Traders have two main options for their accounts: margin vs. cash. When deciding to choose a margin account vs. cash account, there are many factors to consider. In this TradingSim article, I’ll explain the difference between a margin vs. cash account. I’ll also write about how experienced day traders or people who are new to investing can choose the best account for them to have the best trading strategy.

What is a margin account?

If an investor is investing on their own, they may have limited funds. If they need more money, they can deposit cash and a brokerage firm can loan them money, too. That’s leveraged investing for traders. In a margin account, day traders can borrow money to fund their accounts. It’s similar to using credit cards to make purchases when a card company extends credit to a customer.

Ali Hashemian is president of Kinetic Financial. He likens buying stocks on margin to buying a house.

“Using margin to buy stocks is similar to using a mortgage to buy a house. In both instances, investors borrow money to purchase more equity in stocks or real estate,” said Hashemian.

What do brokers like Robinhood charge to trade on margin?

When traders are trading on margin, they’re charged interest on a margin interest loan. In the popular Robinhood app, users are required to have $2,000 in their accounts before they can trade on margin.

In Robinhood’s $5 monthly fee, the first $1,000 of margin is included. If traders borrow more than $1,000, they pay 5% interest on the leveraged investing. For example, if a trader uses $3,000 of margin, they’re charged a daily interest rate of 5% divided by 360 for each day of the trading year.

In that case, $1,000 is deducted from the $3,000. The remaining $2,000 has interest added on to that amount. Then, it’s $2,000 x 5%/360= $0.28 daily interest. While Robinhood charges 5% interest, each brokerage firm has its own interest and may be significantly higher. Investors should check margin interest rates with their firms.

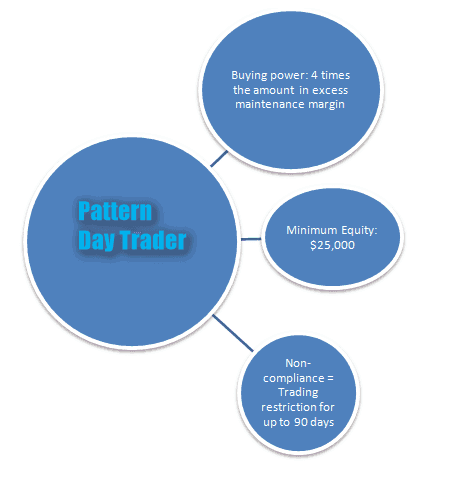

What are the rules for a margin account?

Before an investors trades on margin, there are some rules a trader must follow. When an investor trades on margin, the Financial Industry Regulatory Authority(FINRA) that regulates trade has requirements. FINRA mandates that a trader must have either $2,000 in their account or 100% of the stock purchase prices.

Once a trader has $2,000 in their account, they can trade 50% of the securities they’re going to purchase. For example, if a trader has $2,000 in a margin account, they can buy $4,000 worth of stocks on margin.

After a trader buys an asset on margin, they have to maintain a certain balance in their accounts. A trader has to outright own 25% of assets in their accounts.

A brokerage firm may also ask for a trader’s net worth and income. In addition, a firm may conduct a credit check before an investor can trade on margin.

What are the advantages of a margin account?

If traders need to trade on margin, there are some benefits. There is a potential to profit from trades. For example, a person buys shares of Apple stock for $100,000 with a mix of $50,000 cash and $50,000 margin. If you sell the stock for $125,000, the trader has a $25,000 profit.

If a trader borrows on margin, they can have a brokerage firm give them extra leverage to make larger trades.

Scott Bishop is a certified financial planner with STA Wealth Management. He noted that buying on margin can help investors who need extra financial assistance.

“The margin can almost be like an overdraft line of credit,” said Bishop.

Margin can help bring more investors into trading

Bloomberg writer Nir Kaissar notes that Robinhood is helping more investors get into the stock market with its Robinhood Gold plan.

“One of the things I love about Robinhood is it’s … drawn millions of new people into the market. If we want people to become more savvy about personal finance and investing — and I think we generally say that we do — then I think they need to have the experience of being an investor. I don’t think those are things that you can necessarily learn just in a textbook,” wrote Kaissar.

A Robinhood spokesperson said that the platform is helpful to new investors.

“We believe that broader participation in the markets is more democratic and can bring opportunities to many. Those who dismiss retail investors as ‘gamblers’ or ‘gamers’ perpetuate the myth that investing is only for the wealthy and highly educated,” said the Robinhood spokesperson.

