of Citrix stock,” wrote Ader.

If investors want to rebalance their portfolios by adding a fast-growing tech stock, Citrix could be a good option.

4. Humana

Humana (NYSE:HUM) was a top stock before the COVID-19 crisis. The stock rose because of two reasons. First, the healthcare corporation had a higher enrollment in its Medicare Advantage health care plans in the beginning of the year.

Second, the Democratic presidential primaries helped boost Humana stock 49% over the past year. When democratic socialist candidate Bernie Sanders was winning early primaries, many healthcare companies like Humana worried and shares dropped. Investors were concerned that his Medicare for All plan would eliminate private health insurance if he won a general election.

However, when moderate rival joe Biden won more primaries later on, Humana stock rose as healthcare companies knew Biden wouldn’t implement non-profit insurance if he won the general election.

Humana can be strong stock to rebalance portfolios with telehealth services

While more customers and moderate politics helped Humana pre-COVID-19, telehealth services helped improve Humana’s bottom line after the pandemic spread to the United States. CEO Bruce Broussard noted that telehealth services helped them reach more customers.

“Telehealth, together with increased use of our mail-order pharmacy and early fills allows our members with chronic conditions to continue to receive care to prevent long-term negative health implications. Since the declaration of the national emergency in mid-March, we have closed approximately 630,000 gaps in care,” said Broussard.

“Further the providers in our value-based arrangements saw the benefit of predictable cash flow streams and we’re the fastest to innovate and create thoughtful digital telehealth strategies in response to the crisis,” added Broussard.

With telehealth being a new way to deliver care to more patients, Humana stock can be a good option for investors who want to rebalance their portfolios with healthcare stocks.

5. Target

For investors that want a strong retail stock to rebalance their portfolios, Target (NYSE: TGT) could be a good choice. Target had its stock rise 42% over the past year. The big-box retailer had a double-digit rise because stores remained open during the coronavirus crisis.

Because Target was deemed an essential service, the store had many customers-just not necessarily in physical locations. The store’s online sales grew exponentially with many people home under quarantine. Digital sales skyrocketed 275% since April. The company’s Q1 2020 revenue also beat expectations and reached $19.62 billion.

Target CEO Brian Cornell spoke about the jump in digital sales.

“Unprecedented volatility within the quarter presented the most extreme test of our business and operations that I could have imagined. And in that environment, we drove industry-leading growth with a total comp sales increase of 10.8% and digital comp growth of more than 140%,” said Cornell.

Financial analysts rate Target stock a buy

Wall Street experts also think Target shares can be bought to rebalance portfolios. Raymond James analyst Matthew McClintock wrote in a note to clients that Target stock is a buy because of its strong e-commerce division.

“In a world of retail ‘winners and losers,’ those who have aggressively invested in omni-channel and supply chain capabilities, and those who have differentiated merchandising with highly relevant brands, have an immense market share opportunity over the next several years,” wrote McClintock.

Target sales can make stock a top pick to rebalance portfolios

While other retailers are struggling, Target can be a robust stock for investors who want to rebalance their portfolios. The recent passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act gave much needed financial help to struggling Americans. The government stimulus checks also helped the store’s profits.

Cornell spoke about Target sales rising as Americans received government stimulus checks.

“When April 15 hit and those stimulus checks arrived, we saw a very different shopping pattern. America was back in our stores shopping all of our categories, still taking advantage of the convenience of our contact-free online services,” said Cornell.

With growth in e-commerce sales and perseverance through the COVID-19 pandemic, Target could a strong retail stock to help rebalance portfolios.

Top 5 stocks to sell to rebalance portfolios

1. J.C. Penney sell necessary to rebalance portfolios

While Target’s stock is a buy, this retailer’s stock is a sell. J.C. Penney’s(NYSE:JCP) stock is now just a penny stock. J.C. Penney filed for bankruptcy earlier this month after years of plummeting sales and crushing debt. The troubled retailer will close 242 of its 830 stores as a result. Investors that are still holding this stock should sell the shares to rebalance their portfolios.

