Value stocks can seem like a bargain to investors, but can become a valuable part of an investor’s portfolio. This article will explain what value stocks are, how they differ from growth stocks, and how TradingSim can help investors find the top 10 value stocks to invest in.

What is a value stock?

A value stock is a bit like a stock on sale. Value stocks tend to trade at lower prices than other stocks. In addition to being cheap, value stocks tend to have less-than-average growth than other stocks. They also tend to have low valuations in relation to earnings and cash flow.

Value investing can be a great choice for risk-averse investors who want to slowly wade into the investing waters. Value stocks also tend to have dividend payments to investors every quarter. Also, with the Dow Jones in such volatility, these value stocks could be a safer alternative to faster-paced growth stocks.

How is a value stock different from a growth stock?

Here are some differences between growth stocks and value stocks. The comparison of value stocks versus growth stocks shows vast differences.

Growth stocks usually

- have high valuations. Tech stocks, like Amazon (NASDAQ:AMZN), often have a sky-high valuation in the billions. Amazon has a record-shattering $1 trillion valuation.

- have high P/E ratios. Growth stocks usually have a P/E ratio of 16 and higher. Netflix’s ( NASDAQ:NFLX) P/E ratio has skyrocketed to trading for 86 times its earnings.

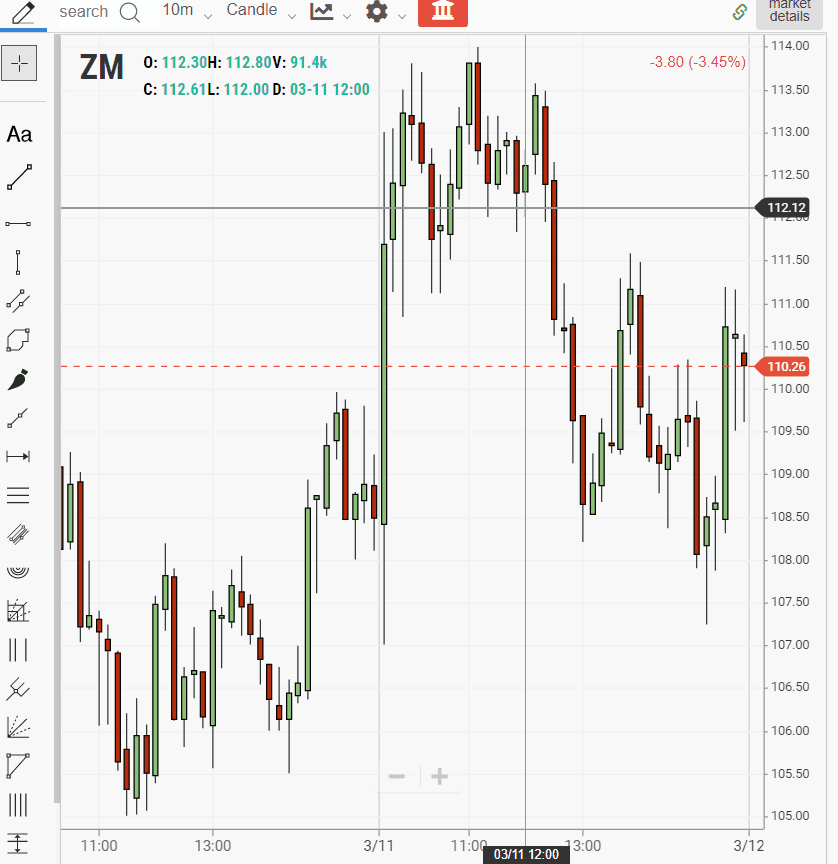

- steadily rising stock prices. Growth stocks like Zoom ( NASDAQ:ZM) have stock prices that surged 200% above its listed IPO price of $ 36 per share.

- strong growth rate. Many growth stocks have better-than-average projected future earnings. Growth stocks also tend to outperform the overall S&P 500.

- more available cash flow. Easily available cash flow is usually a sign that a company has a growth stock.

- don’t pay dividends to investors. Growth stocks from corporations tend to reinvest money back into corporations. They don’t usually offere quarterly dividends to investors.