Some financial advisors say margin wins in margin vs. cash accounts

Colby Davis is portfolio analyst for RHS Financial in San Francisco. He encourages clients to buy stocks on margin if they’re pressed for cash.

“We generally encourage [margin accounts] with our clients even if we don’t plan to do leveraged investing with them. Sometimes a client needs money in a hurry, and instead of having to sell securities and wait two days, you can take the money out immediately and sell the securities the next day or the next week. You don’t have to wait as long to get the cash out,” said Davis.

“If you really want to buy an investment and you don’t have the cash instantly available, it’s a quick way to make sure that you have it,” added Davis.

In addition to that benefit, buying stocks on margin can give investors more time to repay the loans. A brokerage firm gives a trader extra time to repay a margin loan. An investor can repay a loan whenever they can as long as they maintain a margin account balance.

Trading on margin better for experienced traders

For some experienced traders, trading on margin can be effective. Tom Watts is the chairman of Watts Capital Partners. He advises that traders use margin if they’re experienced traders and have extra money. The margin can be used for those traders as an emergency fund for transactions.

“For most of our clients, we like to have a margin account even if they never buy stocks on margin because they can transfer money faster,” said Watts.

“With a margin account, they don’t have to wait: They can access cash instantly,” added Watts.

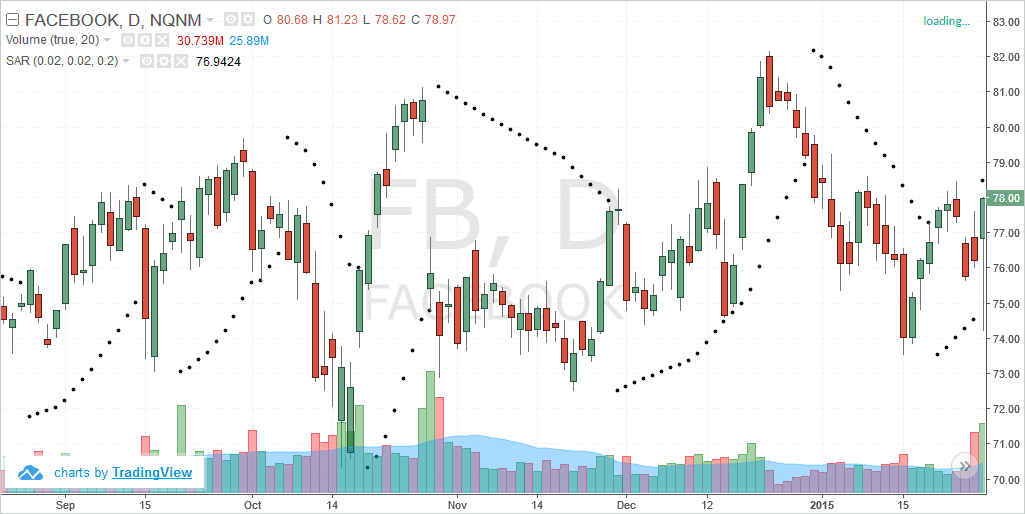

Watts also recommends margin trading if you have time to actively trade and stop losses to limit trading mistakes.

“If you’re in front of your terminal every day, you have strict loss limits and you have a trader mentality, margin investing can be a great thing in up markets. But investors should only do it when the market is going to keep going up and have very strict loss limits,” said Watts.

Buying stocks on margin can postpone capital gains taxes

Nate Wenner is a certified financial planner with Wipfli Financial Advisors. He notes that margin loans let investors postpone paying capital gains taxes. If investors need to make a large purchase, selling investments would lead to capital gains taxes. When traders buy stocks on margin, they can postpone capital gains taxes.

“By taking a margin loan, [you] don’t have any transactions and there’s no tax recognized. In most cases, our clients don’t keep this margin loan for months and years on end…They try to pay it back when they have the cash flow, maybe from a bonus at work,” said Wenner.

In addition to that tax advantage, the interest on a margin loan may be tax-deductible under certain circumstances.

Forex trading on margin is most common

While margin can used for regular stock trades, forex (foreign exchange) margin is the most generous.

Peter Klink is the director of risk management at TD Ameritrade. He said that forex rules gives investors the most leverage.

