In the true spirit of the Tradingsim blog, we will quickly cover the definition of leveraged ETFs, so we can dive into the details of whether you should day trade, swing trade or invest in leveraged ETFs.

Background on Leveraged ETFs

What are Leveraged ETFs?

Leveraged ETFs are an investment vehicle that provide additional exposure to the base unit price of an investment vehicle in order to increase the monetary impacts of price fluctuations. The standard leverage ratios for leveraged ETFs is 2:1 and 3:1 ratio relative to the price of the underlying instrument.

There are complicated back office processes (daily rebalancing, use of borrowed money, accounting practices and investment in index futures) in order to ensure the value of the leveraged ETF continues to perform at the stated ratio (2:1 or 3:1) of the underlying instrument.

While you may get a kick out of knowing the math and inner workings of the finance world that generate leveraged ETFs, it is really of no consequence, as long as you make money. Therefore, if you are working on a finance paper for college, you should probably hit back on Google; however, if you want tangible lessons on how to trade leveraged ETFs, you are in the right place.

Types of Leveraged ETFs

Back in 2006, four leveraged ETFs were approved by the SEC after many years of scrutiny. Today, there are over 200 leveraged ETFs. Leveraged ETFs cover the obvious whales such as the S&P 500, Dow, QQQ, and Russell 2000 index. For the more sophisticated investors, you can find leveraged ETFs for Natural Gas, Silver, Cocoa, and the 10-Year Treasury.

In addition to the wide variety of leveraged ETFs and ratios (2:1 or 3:1), you also have the choice of buying long or inverted (shorting).

Risks of investing in Leveraged ETFs

Before we get into the specific trading strategies, you will need to grasp the level of risk you are taking on in your quest for profits. Trading is hard enough only using cash, but introduce leveraged ETFs and things can quickly get out of hand.

Margin Rules and Leveraged ETFs

When I first heard of leveraged ETFs years ago, my initial reaction was this is bad for the trading community because of the increased leverage. Before doing any research, I assumed leveraged ETFs were indirectly increasing the standard 2:1 margin offered by brokerage firms by allowing you to invest margin funds in the 2:1 or 3:1 leveraged ETFs.

Well, do not get too worked up, because while this is mathematically possible, the finance world will not allow it.

While you may be willing to risk Junior’s college education, brokerage firms are not willing to risk their own money. To illustrate this point, if you are trading a 2X leveraged ETF, most brokerage firms will require you to have 75% or more cash for the open position. Bottom line, brokerage firms require you bring cash to the table in order to protect their risk of loss.

When you can make the most bang for your buck with Leveraged ETFs

Now that we have satisfied the academia crowd, let’s dig into how to make and protect money when trading leveraged ETFs.

Day Trading with Leveraged ETFs

I am a firm believer that you should trade the active stocks of the day; the stocks that are showing sizeable gains or losses with increased volume. Due to the borrowing limitations placed on leveraged ETFs by brokerage firms, I do not see the value in day trading these instruments. You will be better off trading the hot stocks of the day and still being able to use four times your cash on hand, which is the standard day trading margin extended to traders with at least $25,000.

For example, on an average trading day, the S&P 500 may have a 2% trading range. This would produce a possible profit of 6% high to low if you were able to time the price movement perfectly. However, while the price range is size able, due to the margin requirements you will have a good amount of cash tied up in the trade.

On the other hand, if you are day trading the hot stock of the day, the price swing could be 10% or more.

The thing that makes day trading the hot stock more attractive is the hot stock of the day will likely not have special margin requirements. This will allow you to not only trade the more volatile stock, but also use more of the brokerage firm’s money in your quest for profits.