- many growth stocks are in tech or other growing industries. Teledoc (NYSE: TDOC) is a growth stock that rose 18% just over the past month. The telehealth company is successful because of its innovation in medicine. Teledoc’s stock is also performing well because of its timely use by patients during the coronavirus crisis.

- riskier for investors. Growth stocks can rise higher than the overall market, but can fall faster into a bull trap when the market declines into a bear market as well.

Value stocks are less volatile than growth stocks

In contrast to growth stocks, value stocks usually

- have low price-to-earnings ratios (P/E). Value stocks, like MetLife(NYSE:MET) have a rock-bottom P/E ratio of 5.10. Life insurance stocks often have a low P/E ratio below 16.

- have a slower growth rate in more established industries. Growth stocks tend to increase quickly in innovative new fields. Tech stocks, like Tesla (NYSE: TSLA) especially, may have wild swings on the stock market because of production issues ( or Elon Musk’s comments). However, value stocks usually grow at a slower pace and are in industries that have been around for decades. BP(NYSE:BP) is a giant in the oil industry and is a value stock with less drastic change in its stock price.

- pays dividends to investors. In addition to BP, another oil stock, Chevron (NYSE: CVX) is a high-paying dividend stock. Chevron pays investors a 7.5% dividend to investors.

- are undervalued. Semiconductor maker Qualcomm(NYSE: QCOM) has undervalued stock because it’s overlooked, but will be vital to the future. Even though Qualcomm stock is in the $66 range, the stock should rise soon. Since Qualcomm is making chips that will be used in 5G technology, the corporation’s stock will likely benefit from this in the future.

- are less risky than growth stocks. Value stocks are usually less volatile and have steady returns for investors. Even though IBM (NYSE:IBM) stock has dropped, the stock is still a solid value stock. IBM is moving into cloud computing with its acquisition of software company Red Hat. The stock will likely remain a safe bet for investors who are looking for value stocks.

Top 10 Value Stocks for Investors

For investors that want low-risk investing , this value stock list has venerable stocks that have high-yield dividends. Here are 10 stocks that are some of the top value stocks to add to a portfolio.

1. Berkshire Hathaway

Warren Buffett is the OG investor and his Berkshire Hathaway (NYSE:BRK-A) and (NYSE:BRK-B) is the top value stock on Wall Street. The Oracle of Omaha has been choosing stocks since the Beatles were a new group. His conglomerate has chosen some of the best value stocks to invest in, and Buffett’s corporation itself is a must-pick stock.

Berkshire Hathaway started in 1929, but didn’t become a viable company until Buffett took over the corporation in 1965. His investment strategy was to buy undervalued companies, then let them grow. As a result of value investing, Buffett’s fortune has grown to almost $70 billion.

Former hedge fund manager Whitney Tilson says Berkshire Hathaway is a top value stock because of Buffett’s wise choices.

“I’m being even more conservative because I’m not factoring in the value Warren Buffett will likely create as he puts his $128 billion cash hoard to work amidst this chaos: buying back his own stock in size, buying other stocks, and negotiating deals with desperate companies,” said Tilson.

“It’s an incredible collection of high-quality businesses… it’s run by the greatest investor of all time… and it has the ultimate, Fort Knox-like balance sheet: $128 billion in cash and short-term investments, $19 billion in bonds, and roughly $200 billion in liquid, blue-chip stocks,” added Tilson.