‘Generally, forex rules allow for the most leverage, followed by futures, then equities. Depending on the product, forex and futures leverage can be at 20:1 or even 50:1 compared to equities’ overnight margin of 4:1,” said Klink.

Adam Hickerson is a senior manager of futures and forex at TD Ameritrade. He noted that the volatility of forex makes it ideal to trade on margin.

“Geopolitical tensions, economic news, central bank policy decisions … a multitude of things move the forex market every day, and so there are several different reasons to consider using margin in forex trading,” said Hickerson.

“Currency prices change every day, meaning margin requirements for forex positions may also change every day. It’s important to understand that if the base currency is anything other than the U.S. dollar, the margin requirement is going to fluctuate on a real-time basis as the price of the base currency changes relative to the U.S. dollar,” added Henderson.

What are the disadvantages of a margin account?

While there are advantages to having a margin account, there are drawbacks as well. Scott Bishop is a certified financial planner with STA Wealth Management. He advises against traders, especially new investors, from buying stocks on margin because investors may be too emotional and trade too quickly.

“Should the average investor buy stock on margin?” asked Bishop. “No, because the average investor buys on greed and sells on fear,” said Bishop.

Timothy Hooker is a co-founder and accredited investment fiduciary at Dynamic Wealth Solutions. He commented that experienced traders can trade on margin with minimal risk. However, too much leveraged investing can be dangerous.

“If you’re an experienced trader and know what you’re doing, there’s nothing wrong with using margin. But if you’re really trying to take your account to the moon and back, then that’s where you can blow up your account and really derail your financial plan,” said Hooker.

John Person is the founder of Persons Planet, a trading education and advisory service company. He advises investors not to borrow more than 25% from their accounts to buy stocks on margin.

“A small amount of your portfolio can be used to extract cash for small loans. Borrowing more than 25% of your total portfolio is ludicrous because the market can go down,” said Person.

High interest rates can cause problems for margin accounts

Brian Cody is a certified financial planner with Prudent Financial. He noted that margin interest rates are often higher than for other kinds of debt.

“Interest rates on margin loans quite consistently seem to be 3% or 4% higher than what you would get for a home equity line or some other reasonable type of debt,” said Cody.

Colby Davis is a portfolio analyst for RHS Financial. He cautions traders not to use too much leverage investment before stocks lose value.

“Anything you buy can go down in value, so when you buy investments on margin, you’re exposed to more risks because you have liability in terms of the cash you’re borrowing. You have to make sure your investments don’t lose so much value that you lose more than what you owe,” said Davis.

What do financial experts say about trading on margin?

Many financial experts advise traders to buy stocks on margin with a high rate of return. S. Michael Sury is a lecturer of finance at the University of Texas at Austin. He advocates that traders invest in assets with high returns if they’re trading on margin.

“Take an investment that offers an expected return of 15 percent, but with actual results that might range between 15 percent and 30 percent,” said Sury. “Even if the cost of borrowing is low, say 4 percent, the transaction is very risky.

“On the other hand, if a collection of diversified investments can offer a 10 percent rate of return with a narrower range of 9 percent to 11 percent, then the risk of the transaction has been dramatically reduced,” added Sury.

Expert investor Warren Buffett also has a warning for traders who are practicing leveraged investing.

“When leverage works, it magnifies your gains … but leverage is addictive. Once having profited from its wonders, very few people retreat to more conservative practices,” said Bufffett.

Financial expert Lyn Alden also said that traders should be experts in the industry they’re investing in before they trade on margin.

If you understand your industry and you’re trading something of value, you should be able to use debt to trade more,” said Alden.

“These types of ‘good debt’ give far lower interest rates for people with good credit than the typical margin rates offered by brokers,” added Alden.

Tesla margin requirements impact investors

As Tesla raised its margin requirement from 55 to 79%, there have been consequences for investors. Tesla’s margin requirement is the amount of cash a trader has in their account instead of credit.

Benzinga founder and CEO Jason Raznick noted that he was notified about having to sell his Tesla shares.

“A lot of people that got this message yesterday had to sell shares. Multiple people I talked to overnight were forced to liquidate Tesla shares. Multiple people. And these are people who were positive, up on Tesla, and they had to sell by the close yesterday,” said Raznick.

“This is happening because large institutions are buying shares of Tesla, and brokerage firms want to free up shares to sell these large institutions,” added Raznick.