Swing Trading with Leveraged ETFs

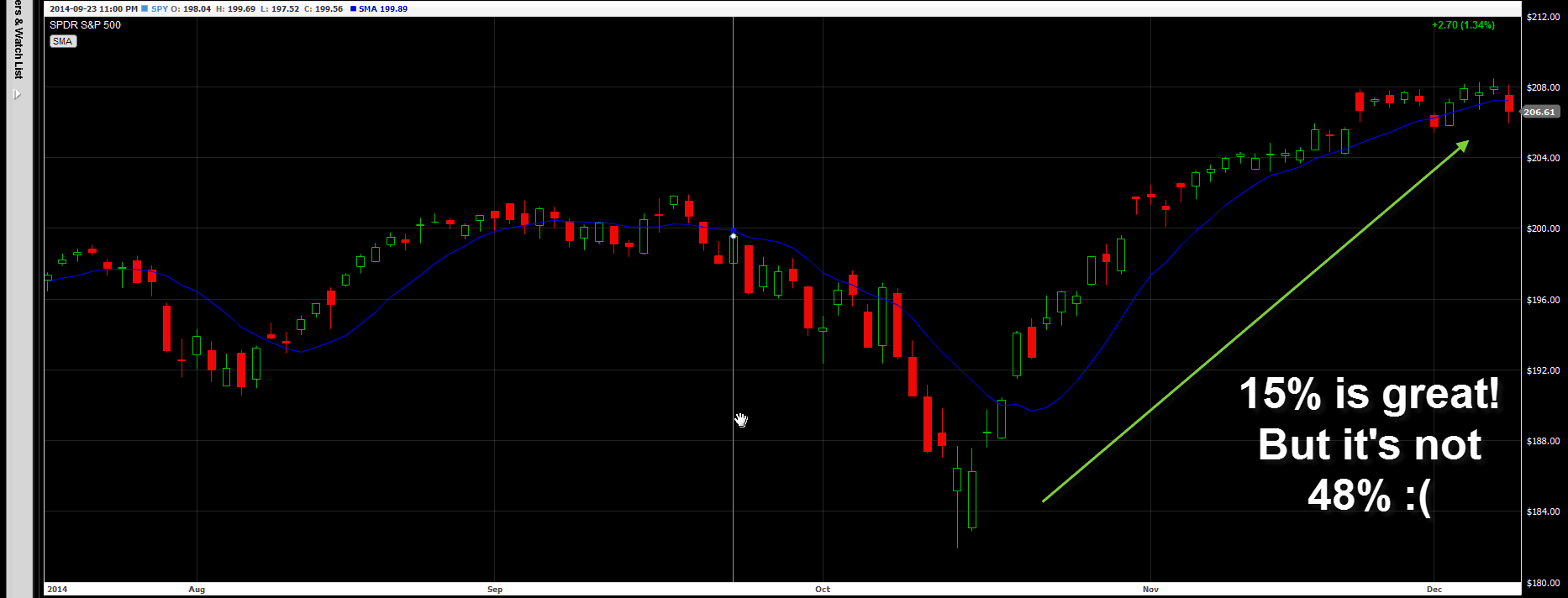

When it comes to swing trading, you can generate significant profits if you can accurately time big moves in the market. For example, as I am writing this article, there was a major bottom placed in the market in October 2014.

The ProShares UltraPro S&P 500 bottomed on October 14 at $91.48. From this low, the ETF has rallied to a high of $135.80 as of November 21, 2014. That represents a 48% percentage gain in a little over a month.

If you had bought the SPY ETF over the same period of time you would have only made ~15%. 15% is a great return over 6 weeks, but it pales in comparison to the 48% from the ProShares Ultra Pro S&P 500.

Now, some of you maybe scratching your head wondering why I would suggest swing trading ETFs versus day trading and it simply comes down to the return potential. You can make more money day trading the hot stocks than you can make day trading leveraged ETFs due to the tighter price range swings and stiff intraday margin requirements. Conversely, when it comes to swing trading, leveraged ETFs provide the ability to make considerable gains if you are able to catch a vertical move and of course resist the urge to sell out too quickly.

Long-term Investing/Buy-Hold Strategies and Leveraged ETFs

I do not believe we have enough trade data for leveraged ETFs to definitively state that a buy and hold strategy over the long haul (10+ years) will produce positive returns for investors.

You maybe scratching your head saying, if the S&P 500 returned 10% over a 2-year period, then I would have made 20% in a 2:1 leveraged ETF. The simple response to this statement is wrong!

The SEC has posted alerts on their site explaining the dangers of investing in leveraged ETFs. This isn’t something necessarily to cause a retreat, since the SEC warns against the dangers of day trading; however, there is math to support their claim of why long-term investing in leveraged ETFs is bad for an investor. Below are a few excerpts from the alert which you can find using the following link:

” The following two real-life examples illustrate how returns on a leveraged or inverse ETF over longer periods can differ significantly from the performance (or inverse of the performance) of their underlying index or benchmark during the same period of time.

- Between December 1, 2008, and April 30, 2009, a particular index gained 2 percent. However, a leveraged ETF seeking to deliver twice that index’s daily return fell by 6 percent—and an inverse ETF seeking to deliver twice the inverse of the index’s daily return fell by 25 percent.

- During that same period, an ETF seeking to deliver three times the daily return of a different index fell 53 percent, while the underlying index actually gained around 8 percent. An ETF seeking to deliver three times the inverse of the index’s daily return declined by 90 percent over the same period.”

The alert then goes on to provide the math of how this under performance by the leveraged and inverse ETF is possible.

“How can this apparent breakdown between longer term index returns and ETF returns happen? Here’s a hypothetical example: let’s say that on Day 1, an index starts with a value of 100 and a leveraged ETF that seeks to double the return of the index starts at $100. If the index drops by 10 points on Day 1, it has a 10 percent loss and a resulting value of 90. Assuming it achieved its stated objective, the leveraged ETF would therefore drop 20 percent on that day and have an ending value of $80. On Day 2, if the index rises 10 percent, the index value increases to 99. For the ETF, its value for Day 2 would rise by 20 percent, which means the ETF would have a value of $96. On both days, the leveraged ETF did exactly what it was supposed to do – it produced daily returns that were two times the daily index returns. But let’s look at the results over the 2 day period: the index lost 1 percent (it fell from 100 to 99) while the 2x leveraged ETF lost 4 percent (it fell from $100 to $96). That means that over the two day period, the ETF’s negative returns were 4 times as much as the two-day return of the index instead of 2 times the return.”