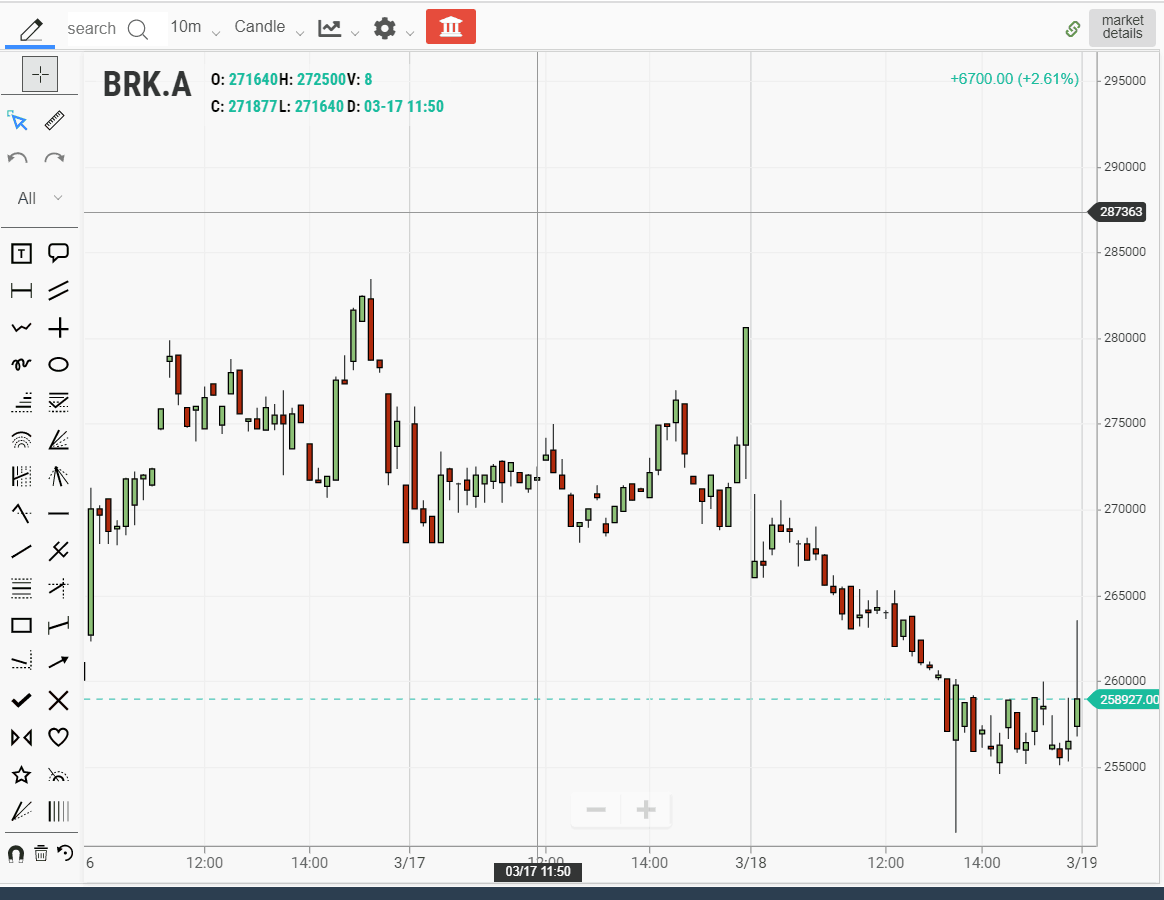

This TradingSim chart shows Berkshire Hathaway’s trajectory the week of March 19, 2020.

Berkshire Hathaway has a low P/E ratio of 5.46, which makes the company’s undervalued shares a value stock for investors. While most value stocks offer dividends, Berkshire doesn’t. Buffett noted that he’d rather reinvest in his companies to improve the efficiency of his investments. For investors interested in value investing, Berkshire Hathaway is a must.

Buffett only buys stocks he likes for the long haul

Berkshire Hathaway is a value stock because of its investment in other blue-chip stocks. Buffett is known for his quotes about cautious, long-term investing. One quote about long-term investing is especially timely with the stock market slowing down now:“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

Buffett also loves to quote Benjamin Graham, the father of value investing. “Long ago, Ben Graham taught me that price is what you pay; value is what you get. Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down,” said Buffett.

Buffett doesn’t just chase trading trends. He only invests in companies he believes in for a long time. Even though his stock picks may seem too safe, they pay off in the long run. His recent $549 million investment in Kroger grocery stores in February has been very savvy. The recent run on grocery stores like Kroger during the COVID-19 pandemic has made Berkshire Hathaway’s investment a good buy. Buffett has the Midas touch when it comes to picking stocks. His time-tested value investing in top corporations make Buffett’s Berkshire Hathaway a top value stock.

2. Apple

One of the value stocks that Berkshire Hathaway invests in is Apple (NASDAQ:AAPL). The tech giant is a value stock because of its lower-than average P/E of 20. For the largest tech company in the world, Apple is ironically undervalued compared to other tech stocks like (NASDAQ:FB). Even though Apple is a tech company, it’s also seen as a hardware company since it produces iPhones and Apple Watches.