J.C. Penney a stock to drop to rebalance portfolio

J.C. Penney hoped to recover with more curbside pickup of orders for customers. The retailer also hoped to increase sales by remodeling their stores. However, with the coronavirus pandemic, J.C. Penney couldn’t compete with other retailers and filed bankruptcy. CEO Jill Soltau spoke about the bankruptcy in a statement.

“Until this pandemic struck, we had made significant progress rebuilding our company under our Plan for Renewal strategy – and our efforts had already begun to pay off,” said Soltau in a statement.

“While we had been working in parallel on options to strengthen our balance sheet and extend our financial runway, the closure of our stores due to the pandemic necessitated a more fulsome review to include the elimination of outstanding debt,” added Soltau.

Even Amazon can’t help J.C. Penney stock benefit rebalance of portfolios

There are reports that Amazon ( NYSE:AMZN) could step in and buy J.C. Penney. J.C. Penney stock could be sold to rebalance portfolios- even if Amazon steps in to rescue the company.

A source that works with Amazon noted that there are representatives from the e-commerce giant in J.C. Penney’s headquarters in Plano, Texas. The representatives are reportedly in talks with JC Penney to form a partnership.

”There is an Amazon team in Plano [Tex.] as we speak,” said the source who conducts business with Amazon. “There is a dialogue and I’m told it has a lot to do with Amazon eager to expand its apparel business — for sure.”

While Amazon could help J.C. Penney in the short term, there is still a long way to go before J.C. Penney can return to its former glory days. Neil Saunders is the managing director of GlobalData Retail and monitors big-box stores like J.C. Penney. He believes that J.C. Penney faces a steep challenge in rebranding itself in this economic downturn.

“A wholesale makeover is required to restore the company’s fortunes. In normal times, that process of reinvention would be challenging — accomplishing it in the midst and aftermath of a pandemic is more than a tall order,” said Saunders.

For investors that want to abandon old-fashioned retail stocks, selling J.C. Penney stock can help rebalance portfolios.

2. Carnival

In this COVID-19 era, the cruise industry has probably suffered the most. Carnival (NYSE:CCL) stock dropped a whopping 77% since the coronavirus crisis struck cruise ships earlier this year. Even though there is a brief rebound in its stock as the economy re-opens, the cruise industry may take longer to fully recover.

Carnival stock sale may be needed to rebalance portfolios

Some financial experts are skeptical that Carnival stock can recover from its current troubles. Danielle Shay is director of options at Simpler Trading and monitors cruise stocks. She thinks that the cruise industry will bear the brunt of the economic downturn.

“I think that the cruise liners are the ones that are going to get hurt the absolute worst out of this,” said Shay.

Shay is also unsure if the cruise industry can recover even if they raise more capital.

“Even if they do have somewhat of a capital raise, eventually, they’re most likely going to head towards bankruptcy and their stock price could head down to 5, even to 0,” said Shay.

Carnival Q1 earnings devastated by COVID-19

Carnival’s economic troubles were evident in its last earnings report. The corporation recorded a loss of $781 million, twice the amount in Q1 2019. Carnival also noted that coronavirus caused a large financial loss.

“The impact of COVID-19 on the first quarter 2020 net loss is approximately $0.23 per share, which includes canceled voyages and other voyage disruptions, and excludes the impairment charges described above,” said Carnival.

“Other previously disclosed voyage disruptions, noted during the Corporation’s December earnings conference call, also impacted first-quarter 2020 results by approximately $0.12 per share,” added Carnival.

Economic slowdown and uncertainty about Carnival could cause rebalance of portfolios

In addition to Carnival’s financial loss, other factors could lead investors to rebalance portfolios by selling Carnival stock. Customers may be hesitant to return to cruise ships because of their reputation for quickly spreading diseases.

Shay is bearish on Carnival stock because she considers the company’s cruise ships a “floating Petri dish.” She also thinks that despite the current rise in cruise bookings, “I really don’t think they’re going to come back anytime soon.”

Even when Carnival resumes cruises in August, many potential customers may not be able to afford cruises. With 30 million people filing for unemployment over the past two months, this is hardly the best time for a luxury cruise on Carnival.