Raznick said that traders are selling Tesla stock because of their margin.

“There are people selling this stock right now not because they want to, not because they have bad fundamentals; they are being forced to. Including myself and including some others, we are forced to sell stock because of the margin we have on it, and I do believe that represents a potential long-term trading opportunity,” said Raznick.

Investors shouldn’t buy too many stocks on margin, experts warn

Davis also advises traders not to buy stocks regularly on margin.

‘I would only recommend using a margin account for the purpose of having additional flexibility on when you can withdraw cash. But I wouldn’t recommend having a margin account to invest as part of their strategic plan unless they’re working with a sophisticated financial advisor or are a sophisticated investor themselves,” said Davis.

Ali Hashemian says that investors can buy more stocks on margin in a bear market. However, he warns that traders not to buy too many shares on margin when the stock market is down.

“An investor might want to use margin to purchase more shares in a down market. The problem is that nobody can predict the bottom,” said Hashemian.

Jose Remy is a partner at Alvarium Investments. He says investors should only trade on margin if they expect great returns on their investments.

“This should be done when the expected return of the investment being made is greater than the cost of leverage. And when the risk profile of the investment and the client’s overall portfolio is commensurate with his or her risk tolerance,” said Remy.

Financial advisers advise traders to borrow on margin carefully

Many young investors are flocking to trading on margin. Chris Larkin is managing director of trading and investment product at E-Trade Financial.

When it comes to Millennials and Gen Z investors, time is on their side, but that doesn’t mean they can be complacent or act emotionally,” said Larkin.

“Access to the market has never been easier, so investors just embarking on trading should walk before they run. A thoughtful and disciplined approach is key—do your research, set up watch lists, and align your trading strategy with your goals and risk tolerance,” added Larkin.

Borrowing on margin can also create problems, like being on margin call.

What happens when an account is on margin call?

When an account is on margin call, a trader is in trouble. If a trader hasn’t maintained a minimum balance of 25% outright owned assets in their account, they’re put on margin call.

Nate Wenner is a certified financial planner. He notes the danger of trading on margin if investors can’t maintain their margin account balances.

“This makes it a dangerous game to play,” said Wenner.

For example, a trader wants to invest $150,000 in a stock whose shares are $100. A trader invests $25,000 and borrows the rest on margin. A brokerage firm can then institute a 30% margin maintenance on their accounts.

If shares fall to $70, a trader’s margin can fall down to $87,000. That amount may be above the margin maintenance threshold. However, if the stock keeps falling and the margin maintenance account drops to below the 30% threshold, the trader is placed on margin call.

Will margin accounts be in more danger after the quarantine?

Christopher Gerold is president of the North American Securities Administrators Association. He noted that the increase in trading during the quarantine will lead to more margin calls on traders.

‘In the coming weeks, I expect that we will see a significant increase in complaints related to suitability, specifically use of margin in retail accounts. I expect many will have been unsuitable and will require investigations by regulators,” said Gerrold.

Gerrold also noted that more staff will be needed to deal with margin call accounts.

“Processes, procedures, and staff must be in place so that investors can reach their financial professional to ask questions, raise concerns, and discuss investment options. We’ve heard–and these have been very public–about trading delays and crashes of electronic systems at some of the largest broker-dealers in the last couple weeks,” said Gerrold.

What should investors do when they’re on margin call?

If an investor is on margin call, then an investor has to take action. A trader has to have deposit funds to meet the margin minimum, usually within three business days. If a trader doesn’t have the funds right away, they may have to sell stocks in order to meet the margin minimum. Firms may also totally liquidate a trader’s account if they can’t pay off their margin call.

If a trader can’t pay the margin call, a brokerage firm may have to report your debt to a credit agency. A trader’s credit could be negatively impacted for a long time.