The company has a hallmark of a value stock, strong earnings reports. Apple’s last earnings report saw the company earn a record- shattering $91.8 billion. Apple’s ample cash glow gives the stock a characteristic of a growth stock. However, the company’s $58.9 billion in cash flow in fiscal year 2019 helped pay its $14.1 billion dividend payout to investors. That’s an impressive 6.5% yield. Apple is a reliable value stock that investors should add to their portfolio.

Coronavirus will impact Apple, but stock will bounce back

The COVID-19 crisis has hit every corporation, especially Apple. Many Chinese factories that make Apple devices have been shut down in February. However, the pandemic is slowing in China and factories are starting to reopen. Apple is also set to launch its 5G iPhone in the fall, which should help Apple stock recover from its current losses. Apple recently noted that even though iPhone sales are down in China, there is still growth in sales in other countries. This TradingSim chart shows the volatility in Apple’s stock.

“Outside of China, customer demand across our product and service categories has been strong to date and in line with our expectations, ” said Apple.

Wearables make Apple a value stock

Even though Apple stock is currently down, Apple devices are still going strong. Many homebound people are Facetime on their iPhones and iPads to stay connected to each other (and to the games they’re addicted to playing). Apple Watches and other wearable device sales rose 17% in 2019. The ability of Apple to innovate in technology gives value investing in Apple a benefit to investors.

Craig Johnson, chief marketing technician at Piper Sandler, said Apple is still a value stock because of customer loyalty. He noted that even through the last economic downturn 10 years ago, customers still bought iPhones.

“People are still going to step up and they’re going to buy the iPhone. You know, when this gets relaunched and gets released for the 5G iPhone, they’re going step up and buy it. We saw the iPhone get released in 2007 and 2008 in the middle of the crisis there. Consumers still were able to open their wallet and buy these things,” said Johnson.

Apple can withstand the current market volatility and COVID-19 crisis because of its ample cash flow, innovative new products, and a devoted customer base.

3. Coca-Cola

Another value stock Buffett believes in is Coca-Cola( NYSE:KO). Buffett owned the stock since hip-hop was a new category of music. The soft drink company is a value stock because of its high dividend and its steady cash flow. Coca-Cola made billions by selling its soda. Then the corporation pivoted to sales from water and low-calorie drinks and increased sales. The beverage company’s earnings for Q4 2019 were $9.07 billion and the stock rose 22% over the past year. However, CEO James Quincey noted that Coca-Cola has been negatively impacted by the coronavirus pandemic.

“The supply chain is creaking around the world. There are flash points when it’s getting a little harder to get ingredients through, whether it’s delays at the borders, the big changes in channel mix,” said Quincey.

The corporation also noted that the 2020 guidance would be impacted by restaurant closures and sport events cancellations. Coca-Cola sells many of its beverages in dining establishments and during games.

“[S]ince our last guidance update, local market policies and initiatives to reduce the transmission of COVID-19 have significantly increased. These initiatives include the direction to refrain from dining at restaurants,” said Coca-Cola.

However, Quincey noted that Coke’s workers are “doing a great job at adapting” to the changes brought on by COVID-19.

Coca-Cola dividend consistent for investors

The company’s dividend may be small at 3.5%, but it’s very consistent. The dividend has risen for an astonishing 57 straight years. For a value stock that proves that slow and steady investment pays off, investors should choose Coca-Cola.

4. ExxonMobil

In addition to Coca-Cola and Apple, ExxonMobil ( NYSE:XOM) is an established value stock for investors for many reasons. One reason investors can pick ExxonMobil to implement their value investing is its well-paying dividend. ExxonMobil had $6.6 billion in free cash flow last year. The oil corporation paid $14.6 billion in dividends to investors in 2019. Like many value stocks, ExxonMobil is an undervalued stock that has a high-yield dividend of $3.48 per share. That’s an impressive 9% dividend for investors.

ExxonMobil will survive oil crisis

ExxonMobil has been hit by two crises. The ups and downs of the stock market has affected the Dow Jones overall. However, oil companies have been rocked by the decline in oil prices. Saudi Arabia is overproducing oil to drive down prices and spite rival producer Russia.