If investors want to rebalance their portfolios, they can sell their Carnival stock. The volatile cruise industry may not be the best option for traders until it has a full recovery.

3. United Airlines

United stock sale may be crucial to rebalance portfolio

In addition to the cruise industry, the airline industry is cratering as well. If investors want to rebalance their portfolios during a crash, United Airlines (NYSE:UAL) stock may have to be sold. United Airlines stock has tumbled 70% this year as travel ground to a halt during the quarantine.

The corporation noted in its Q1 2020 earnings report that it reported a $1.7 billion loss as a result of the COVID-19 pandemic. The airline also expected to have a large cash burn for Q2 2020.

“The company currently expects daily cash burn to average between $40 million and $45 million during the second quarter of 2020,” added United.

Warren Buffett rebalances portfolio by dumping airline stocks

Even famed investor Warren Buffett saw a need to rebalance his portfolio during this latest economic downturn. Buffett’s Berkshire Hathaway sold 100% of its airline holdings as a result of the coronavirus’ effect on the industry.

Buffett explained that he has completely abandoned his 21.9 million United shares. He rebalanced his portfolio recently.

“When we sell something, very often it’s going to be our entire stake: We don’t trim positions. That’s just not the way we approach it any more than if we buy 100% of a business. We’re going to sell it down to 90% or 80%,” said Buffett.

During Berkshire’s latest virtual shareholder meeting, Buffett noticed how the airline industry suffered this year and why he needed to rebalance Berkshire Hathaway’s portfolio.

“The world has changed for the airlines. And I don’t know how it’s changed and I hope it corrects itself in a reasonably prompt way,” said Buffett.

Warren also expressed pessimism that the airline industry can recover from the nationwide shutdown.

“I think there are certain industries, and unfortunately, I think that the airline industry, among others, that are really hurt by a forced shutdown by events that are far beyond our control,” added Buffett.

Financial analysts say United Airlines should be sold to rebalance portfolios

Even though United Airlines is slated to receive a $5 billion government bailout to keep it afloat, the airline is still drowning in debt. The company’s crippling debt and fewer passengers could cause investors to rebalance portfolios with sales of United stock. Argus Research analyst John Staszak wrote in a note to clients that he was downgrading United Airlines stock.

“United Airlines faces multiple headwinds in 2020. Even prior to the coronavirus outbreak, flight demand had weakened due to the U.S.-China trade war and slower economic growth in China,” wrote Staszak.

Even if United rebounds, the corporation still faces an uphill battle. Because of social distancing, their planes can’t be at full capacity, so that could hurt the airline’s sales. If United raises prices to offset losses, customers could stay home if they can’t afford price hikes. If investors want to rebalance their portfolios, they can sell United shares.

4. Tyson Foods

In addition, Tyson Foods(NYSE:TSN) stock could be sold to rebalance investors’ portfolios. The frozen food company has been rocked by COVID-19 as meat warehouse workers are falling ill with the virus. Some meatpacking workers have even died from COVID-19. These tragic occurrences have weighed on the corporation.

Tyson Foods pledged to protect workers’ safety in a statement. The corporation also acknowledged that the reduced workforce and increased production costs will impact the company.

“Operationally, we have and expect to continue to face slowdowns and temporary idling of production facilities from team member shortages or choices we make to ensure operational safety,” said Tyson in a statement.

“The lower levels of productivity and higher costs of production we have experienced will likely continue in the short term until the effects of COVID-19 diminish,” added Tyson.

Tyson has disappointing Q2 2020 earnings report

Tyson Foods had a disappointing Q2 2020 earnings report. The company’s net income fell 15% from $426 million to $364 million. The stock dropped 9% after the lackluster report.

Restaurant closures can lead investors to rebalance portfolios

In addition to Tyson’s workers contracting COVID-19, Tyson’s sales have been impacted by the virus as well. Restaurant closures have caused a decrease in demand for Tyson’s chicken. Food service sales to restaurants fell by as much as 30% in its last quarter.

The corporation noted that even if the economy re-opens soon, consumer demand may not offset the current slumping food service demand.