Let’s say you ignore all of this and say to yourself, well I would still be up more than investing in the underlying instrument, let me show you a few charts that may provide you a dose of reality.

Take a look at the below chart of the recent 4.5 year bull market run.

The returns are silly when you compare them to the S&P 500. But honestly, how many people have been calling for the top of this run, which is well beyond the average bull run of 3.8 years.

Bottom line, the returns look great on a historical chart, versus the reality of being able to time the moves and sit through all of the gyrations.

Short a.k.a Inverted ETFs

Inverted leveraged ETFs provide the ability to take a bear position on the market, without the unlimited risk to the upside that a short position contains.

The challenge with buying an inverted leveraged ETF is that you could get it wrong. That last sentence may seem like the obvious conundrum of trading, but the market has a natural bias to the long side, so nailing bottoms is always easier then picking tops. For this reason, I do not advocate buying inverted leveraged ETFs, because if you get it wrong your losses can quickly mount as bull markets drag out. Even if you manage your money correctly and can withstand a serious hit to your account, you still have the opportunity costs of sitting in a losing position for an extended period.

If you do not believe me, look at the 3X Inverted SPY ETF since 2012.

If you are a permabar, each low point in the market was followed by another high in the market. Looking at that chart, my heart goes out to anyone that took on an all-in position near the bottom and have been waiting for some sort of return.

The Simple Reason I personally do not trade Leveraged ETFs

This title could be throwing you for a loop, but please hear me out first before you label me a flip flopper.

If you step back for a second, strip away all of the complicated algorithms for leveraged ETFs and look at the instrument for its real purpose, it boils down to greed.

Why do traders need to get involved with something that is 3 times the value of its underlying security? Isn’t your cash enough for you to make a healthy profit if you use a sound trading system over an extended period of time?

Today there are only 3X leveraged ETFs offered, but would you trade a leveraged ETF that was 5X or 10X, if it was allowed by the SEC? When does it all end?

As a trader, you are better off focusing on mastering your craft and making consistent gains over an extended period of time, resulting in a steadily increasing equity curve.

The need to nail the big one can be catastrophic if you are unable to get it just right. So, if you are looking to invest in the broad market and you do not want to get involved in trading futures, just trade the ETFs that mirror the movement of an index. Leave the leveraged instruments to the riverboat gamblers.

Popularity Dying Out or a result of low volatility in the market?

The popularity of leveraged ETFs was at its height with the initiation of a number of ETFs in the ‘08 and ‘09 timeframe. This coincidentally tied into high volatility in the market. Take it for what it’s worth, but notice how the monthly volume in the below ETFs has plummeted over the last 5 years.

The volume in the UPRO is down over 60%.

Volume in DTO (Power Shares DB Crude Oil Double Short ETN) is down ~50% from ‘08 to ‘09.

UGL (ProShares Ultra Gold) volume is down ~50% from the ‘08 to ‘09 timeframe.

Therefore, we have to ask ourselves if this drop in volume is a result of waning interest in leveraged ETFs, or if leveraged ETFs need volatility for market participants to step in and start trading these issues.

Unless this bull market comes to an immediate stop or we shoot up to a new high in an impulsive fashion, low volatility is like to continue over the near term.

Leveraged ETFs Closing Down

For those of you that think I’m just a big scaredy cat and that’s why I don’t trade leveraged ETFs, don’t take it from me, listen to the people that make a living offering these investment vehicles. There was an article posted on ETF Trends stating that ProShares will be closing 17 inverted ETFs in January 2015. The article goes onto say that over 100 ETFs have been closed in 2014 and in the near future ProShares is focusing on expanding its non-leveraged funds.

Since ProShares is the largest issuer of leveraged and inverse ETFs, I would follow the smart money and expect interest in these ETFs to continue to decrease over time.

In Summary

The bottom line is if you are going to trade leveraged ETFs you can swing or day trade them, but you should not plan on investing in these instruments over the long haul.

The fact that ProShares is closing down ETFs, the SEC has posted alert bulletins, and the math can have you losing money while the chart shows a positive return, should give you reason to pause.

There are so many ways you can make money in the market, so you will have to ask yourself if leveraged ETFs are worth the risk.

Leveraged ETF Resources

Tradingsim Market Replay Platform

The Tradingsim market replay platform has every leveraged and inverted ETF with intraday data going back for the last 18 months. If I cannot sway you from day trading these instruments, please practice trading a few months to see how it affects your bottom line.

Below is a list of leveraged ETFs you can use to research the best investment opportunities based on your trading style and interests:

List of 2X Leveraged ETFs and 3X Leveraged ETFs

Long-term stock charts courtesy of Stockcharts.com

As always, good luck trading and remember to enjoy the journey of becoming a master trader.

Al Hill