As a result, the volatility of the stock market and oil prices have dropped to about $30 a barrel. ExxonMobil CEO Darren Woods announced that ExxonMobil will reduce capital expenditures to reserve its cash flow.

“Based on this unprecedented environment, we are evaluating all appropriate steps to significantly reduce capital and operating expenses in the near term. We will outline plans when they are finalized,” said Woods. This TradingSim chart shows ExxonMobil’s stock trajectory over the past few weeks.

Despite the reduction in spending, Woods said ExxonMobil will survive the current uncertainty in the oil industry. With refinery expansion around the world, ExxonMobil is poised to recover from this current setback.

“We are confident that we will manage through these challenging times by taking deliberate action to keep our people safe, our environment protected and our company strong,” said Woods.

ExxonMobil is a value stock before oil companies recover

ExxonMobil is a bargain value stock for investment. Investors could buy the stock while the oil industry is in turmoil. Then they could reap the benefits when the economy and oil industry recovers. Oil will likely bounce back above $30 a barrel if Saudi Arabia compromises with Russia and other oil-producing countries in OPEC ( Organization for Petroleum Exporting Countries) to reduce its oil output. If the economy recovers, the oil company will rebound and ExxonMobil will remain a value stock.

5. Johnson & Johnson

Just as ExxonMobil has been an established stock for almost a century, Johnson & Johnson (NYSE:JNJ) is another value stock with longevity. The multinational corporation has been around for a century and has been a reliable stock for value investors. The company’s stock pays a healthy 2.6% dividend and increases every year. The corporation has survived a scandal about asbestos in their talcum powder to remain a value stock. For investors that want a safe value stock, Johnson & Johnson is a safe pick-especially in the wake of the coronavirus outbreak.

Johnson & Johnson stock rises on coronavirus vaccine hopes

The world’s biggest healthcare product producer is racing to create a vaccine for COVID-19. The company has signed a $1 billion deal with the U.S. government to create 1 billion doses of a possible vaccine for the respiratory disease. Johnson & Johnson CEO Alex Gorsky expressed optimism that the company can create an effective vaccine to slow the disease.

“We have very good early indicators that not only can we depend on this to be a safe vaccine base but also one that will ultimately be effective based on all the early testing and modeling we’ve been doing. This is a bit of a moonshot for J&J going forward, but it’s one we feel is very, very important for use to be doing at this period in time,” said Gorsky.

Johnson & Johnson said in a statement that it “is committed to bringing an affordable vaccine to the public on a not-for-profit basis for emergency pandemic use.”

The hope of a vaccine has raised investors’ confidence in the stock. Johnson & Johnson stock has jumped 8% as a result of the news. Johnson & Johnson’s stock shows that an established company can weather any storm and persevere. By providing medical devices and other badly needed products during this health crisis, Johnson & Johnson has proven to be a value stock that will withstand Wall Street volatility.

6. JP Morgan Chase

Just as Johnson & Johnson is a health product institution, JP Morgan Chase (NYSE:JPM) is a banking institution that has a value stock. Chase’s P/E ratio is 8.68, making it an undervalued stock that’s perfect for value investing. Chase had a positive earnings report in Q4 2019 with profits of $8.52 billion. CEO Jamie Dimon said in a statement that the company can withstand Wall Street’s ups and downs.

“While we face a continued high level of complex geopolitical issues, global growth stabilized, albeit at a lower level, and resolution of some trade issues helped support client and market activity towards the end of the year,” said Dimon. This TradingSim chart shows the volatility of Chase stock during the week of March 19.

Chase stock has also been helped by the Federal Reserve injecting $1 billion into banks as part of the Fed trying to revive the economy. With that security, Chase can loan more to customers. Customers themselves will need to take out loans more than ever with the struggling economy. Before the coronavirus crisis, Chase was opening more branches and investing more in banking apps. Now the bank can be an option for consumers during this time of economic uncertainty. Chase is a top value stock for investors looking for a solid bank stock to add to their portfolios.

7. Walmart

While many banks have value stocks, the nation’s biggest retailer also has a reliable value stock. Walmart(NYSE:WMT) has succeeded by selling many essential products and become a value stock because of its strength during the COVID-19 crisis. The nation’s largest big-box store was a top stock to financial experts like Jefferies analyst Christopher Mandeville. Even before the coronavirus pandemic, Mandeville praised Walmart for its financial strength.