“For the remainder of fiscal 2020, we do not believe pricing will improve, and we do not expect increased demand in consumer products to completely offset the expected decrease in food service,” said Tyson.

Meat alternatives could cause investors to rebalance portfolios

Tyson is also facing competition from the aforementioned Beyond Meat. With meat alternative products gaining in popularity, Tyson’s meat products are in shorter supply because of plant closures after workers contract COVID-19. Investors may rebalance their portfolios and sell Tyson shares.

In contrast, Beyond Meat reported that it has enough inventory to supply grocery stores and restaurants once they re-open. If customer tastes continue to change and meat supply is inconsistent, investors may drop Tyson stock to rebalance their portfolios.

Tyson Foods stock sale could benefit rebalance of portfolio

After a worse-than-expected earnings report, an interrupted meat supply chain, and diminished demand for meat, traders may want to sell Tyson Foods stock to rebalance their portfolios.

5. Marathon Oil

Marathon Oil may be dropped to rebalance portfolio after oil crisis

Oil stocks like Marathon(NYSE:MRO) can be sold to rebalance portfolios. Oil shares had a terrible run because of the impasse between Saudi Arabia and Russia. In March, the countries disagreed on an oil production cut to drive up prices. As a result, Saudi Arabia flooded the market with oil and drove down crude prices.

Vivek Dhar of the Commonwealth Bank of Australia noted that the US oil supply would be negatively impacted by the oil overproduction. The overproduction can lead investors to rebalance their portfolios and sell Marathon stock.

“We think oil supply from the US, Canada and China are the most likely to be curtailed at low oil prices. US oil production cuts are expected to be the most significant,” wrote Dhar.

Marathon Oil has worse-than-expected earnings if investors want to rebalance portfolios

As a result of the oil overproduction, Marathon Oil tumbled 57% year-to-date. In addition to a surplus of crude, there was a diminished demand for oil during the quarantine. Because fewer people drove, there was less demand for oil, and Marathon’s stock fell.

In its Q1 2020 earnings report, Marathon CEO Lee Tillman noted that Marathon was reeling from the international events affecting the oil industry.

“The impact to global oil demand, in particular, is unprecedented with a global health crisis essentially shutting down U.S. and global economic activity,” said Tillman.

Marathon also noted that the company will reduce its capital expenditures, halt dividends, and reduce its workforce by 16%.

“The revised capital budget of $1.3 billion or less represents a cumulative budget reduction of $1.1 billion from initial 2020 capital spending guidance. 2020 capital spending is now expected to be approximately 50% below actual capital spending in 2019,” noted Marathon.

Financial advisors say sell Marathon to rebalance portfolios

Morgan Stanley analysts note that if investors want to rebalance their portfolios, they should sell Marathon stock. Lead analyst Devin McDermott wrote that Morgan Stanley was downgrading the stock to an underweight rating. The bearish rating means that they believe Marathon’s stock returns will be lower than their peers for the next year. That’s a strong indication that investors should rebalance their portfolios.

“While the company is taking the right steps to preserve liquidity in response to low oil prices, [Marathon Oil] screens challenged versus peers with a 2021 [West Texas Intermediate] break-even of $37 a barrel (in the upper half of our coverage), and year-end 2021 leverage that rises to 4.5X at strip, above the peer median of approximately 2X,” wrote McDermott.

Moody’s says investors should rebalance portfolios and dump Marathon stock

Moody’s also thinks investors should rebalance portfolios by selling Marathon stock. The firm downgraded its rating of Marathon stock as a result of its recent troubles.

“Marathon Oil’s decision to reduce capital spending and suspend its dividend will help protect its 2020 cash flow in a low oil price environment. While the company’s very good liquidity is supportive, the negative rating outlook reflects the company’s limited resilience to a prolonged industry downturn due to an anticipated decline in production,”said Moody’s.

Rebalancing portfolios may happen if investors sell poorly performing and badly rated stocks like Marathon Oil.

Rebalancing portfolios in a crash can lead to better results

If investors rebalance portfolios during a recession, they can have more successful returns. TradingSim charts and blogs can help investors make the best choices to rebalance portfolios to maximize profits.