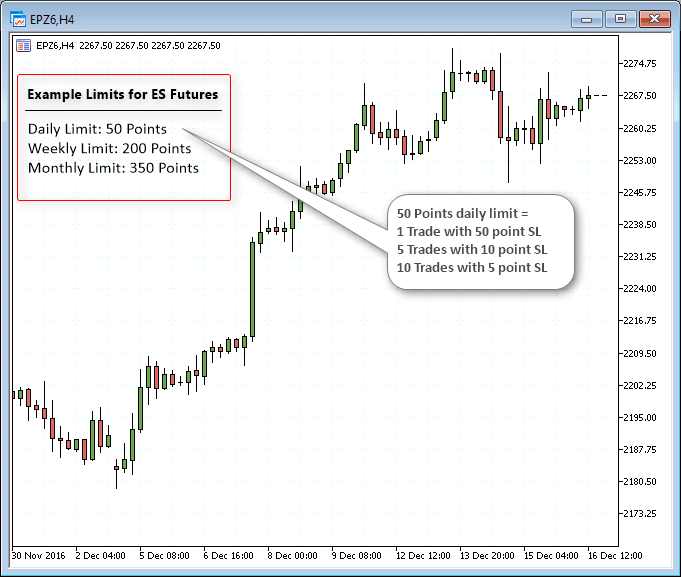

How can an investor avoid margin call?

There are ways for investors to avoid margin call. If an investor is able, they should have an emergency fund on hand in case there is a margin call. A trader should also be knowledgable about the margin requirements before buying stocks on margin. In addition to those measures, traders can use stop-loss measures to prevent themselves from plunging into debt. With stop-loss measures, traders can limit their margin losses.

As TradingSim’s own Al Hill told Mint, traders shouldn’t use all of their margin when buying individual stocks. Only a small percentage is best fro each individual trade, especially for beginning investors.

“Only use 10 percent of your margin. For example, if you have $100k cash, which would afford you $400k in margin, only use $40k on any one position”, said Hill.

Where do investors trade on margin?

Some investors have personal accounts of trading on margin. In one example, Zaki Ahmed trades with Oanda. He uses a lot of leveraged investing when he makes trades.

“Oanda recommends a moderate leverage amount of 20 to 1 or lower. My leverage is almost 50 to 1,” said Ahmed.

While Ahmed trades on margin, he admits that it’s wreaked havoc on his finances.

“I’ve been through the ringer in terms of all manner of investment and gambling. To be honest, I regret that I’m doing this now. I won’t tell you how much I’ve lost but it’s in the thousands,” said Ahmed.

If traders want to trade on margin, they have to exercise a lot of caution and be prepared for losses.

How can investors trade with a cash account?

If trading on margin is too risky, investors can trade using cash accounts. In cash accounts, investors can simply buy stocks with their available cash. For instance, if a trader has $1,000 in an account, they can only buy $1,000 worth of stocks.

What is the difference between a margin account vs. cash account?

While a trader can trade right away by borrowing on margin, having a cash account requires an investor to have more patience.

Brandon Herman is the senior manager of margins clearing at TD Ameritrade. He commented on the differences between the two different kinds of accounts.

“In a cash account, if you buy and you sell, you have to wait for that sale to settle before you can use the funds again. Some clients may find it worthwhile to use a margin account every now and then to be able to buy what they want to buy, when they want to buy it, and borrow with margin for a short period of time,” said Herman.

What are the benefits of using cash accounts?

In contrast to margin trading, cash accounts are a one-time investment. Patrick Lach is a certified financial planner and assistant professor of finance at Indiana University. He noted that investing on margin requires extra cash to maintain an account. On the other hand, cash accounts don’t have that requirement.

“This is a major risk of margin investing. It may require the investor to come up with additional cash to maintain the position. This is not an issue with cash accounts—they only require a one-time, up-front investment of cash,” said Lach.

He also noted that when there is a margin call, investments have to be sold and lose value quickly. However, Lach noted that with a cash account, investors have time to recover from their losses with cash accounts.

“With a cash account, the investor has the luxury of waiting for a stock to recover in price before selling at a loss,” said Lach.

What are the disadvantages of a cash account?

While there are advantages to having a margin account, there are drawbacks as well. If a trader wants to trade in a hurry, they’re unable to with a cash account. Cash must settle before a trade officially takes place.

For instance, if a trader uses $500 in their account to make a trade on Monday, they can’t make a trade with that same $500 until Thursday at the earliest. That delay is called a settlement and is part of the transfer of assets to a buyer’s account and cash to a seller’s account.