“WMT[Walmart] exhibited just how well the company is leveraging its physical scale/digital presence and financial stamina to push the boundaries of retail, using innovative tech and learnings from abroad. With clear momentum in grocery and a sustainable productivity loop in place, WMT[Walmart] now pivots to better general merchandise, one item alongside enhanced fulfillment practices that is critical to long-term e-com success,” said Mandeville.

Walmart thrives during COVID-19 outbreak

After the COVID-19 outbreak,Walmart has become an essential resource by staying open during the pandemic.

Walmart CEO Doug McMillon noted that the corporation has seen e-commerce sales grow by 35% over the last few months.

“We continue to see good traffic in our stores. We’re growing market share in key food and consumables categories, especially with its online grocery delivery service. including fresh,” said McMillon.

Goldman Sachs analyst Kate McShane noted that Walmart will help customers by keeping stores open and by delivering groceries as well.

“In the short term, we expect demand to remain robust, even if panicked buying subsides, given the companies’ mix of essential/grocery. Further, these stores will likely remain open (versus over half of retail in the U.S. that is currently closed), even in states that have “shelter in place” rules,” said McShane.

Walmart dividend makes stock attractive to investors

Like many value stocks, Walmart has a well-paying dividend for investors. Walmart’s payout to investors tops 2% and has steadily increased for an impressive 47 years. Walmart’s consistent dividend payouts make the retailer’s stock a stable value stock for investors.

8. AT&T

AT&T(NYSE:T) is another top pick for value investors. The telecommunications company has been a great value stock. The corporation is a “dividend aristocrat” that consistently raises dividend for investors every year. The current yearly payout to investors is a hefty 6.5%.

AT&T also will keep many of its stores open during the coronavirus pandemic. The corporation said that it’s critical for customers to stay connected during the quarantine orders nationwide.

“Connectivity is always essential to our customers — doctors and nurses, first responders, governments, banks, grocery stores, pharmacies, and others delivering vital services.”It’s even more critical during a public health crisis that’s challenging everyone. In fact, as a critical infrastructure provider, AT&T views it as our civic duty to step up and keep our customers and communities connected,” said AT&T.

5G technology and streaming could help AT&T stock

The lastest Wi-fi technology could also help boost AT&T stock. 5G technology will soon come to many phone customers that subscribe to T-Mobile ( which is owned by AT&T) could benefit from having 5G devices. With faster streaming on devices, AT&T could have a lock on the 5G market once the technology takes off.

In addition to 5G technology, AT&T stock could rise once it enters the streaming wars. The corporation plans to launch HBO Max, which will fan favorites like Friends and The Boondocks. When the service debuts in May, HBO Max could help AT&T stock grow if gains a lot of viewers. AT&T stock could rise after launching the streaming service. AT&T stock could be ideal for value investors looking for a long-established stock pick.

9. Disney

Just at AT&T is evolving to meet new communications needs, Disney is adapting to new forms of entertainment. The entertainment conglomerate has been struggling during the COVID-19 crisis because of the closure of its theme parks. However, Disney+has been a bright spot for the corporation. The streaming service has attracted 28.6 million subscribers since its launch in November. The international expansion of Disney+ in Europe should help the corporation’s earnings in the long run. Minal Modha, consumer research lead at Ampere Analysis, noted that Disney has to appeal to kids that love Frozen 2 and adults who want to binge watch Star Wars: The Mandalorian.

“It will now be key for Disney to ensure it retains these customers with a mix of new Disney Plus originals and new release movie titles,” Modha said in a statement. “Furthermore, while there is still room for growth among both the two core demographic groups, it will be imperative for Disney Plus in the longer term to broaden out its content offering to appeal to a wider audience.”

Hulu, another Disney-owned streaming service, is also an area of growth for the company with 30 million subscribers. Even though many sports events are canceled, ESPN+ still has 6 million subscribers. With many people being quarantined, Disney’s popular movies can enjoy a greater audience and possibly increase its stock price.

