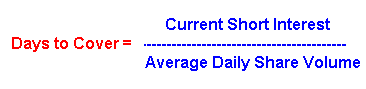

In recent months we’ve seen a number of liquidity traps showing up as a result of the “dead cat” bounces from oversold conditions in many stocks. We’ve written fairly extensively on this setup before. So if you haven’t read up on the liquidity trap basics, be sure to do so, along with our explanation of Days to Cover. In this post, we’re going to dive a little deeper and uncover some more advanced entry techniques for liquidity traps.

What are liquidity traps?

We’re not going to spend much time here, because we assume you’ve taken the time to read the articles linked to above. However, as a brief reminder, liquidity traps can a very explosive and profitable strategy when trading lower float, lower priced stocks.

The concept revolves around a large volume day, usually a high-volume gap up. Because these stocks gap so frequently, they become prime targets for short sellers. More often than not, the large gaps end up being what many day traders refer to as a gap and crap scenario.

Usually, these are companies that bleed cash and hire PR firms to pump their stock to retail traders, only to sell more shares into the pump. This dilutes the company, obviously. It happens over and over again in the market. To learn more about it, be sure to watch our recent SimCast episode with Rick Analog.

Often times, one to many gaps that fail trains short sellers, like Pavlov’s dog, to slam the bid on day one. Fast forward a few days, add in a million more retail traders than prior years, and you’ve got a recipe for a fast 2-3 day short squeeze.

Here’s a liquidity trap example:

Notice a few things here. One, you’ve got a big selloff from the prior high volume day noted on the chart. Two, you have another “pump” day. But then, things get interesting.

In day 2 and 3 of the most recent pump, you get diminishing volume characteristics while price remains elevated. By the fourth day, shorts are in hot water as price breaks to a new high there, enough for a move from $2 to $3. That’s a huge move!

It’s the anticipation of the big secondary move that we call a liquidity trap setup. But how can we zoom in and find our best entry? That’s the question we seek to answer in this tutorial.

Advanced Entry Techniques for Liquidity Traps Using the VCP Strategy

Using the example of AACG above, let’s zoom in on a 15 minute chart and see if we can find the Volatility Contraction Pattern. This should allow us to set our risk levels off of “higher lows” in the formation.

As annotated on the chart, we have the initial run, like a flag pole. Then we have consecutive pullbacks that get tighter and tighter while maintaining key support levels. It’s our job to find an area to risk to in anticipation of a breakout.

The question will be, what happens on the current pullback, the 4th pullback. But let’s not jump the gun. Let’s use more technical analysis to help us time our entry.

Using VWAP Boulevard and Support/Resistance Lines as Advanced Liquidity Trap Entry Techniques

Now that we have some indication of a potential setup. Let’s look more in depth at the key levels on the chart.

One way to do this is using the concept of VWAP Boulevard. We’ve written an ultimate guide on this subject, thanks to the education efforts of @team3dstocks on Twitter. Be sure to check out both links if you aren’t familiar.

Applying vwap boulevard to our 15 minute chart and daily chart, we gain insight as to where the majority of the stake holders are present. This gives us clues as to where the “whales” might be supporting either their long or short positions. It also might represent who becomes the bag holder, and where that line is drawn.

In TradingSim, we’ve built a vwap boulevard drawing tool that allows you to select a range of candles from dates that you want. Here, we’ve selected only the closest candles to the recent high volume day. The key level for the highest volume day is 1.91.

Just a quick glance at the chart allows you to see that this remained a key support/resistance level in the days to follow. It’s a great way to manage risk over/under.

We’ll leave this drawing up, then head back to the 15 minute chart to see how these levels correspond.

VWAP Boulevard On Lower Time Frames for Advanced Liquidity Trap Entry Analysis

Coming back to the 15m chart of AACG, you’ll notice that we’ve left the key vwap boulevard lines from the daily chart, but have also drawn a second set of vwap boulevard lines based off of the 15 minute bars. This gives a bit of insight into the more granular “control lines” intraday.

Interestingly enough, the two black lines which represent the closing vwap of the largest volume candles create the channel for AACG’s consolidation. Why is this so cool? It gives you an idea of where to risk for long or short.

If you’re wondering what the other pinkish lines represent, they are vwap boulevard lines also — but not for the most significant volume candles.

So far, we’ve seen that we can use a volatility contraction pattern and vwap boulevard to help us build our advanced entry techniques for liquidity traps. Now, let’s look at the volume and price analysis.

Using Intraday Swings and “VooDoo” as Advanced Entry Techniques for Liquidity Traps

No, we’re not talking about black magic or dark arts here, even though it might seem like it the more you see Volume Dry Up into these patterns. This lack of supply often precedes large moves as shorts begin looking around wondering when their reinforcements are going to arrive.

We’ve written extensively on pocket pivots and vdu (“voodoo”) thanks to Gil Morales’s teachings. They go hand in hand with consolidation patterns like volatility contraction patterns. For that reason, let’s apply them to our AACG chart and see what we can glean for another advanced entry technique in this liquidity trap.

We’ve left the vwap boulevard lines up, zoomed in just a little, drawn a descending diagonal trendline, and thrown in annotations for VDU and Pocket Pivots. Pay close attention to how the fourth day has a quick washout at the open. This then finds support at vwap boulevard yet again.

After the rally, we pull back into the body of those significant rally candles and find support on a higher low. Most importantly, volume diminishes during this pullback. As shorts begin to realize the impending squeeze, it leads to a pocket pivot of demand up and out of the trading range.

We test the upper vwap blvd briefly, then break to new highs.

Advanced Entry

You might be asking, where would I enter the stock long?

Using these advanced entry techniques, you could have entered long as the morning washout reclaimed the lower vwap boulevard level. We’d call this a spring move. Your risk would be set below that wick.

If you missed that entry, you might consider the pullback. We like to time our entries as volume moves from vdu to pocket pivots, risking the most recent vdu lows. In this case, you’d go long around $2.00-$2.05, risking just below $2 or $1.91 depending on your risk personality.

Analyzing Intraday Swings for Advanced Entry

We’d like to touch on one other technique for advanced entry in liquidity traps, and that’s intraday swings. Intraday swings are essentially the prominent trends that form throughout a consolidation in a stock.

Using the 15 minute chart, what we notice, in addition to the higher lows, is that the stock is losing its downward momentum over time. In other words, the slope of each downward swing is less and less. Take a look:

What this tells us is that the big picture could be bullish in the intermediate timeframe. If each day represents the force of supply, then it’s safe to say that supply is waning into the apex of the consolidation. This is typically bullish.

As traders, it is our job to consider this context as we anticipate and build a thesis behind a trade. It gives us the detail, along with all the other components of the structure that we’ve examined, that bolsters our conviction for the entry.

Conclusion

We hope this has helped you with the broader framework behind choosing a “setup.” Sometimes it’s as simple as seeing a pattern and pushing the buy button. But we think that the more boxes we can check with analysis, the more confident we can be in our trade.

Advanced early entry techniques like these provide opportunities for low risk, and higher reward. With enough backtesting of these strategies in the simulator, you may find your own niche. Breakouts can then become add-on points instead of high risk entries.

As with any strategy, it’s always best to test it in a simulated environment and track your results before putting real money to work

Here’s to good fills!