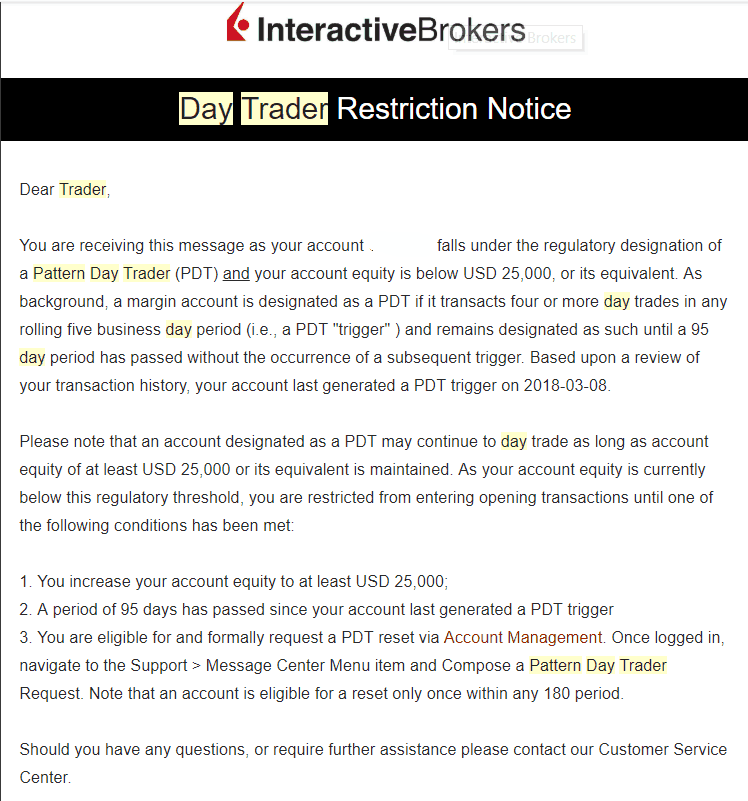

Another problem with cash accounts is having good faith violations. A good faith violation is when investors make trades before cash has settled. If traders make these violations three or four times, they can put into a 90-day trading restriction.

Dan Merritt, manager of margin risk at TD Ameritrade, advises investors to exercise caution before having good faith violations.

“It’s not like there’s a lot of wiggle room for exceptions, so it’s best to know how to stay on the right side of the regulations,” he said.

Merritt also advises traders to call their brokerage firms before they reach the 90-day trading restriction limit.

“If you call us after you do something, it’s harder for us to assist you, so calling us and asking what will happen in a situation is sometimes better. That way we can walk you through all of your choices at that point,” said Merritt.

What other violations can jeopardize a cash account?

In addition to good faith violations, free riding violations can hinder a cash account. Freeriding occurs when a trader tries to buy or sell a stock without depositing enough funds before settlement. One way to have a free riding violation is to use the same capital on the same day on two separate trades. A trader can buy a security and sells it before settling the first purchase.

For example, a trader has 500 shares of Ford (NYSE:F) with shares at $20 on Thursday. A trader needs $10,000 to settle the transaction. On Friday, Ford’s stock rises to $25. As a result, the trader earns $25,000. However, if a trader didn’t settle the original trade without the new sale’s profits. If an investor can’t settle the first trade, then the trader is freeriding.

If a trader is freeriding, a brokerage firm can freeze a trader’s account for 90 days. In the middle of the freeze, a trader can use a cash account to make trades. However, a trader has to settle all purchases on the trade date.

How to cash in a margin account

In a margin vs. cash account, cashing in a margin account takes certain steps. A trader can close their account and completely cash out their margin accounts. First, an investor has to sell their investments. Then, a trader has to make sure their margin loan balance is at zero. Then, an investor has to close the officially close the account through a broker.

If an investor wants to cash out their margin loan balance, there are steps that traders can take. They can request a cash withdrawal with available funds minus the margin loan amount. Once the cash is withdrawn, a trader can make sure the money is transferred to another account. Then, an investor’s brokerage margin account shows the next margin loan balance.

Which account wins in margin vs. cash account?

When choosing between a margin vs. cash account, a trader has to make many considerations. If a trader wants to day trade often without fear of pattern day trader status, a cash account may be best. A cash account may also be best for traders who have the patience to wait until their settlement period of two or three days.

If a trader wants to trade right away but has limited funds, margin trading may be best for them. Also, if a trader wants to trade volatile and high-risk assets like forex, margin trading may be their best option.

Ultimately, a trader has to make the best decision for them about deciding between a margin vs. cash account.

Regardless of which account a trader uses, TradingSim can help traders whether they choose a margin vs. cash account. With TradingSim’s blogs and charts, traders can find the best accounts for them to potentially increase their profits.