Disney dividend is no Mickey Mouse amount

Disney can be a daily stock pick for investors because of its ability to withstand the current Wall Street volatility. The corporation’s dividend payout is consistent for investors. Because Disney’s net income grew to $10 billion in 2019, its dividend payout to investors is 1.8%. While that figure is smaller than other companies’ yields, it’s still a steady increase year after year. Disney stock is a top stock pick for value investing.

10. Weight Watchers

Another value stock may be the least likely. Weight Watchers(NYSE:WW) isn’t just for your fluffy Aunt Margaret anymore. The company has grown from a weight-loss company predominately for women to a wellness company for all genders. Since Oprah purchased 5 million shares of Weight Watchers, the company has added 6 million more subscribers. “The Oprah effect” of her magic touch helping businesses has helped Weight Watchers.

Weight Watchers has also evolved because of its new marketing campaigns to reach more male customers. DJ Khaled has become a spokesperson and another one- big male superstar, that is- is aligning with the brand. The Rock joined Oprah on her Weight Watchers tour to promote the rebranding of the corporation. The revamp to focus more on holistic health instead of weight loss appears to have worked. Chief Financial Officer Nick Hotchkin, said that tour helped drive Weight Watchers awareness up with potential customers. The success also drove the corporation’s earnings up to $29 million in its last earnings report.

“We believe this high visibility has had a halo effect well beyond those who are in the audience.In addition, the tour helped reinforce our brand transformation, showing how WW is your partner in both weight loss and wellness. Member recruitment so far in 2020 has been well above the prior year, as expected, and is reflected in revenue and earnings growth guidance for full year 2020,” said Hotchkin.

Weight Watchers may benefit after quarantine

With many people cooped up inside and stress eating during the quarantine, Weight Watchers could benefit after the nationwide quarantine ends. When the COVID-19 crisis passes, people will be eager to be more active and become healthier. Morgan Stanley analyst Lauren Cassel says that Weight Watchers could add more subscribers after the end of the nationwide quarantine.

“Once the ‘cocoon’ phase ends and shelter in place measures are raised, we[Morgan Stanley] see WW as a potential beneficiary of changes in consumer behavior. We anticipate a heightened focus on health, wellness, and weight loss after weeks of gym closures, stress eating, and limited physical activity.”

In addition, Cassel said that “the extent to which existing subscribers are currently showing greater interest and spending more time engaging with the app during the cocoon phase could lead to better retention curves for these subscribers over the medium term, which we incorporate into our $47 Bull case valuation. Bottom line, we think WW’s value proposition is actually stronger post-COVID-19 than it was before,” Cassel said.

“WW’s value proposition is actually stronger post virus than it was before”, said Cassel.

The wellness company has had its stock rise 17% last week while the S&P only gained 11%. Weight Watchers can be an affordable option for investors who want to cash in on wellness.

Weight Watchers stock is a bargain for investors

The wellness company is undervalued and is selling for only 8 times its earnings. The stock will likely continue to rebound and be a great pick for value investing. Unlike other value stocks, Weight Watchers stock doesn’t pay a dividend. However, Weight Watchers stock is a value stock that investors can choose if they want a stock that is capitalizing on the wellness trend.

Value stocks are safe stocks in volatile stock market

Value investing may seem boring, but can pay off in the long run. In this time of economic instability, value investing can be a great way for investors to build a slow and steady growth in their portfolios. Growth stocks and cryptocurrencies may get more attention, but value stocks can stand the test of time. For investors taking a long-term view and that can exercise patience, value stocks are a safer option.

Diversification is key in value investing

Even though many value stocks are in similar established fields, there is still room for diversification. Value investing can consist of investing in life insurance stocks, bank stocks, and even tobacco stocks. Altria (NYSE:MO) is a long-established stock that offers a strong dividend. By diversifying a value stock portfolio, investors can get bigger returns in their investments. If the bank industry is struggling, diversification in another field can help create a healthier portfolio.

Conduct research before investing in value stocks

Research is important to find the best stock for investors. By using TradingSim’s analysis and trading simulations, investors can find the best value stocks for them. Investors can take advice from Warren Buffett, but ultimately have to decide for themselves what value stocks are best for them. With TradingSim’s charts and guidance, value investing can be rewarding- and maybe even profitable.